KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

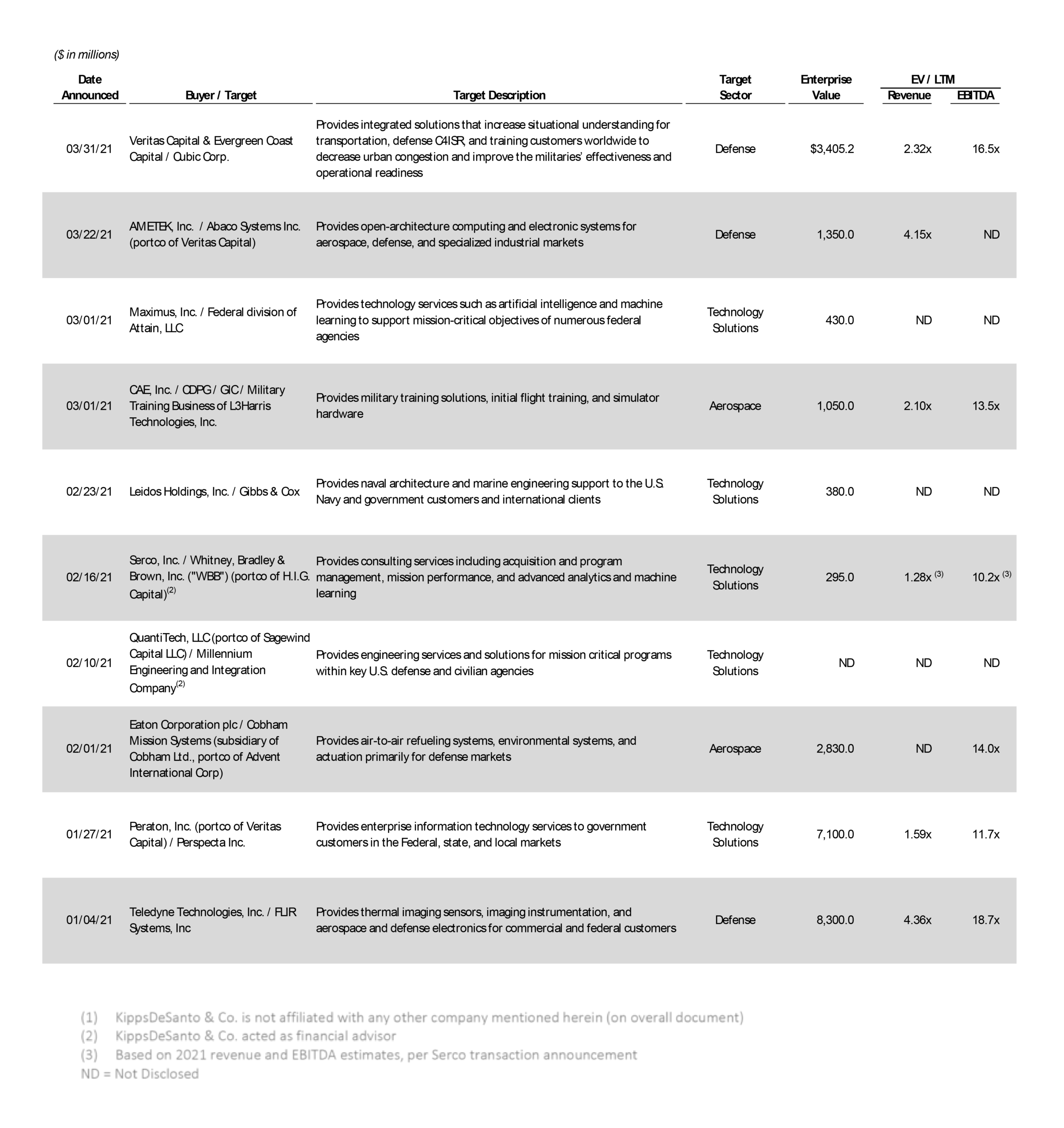

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended March 31st, 2021.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is the pending acquisition of Cubic Corporation (NYSE: CUB) (“Cubic”) by Veritas Capital and Evergreen Coast Capital (an affiliate of activist investor Elliott Management). Headquartered in San Diego, CA, Cubic is a technology-driven, market-leading provider of integrated solutions that increase situational understanding for transportation, defense C4ISR, and training customers worldwide to decrease urban congestion and improve military effectiveness and operational readiness. Cubic has two divisions: Cubic Mission and Performance Solutions (“CMPS”) and Cubic Transportation Systems (“CTS”). Following a weeks long bidding war, Cubic announced on March 31st that it accepted Veritas and Evergreen’s proposal to buy the company at $75 per share. The contention surrounding the acquisition began on February 8th, when Cubic announced an agreement to be acquired by New York-based private equity firm Veritas Capital and California-based private equity firm Evergreen Coast Capital for $70 per share, or approximately $3.3B. The transaction, which was expected to close in 2Q21, was halted by the March 22nd announcement of Singapore Technologies Engineering’s (“ST Engineering”) (SGX: S63) bid to acquire Cubic for $76 per share, or approximately $3.6B. ST Engineering had planned to sell the CMPS business to an affiliate of Blackstone Tactical Opportunities and intended to invest in CTS and retain the “Cubic” brand. However, on March 29th, subsequent to their original response, Veritas and Evergreen submitted a revised offer of $72 per share, which ST Engineering countered the same day with an offer of $78 per share. Thereafter, Veritas and Evergreen raised their bid to $75 per share, leading to Cubic’s announcement that it would accept the proposal “based on the superior certainty and anticipated timing of closing the existing transaction with” Veritas and Evergreen.

The technology solutions deal of the quarter is the pending acquisition of Perspecta Inc. (NYSE:PRSP) (“Perspecta”) by Peraton Corporation (“Peraton”), a portfolio company of Veritas Capital (“Veritas”). Based in Herndon, VA, Perspecta provides enterprise information technology (“IT”) services to government customers in Federal, state, and local markets. The acquisition bolsters Peraton’s current solutions set as a provider of highly-differentiated space, intelligence, cyber, defense, homeland security, and communications. Once combined, the two organizations will create a leading technology provider delivering end-to-end capabilities in IT and mission support for a diverse array of U.S. government customers. As part of the $7.1 billion purchase price, Perspecta shareholders will receive $29.35 per share in cash, representing a premium of 49.7% to the Company’s unaffected closing stock price of $19.60 on November 6, 2020, the last trading day prior to media reports of a strategic review process. Veritas owned two of the three businesses that were combined to create the publicly-traded Perspecta in 2018 and at the time of the announcement owned approximately 14.5% of total shares outstanding. This acquisition not only demonstrates Veritas’ continued focus on the government technology market, but also highlights the continuation of sector consolidation. Despite the ongoing COVID-19 pandemic and associated economic challenges, M&A deal volume across the government services marketplace remains at record levels, with more than 110 and 45 deals announced in 2020 and year-to-date 2021, respectively.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.