KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

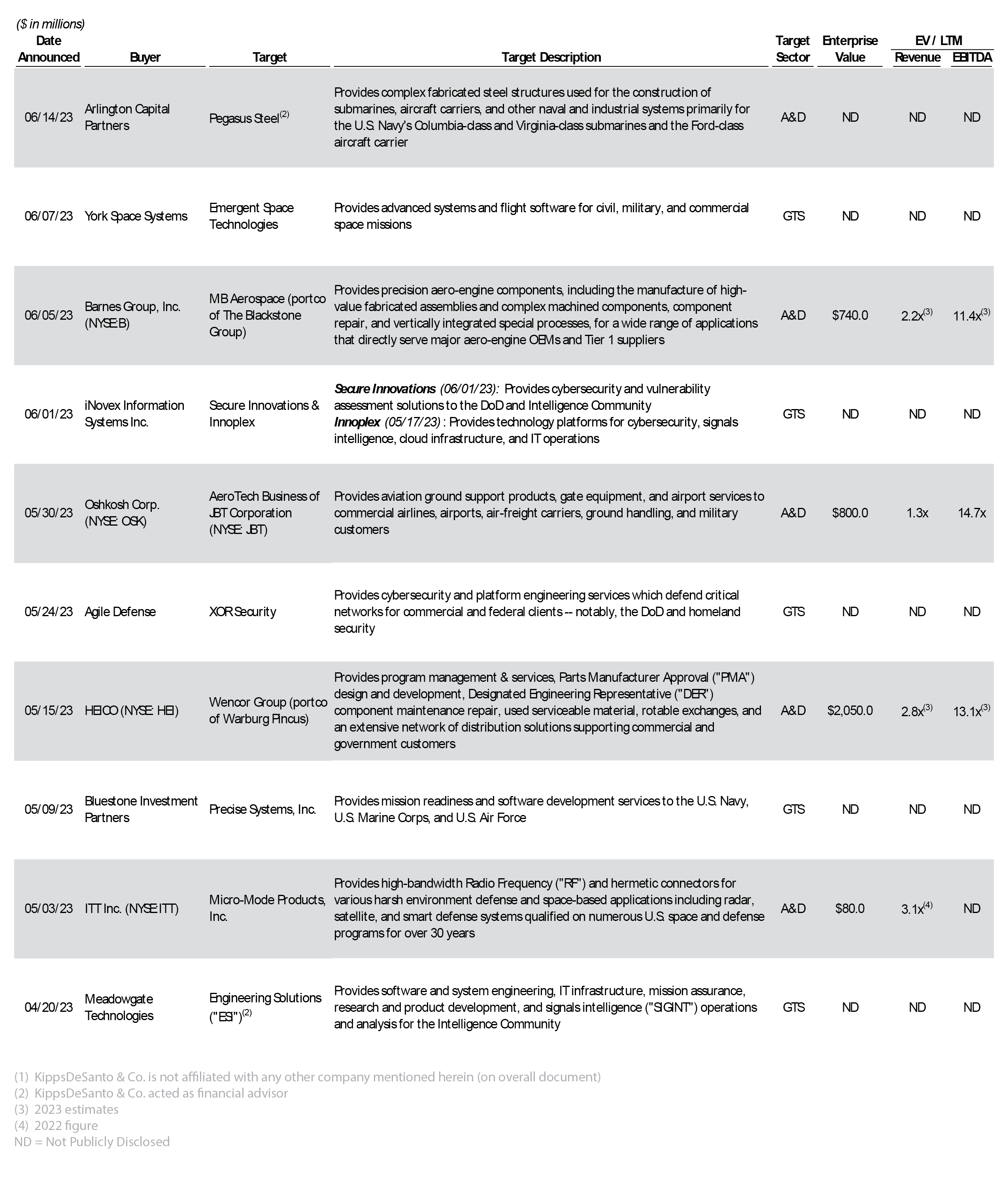

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2023.

Of the above transactions, we would like to highlight the following deals:

Of the above transactions, we would like to highlight the following deals:

HEICO Corporation’s (NYSE: HEI) pending acquisition of Wencor Group, LLC (“Wencor” or “the Company”) (a portco of Warburg Pincus, LLC). Headquartered in Peachtree City, Georgia, Wencor provides Parts Manufacturer Approval (“PMA”) design and development, Designated Engineering Representative (“DER”) component maintenance repair, program management and services, used serviceable material, rotable exchanges, and an extensive network of distribution solutions supporting commercial and government customers. The Company employs 9,000 employees at 100+ facilities worldwide servicing airline operators, aircraft MRO companies, military agencies, and defense contractors. Wencor has created over 6,000 PMA designs for products that support pneumatics, hydraulics, engines, auxiliary power units (“APUs”), landing gear, cabin interiors, and airframe parts. The Wencor acquisition expands HEICO’s aftermarket product offerings and accelerates the combined company’s growth, innovation, and development of reliable, cost-saving products and services for customers. This transaction reflects HEICO’s strategic investment in capturing aftermarket demand as consumer airline passenger volumes surge past pre-COVID levels and military optempo increases in line with global conflicts—ultimately driving growth in commercial and military aircraft utilization. Wencor employs approximately 1,000 people and is expected to generate ~$724 million in revenue for FY2023. As HEICO’s largest ever acquisition to date, this ~$2.1 billion transaction includes 93% cash and 7% stock consideration, and is subject to regulatory approvals and customary closing conditions before its expected close at the end of calendar 2023.

iNovex Information Systems Inc.’s (“iNovex”) acquisitions of Innoplex, LLC (“Innoplex”) and Secure Innovations, LLC (“Secure Innovations”), which were announced on May 17, 2023 and June 1, 2023, respectively. Headquartered in Columbia, MD, Innoplex provides end-to-end hardware and software systems engineering, information assurance, signals analysis, and wireless technology expertise to national and tactical-level end users in the defense and intelligence sectors. The acquisition of Innoplex extends iNovex’s services into high-performance software engineering, cloud infrastructure, and cyber and signals intelligence (“SIGNIT”). The acquisition of Columbia, MD-based Secure Innovations bolsters iNovex cybersecurity offerings by enhancing the combined entity’s defense cyber operations, systems security engineering, and vulneralbility assessment and penetration testing expertise. With the acquisition of Innoplex and Secure Innovations, iNovex is poised to be one of the largest middle-market technology solutions providers focused on national security interests with over $2 billion in combined prime contracts and over 1,000 employees. The combined entity has an entrenched footprint with national security customers and is well positioned to support the government’s goal of cyber dominance through novel approaches and innovative solutions, including the use of automation to manage its multi-cloud structure.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.