KippsDeSanto & Co. Advises Atlas Research LLC on its sale to Customer Value Partners, LLC

KippsDeSanto & Co. Advises Atlas Research LLC on its sale to Customer Value Partners, LLC

KippsDeSanto & Co. Advises Atlas Research LLC on its sale to Customer Value Partners, LLC

KippsDeSanto & Co. is pleased to announce the sale of Atlas Research LLC (“Atlas” or the “Company”) to Customer Value Partners, LLC (“CVP”).

Headquartered in Washington, D.C., Atlas provides evidence-based and innovative transformation solutions targeted at the most pressing, sizable, and complex health, healthcare, and social services challenges facing Federal agencies. Through implementation of data-driven insights and analytics, Atlas helps drive improved organizational effectiveness and transformation campaigns by optimizing technology, operations, and programs across the full lifecycle of customer needs.

Since its founding in 2008, Atlas has built deep and longstanding relationships across the Federal health market due to its role as a trusted partner capable of repeatedly delivering successful large scale, highly-visible, complex transformations across diverse enterprise-wide and organizational transformation efforts. Notably, the Company has established embedded relationships within the Department of Veterans Affairs (“VA”), the Department of Health and Human Services (“HHS”), and the Department of Defense (“DoD”), amongst others.

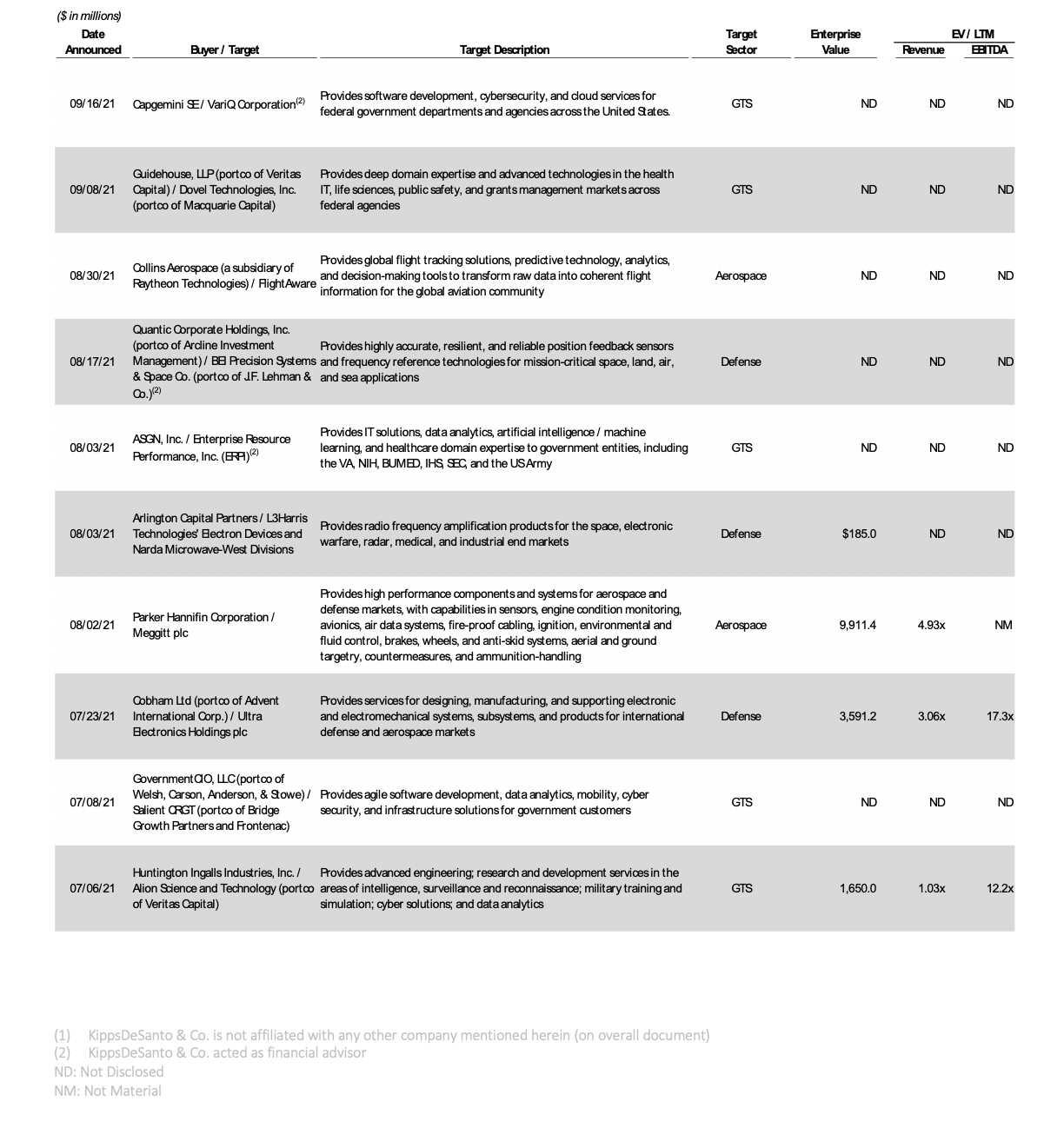

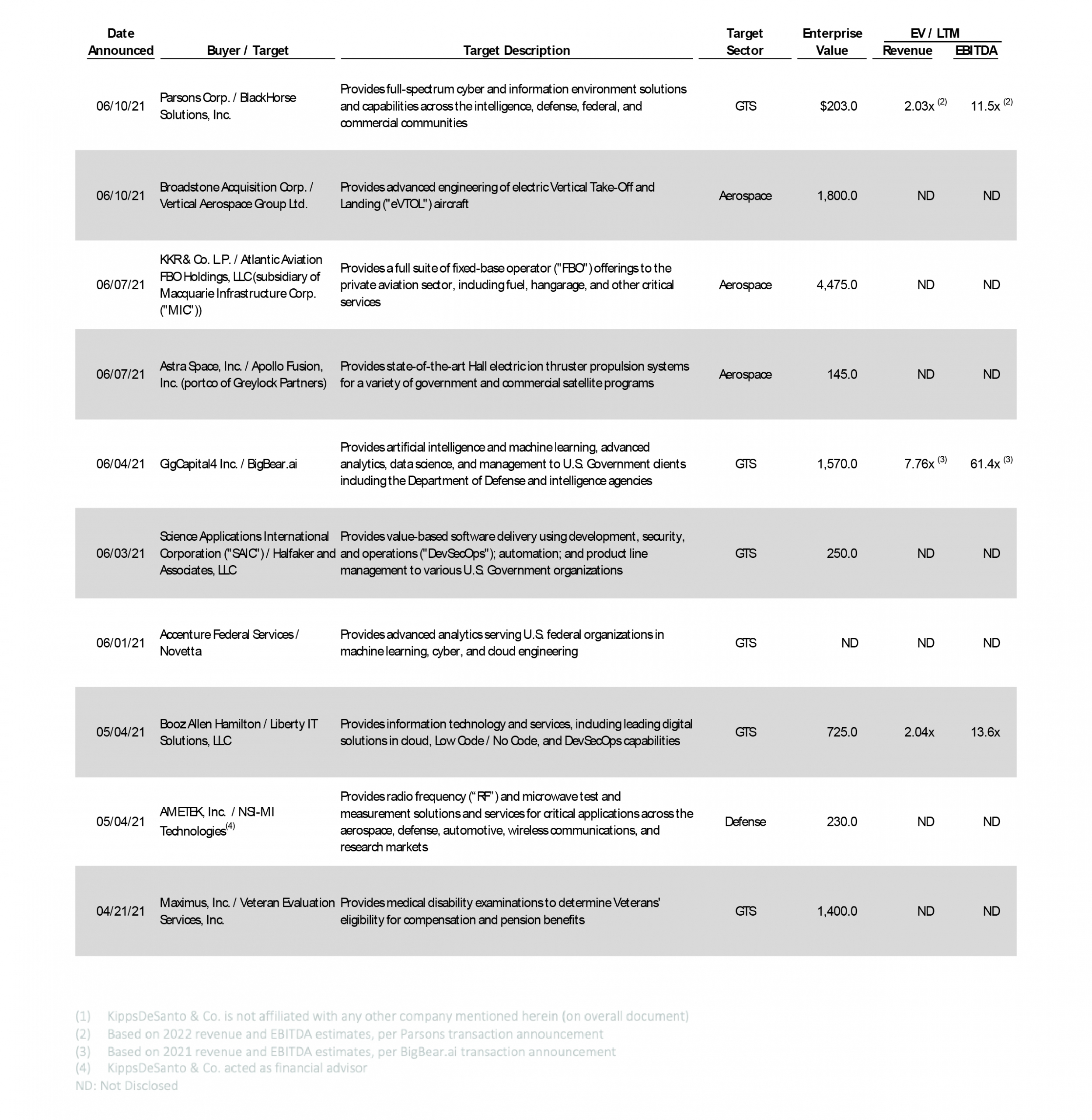

We believe this transaction highlights several key trends in the M&A market:

- Favorable view of exposure to large, growing Federal health market given recent change in administration

- Strong demand for access to the VA and HHS via major contract vehicles and BPAs (e.g., access to $1B VHA IHT IDIQ and $322M FDA BPA) as well as longstanding and embedded customer intimacy

- Desire for bolstered capabilities in leading edge digital and transformation solutions and expertise

- Continued emphasis on acquiring companies with deep personnel benches (highlighted by technical subject matter expertise, level of education, and requisite industry credentials)

- Strategic buyers place high value on the ability to complement and expand capabilities portfolio to further establish customer footprint without compromising on cultural alignment

About KippsDeSanto & Co. KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

CVP Acquires Atlas Research, Broadens Healthcare Strategy, Consulting and Research Offerings

Fairfax, VA – August 24, 2021 – Customer Value Partners, Inc. (CVP), a business and technology consulting firm that helps organizations prepare for a culture of Continuous Change, announces today its acquisition of Atlas Research (Atlas), an award-winning firm that partners with federal health organizations to drive mission-critical innovation and transformation. Through this acquisition, CVP further realizes its goal of becoming a premier mid-tier comprehensive healthcare solutions and citizen services consulting and systems integration firm. CVP acquired Atlas because of its similar culture, values, and vision for the future as well as its exceptionally talented team.

With Atlas, CVP adds new capabilities spanning research and evaluation, organizational transformation and innovation, strategic communications, and human capital solutions; deep domain expertise in veterans and military health, pandemic planning and response, health equity, mental health, and rural health; and a marquee federal health customer base. This merger, done solely through the strength of CVP’s own resources, adds over 170 professionals with deep healthcare and consulting experience to the CVP family.

Atlas brings a franchise position at the US Department of Veterans Affairs, a client they have served since 2008. Atlas accelerates CVP’s growth through the addition of major new health clients, domain expertise, capabilities, and contract vehicles. The acquisition strengthens CVP’s strategic focus on federal health agencies by adding a strong portfolio in the VA and expanding our portfolio across HHS. It includes the Veterans Health Administration (VHA) Integrated Healthcare Transformation (IHT) contract—a 10-year, $1 billion indefinite delivery/ indefinite quantity (IDIQ). It opens up access to the FDA with the $322M ceiling Business Transformation Team (BTT) BPA and the $100M ceiling Integrated Solutions (IS) BPA. It also provides a new government-wide vehicle for CVP’s transformation and human capital offerings via GSA’s Human Capital and Training Solutions (HCaTS) BPA (UNR).

“CVP’s acquisition of Atlas is the realization of a shared vision for an industry-leading, comprehensive mid-tier healthcare technology and consulting firm primed for growth,” said Atlas Co-Founder and CEO Ryung Suh. “The marriage of our respective capabilities, experience, and mission-driven cultures will translate to added value for our clients and their efforts to improve the health and wellbeing of our fellow citizens.”

“CVP’s vision as a fully integrated healthcare solutions and citizen services firm relies on expanding from a technology-centric services innovator to an end-to-end advisory, research, technology, and managed services firm,” said Anirudh Kulkarni, CVP Founder and CEO. “Atlas’ experience as the trusted transformation partner of clients across the VA and HHS provide the advisory and consulting capabilities to accelerate CVP’s growth strategy.”

About CVP

Customer Value Partners (CVP) is an award-winning business and next-gen technology consulting company that helps organizations navigate disruption and prepare for a culture of Continuous Change. We solve critical problems for healthcare, national security, and public sector clients through innovative strategies and solutions that leverage technologies and industry expertise in areas including Technology Modernization, Data Science & Engineering, Business Transformation, and Cybersecurity. CVP delivers unparalleled excellence to clients and employees through a strong culture of integrity, engagement, respect, and a passion for our clients’ missions.