KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

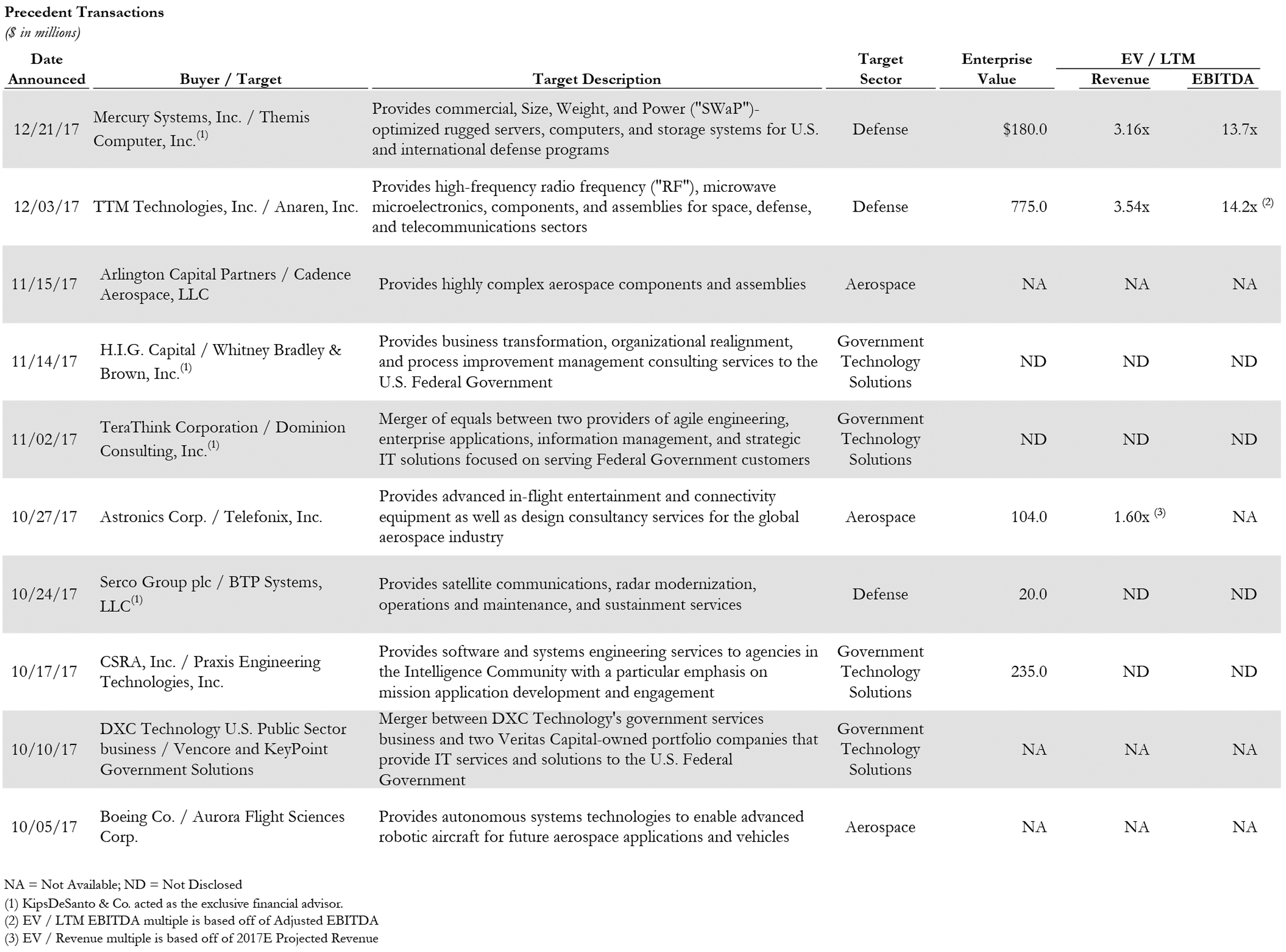

/in News & Publications, Deal View/by kippsdesantoKippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended December 31, 2017. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Click here to download the table above

Of the above transactions, the following were especially noteworthy:

The aerospace and defense (“A&D”) deal of the quarter is Mercury’s announced acquisition of Themis Computer, Inc. The proposed acquisition is an all cash deal worth $180 million, in excess of 3x 2017E revenue and approximately 14x 2017E EBITDA. The deal is expected to be immediately accretive to Mercury’s earnings and will be financed through Mercury’s existing revolving credit facility. Themis Computer is a leading designer, manufacturer, and integrator of commercial, SWaP-optimized rugged servers, computers, and storage systems that serve some of the largest Navy and Army server programs in the U.S. Department of Defense (“DoD”) as well as international defense programs. The acquisition will provide Mercury with a strategic platform acquisition that will enable Mercury to continue penetrating the Command, Control, Communications, Computers, and Intelligence (“C4I”) market and provide important new capabilities for its customers.

The government technology solutions deal of the quarter is the announced merger between DXC Technology’s U.S. Public Sector (“USPS”) business, Vencore Holding Corporation, and KeyPoint Government Solutions. DXC Technology was formed in April 2017, through the merger of Hewlett Packard’s Enterprise Services division and what remained of Computer Sciences Corporation, following the spinoff of its government services business to SRA International, which became CSRA Inc. Vencore is a provider of information solutions, engineering, and analysis to the U.S. Intelligence Community, the Department of Defense, and federal and civilian agencies worldwide, and KeyPoint is a provider of specialized investigative and risk mitigation services to the U.S. Federal Government. DXC is spinning off its USPS business to combine it with Vencore and KeyPoint to create a competitive, large-scale, government-focused IT services provider. The proposed transaction will be tax-free to DXC and its shareholders through a Reverse Morris Trust transaction structure, which is the same structure used for the formation of DXC as well as Leidos’ acquisition of Lockheed Martin’s IT business in 2016. The DXC USPS deal is expected to close by March 31, 2018, and the still-unnamed, public, combined entity will have 14,000 employees and ~$4.3 billion in annual revenue. DXC shareholders will own 86% of the combined business and receive $1.05 billion of cash upon closing. Veritas Capital, the prominent private equity firm that owns both Vencore and KeyPoint, will retain approximately 14% of the combined entity’s equity and receive $400 million of cash at closing. This transaction follows the recent trend of mega-mergers (~$1 billion in revenue) across the government technology solutions landscape and is the third of its kind behind CACI’s acquisition of L-3’s NSS business unit and Leidos’ acquisition of Lockheed Martin’s IT business.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck