DealView Fall 2018

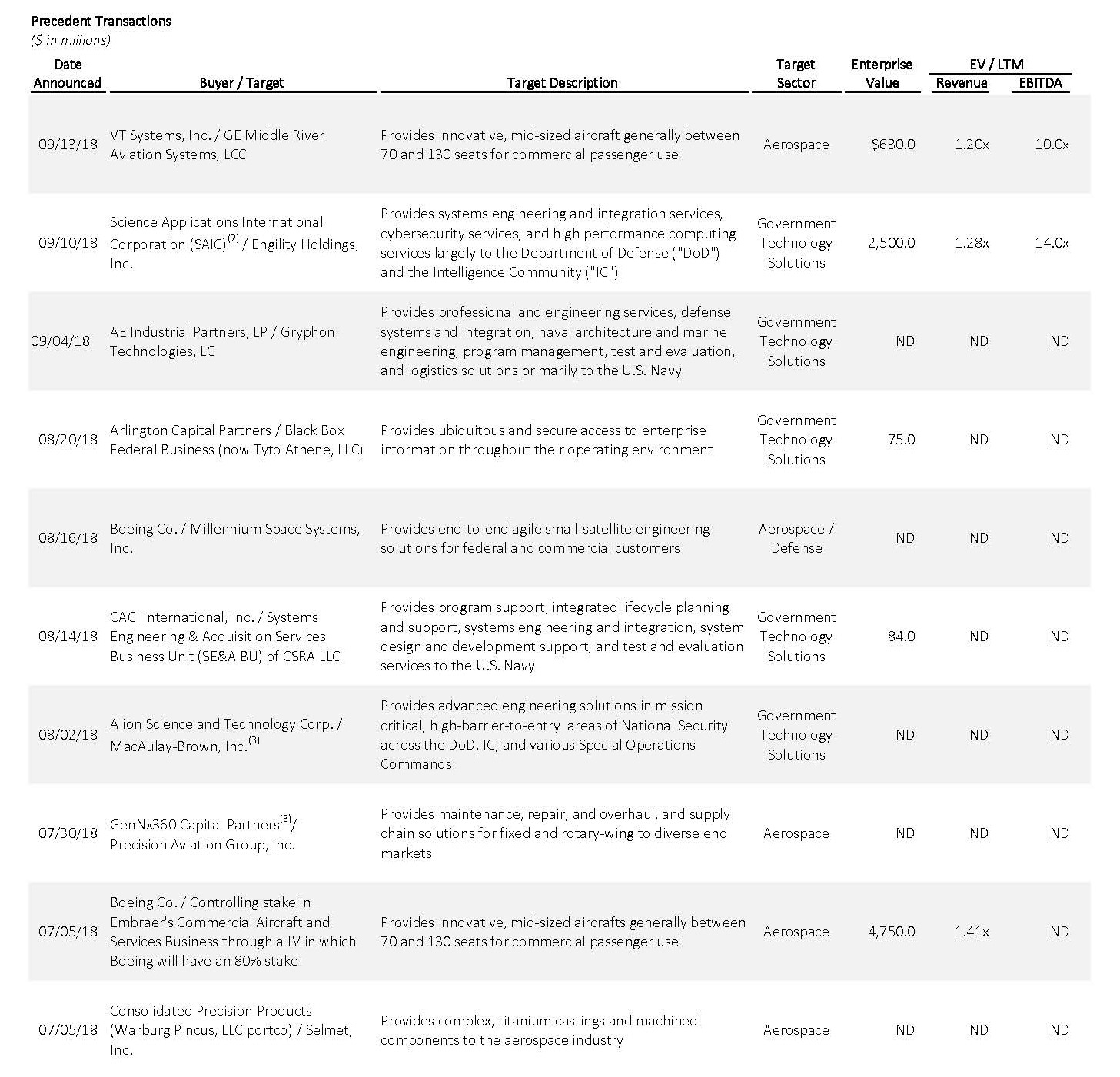

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended Septemebr 30, 2017. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact. Click here to download the table above

Click here to download the table above

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is Boeing’s acquisition of Embraer’s commercial aircraft division. Embraer’s commercial aircraft segment designs and manufactures jets, provides support services, and leases aircraft for commercial customers. Boeing purchased 80% of the commercial aircraft business for $3.80 billion, valuing the entire segment at $4.75 billion. Following the agreement, Boeing’s commercial aircraft line will range from 70 to 450 seats. The deal will allow Boeing to strategically position itself in the market for smaller regional aircraft, which is particularly important as it follows Airbus’ investment in Bombardier’s C Series program. Boeing and Embraer’s partnership now heightens barriers to entry in the industry as it forms a multi-layered duopoly with Airbus and Bombardier. The transaction is expected to close in 12 – 18 months, with Brazilian management leading the joint venture upon closing.

The government technology solutions deal of the quarter is Science Applications International Corp.’s (“SAIC”) $2.5 billion all-stock deal to acquire Engility Holdings Corp., which was announced on September 10th. The acquisition positions SAIC as the third-largest contractor by revenue in the government technology solutions space behind Leidos and General Dynamics Information Technology, Inc. (“GDIT”), generating pro-forma LTM revenue of $6.5 billion. The acquisition is anticipated to expand SAIC’s customer footprint at Air Force and within the intelligence community while simultaneously broadening its capabilities portfolio through bolstered expertise in intelligence analysis, launch support, and high-performance computing. This deal continues a trend of public company government contractors pursuing mega-mergers and acquisitions to achieve increased scale and meaningful cost synergies. The announcement follows General Dynamics’ (“GD”) acquisition of CSRA, which followed a high-profile bidding war between CACI, SAIC, and GD. According to SAIC, this strategic move provides the Company with significantly increased size and scale to hopefully compete more effectively in today’s marketplace. The deal is anticipated to close in SAIC’s FY19 Q4 (ending February 1, 2019), at which point Engility shareholders will own approximately 28% of SAIC on a pro-forma basis.

Click here to access KippsDeSanto’s 2018 Aerospace/Defense & Government Services M&A Survey

About KippsDeSanto & Co.: KippsDeSanto & Co. is an investment bank focused on delivering exceptional results for leading, growth-oriented aerospace / defense and technology companies. We leverage our creativity and industry experience to provide M&A, private financing and strategic consulting. Capitalizing on real-time industry trends and in-depth technical and strategic analysis, our solutions-driven approach is highly structured and uniquely tailored to each client. KippsDeSanto is recognized for its market insight and broad industry relationships. We help market leaders realize their full strategic value. KippsDeSanto, member FINRA/SIPC, is not affiliated with other companies mentioned herein. For more information, visit www.kippsdesanto.com.