KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

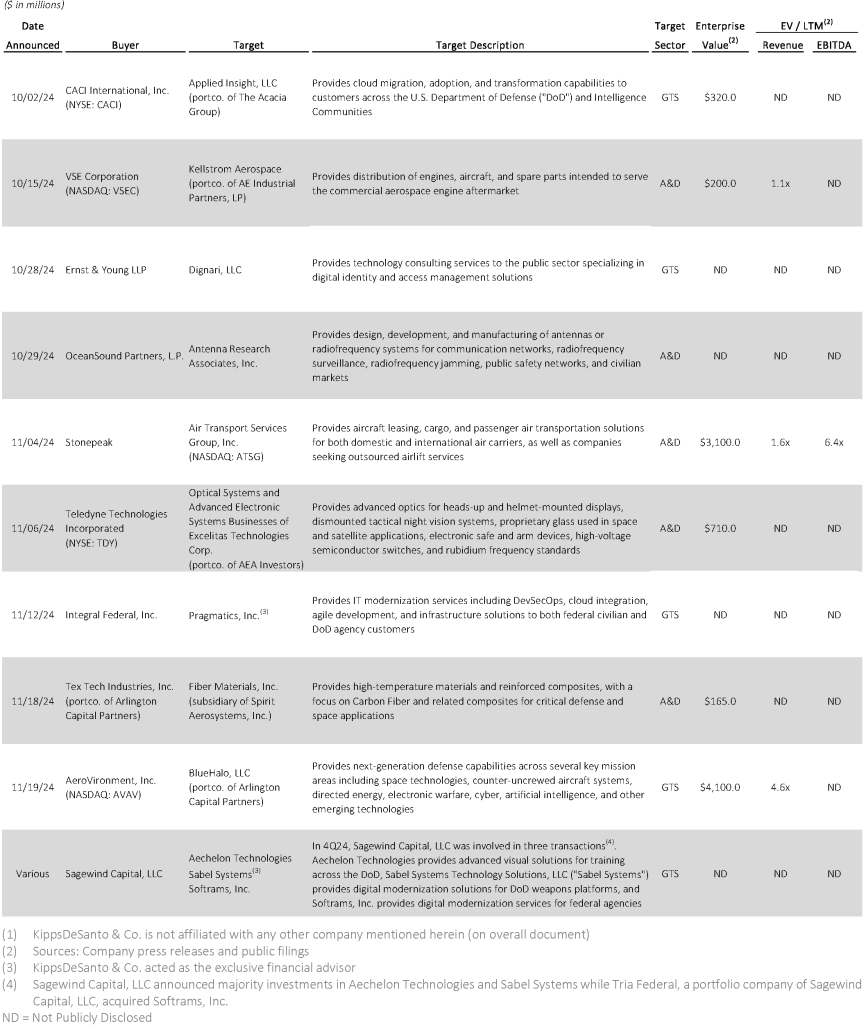

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2024.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Stonepeak’s pending $3.1 billion acquisition of Air Transport Services Group, Inc. (NASDAQ: ATSG) (”ATSG” or “the Company”). Headquartered in Wilmington, Ohio, ATSG provides aircraft leasing, cargo, and passenger air transportation solutions for both domestic and international air carriers, as well as companies seeking outsourced airlift services. The Company supports 5,300 employees and 10 subsidiaries, each operating across four key business segments: Aircraft Leasing Solutions, Aircraft Operating Solutions, Aircraft Maintenance, Repair, and Overhaul (“MRO”), and Flight and Ground Support Solutions. ATSG’s fleet includes 114 freighter, 16 passenger, and 4 combi aircraft across models such as the Airbus A321, Boeing 767, and Boeing 757. The acquisition serves Stonepeak’s North American Infrastructure Investment Strategy by accessing ATSG’s deep relationships with large e-commerce companies and integrators, a fleet full of scale and capacity, and an employee base relentlessly focused on safety and on-time performance. ATSG’s position as the top provider of freighter leasing globally, combined with its critical function within e-commerce and other supply chains, demonstrates continued demand for critical infrastructure assets among financial sponsors. Stonepeak will acquire all the issued and outstanding common shares of the Company at $22.50 per share. The consideration offered to the Company’s shareholders under the transaction represents a 29.3% premium to the closing share price on November 1, 2024, the last full trading day prior to the deal’s announcement. The transaction is expected to close in the first half of 2025 and remains subject to regulatory approvals.

The GTS deal of the quarter is the acquisition of BlueHalo, LLC (“BlueHalo”), a portfolio company of Arlington Capital Partners, by AeroVironment, Inc. (“AeroVironment”). Based in Arlington, VA, BlueHalo is a provider of next-generation capabilities in several key mission areas including space technologies, counter-uncrewed aircraft systems, directed energy, electronic warfare, cyber, artificial intelligence, and other emerging technologies. BlueHalo has grown organically and through a series of acquisitions since Arlington Capital Partners’ initial investment in 2019, focused on cutting-edge research and development to create transformative products and services for the future of global defense. AeroVironment’s acquisition of BlueHalo will create a diversified defense technology company with a highly complementary and differentiated portfolio of solutions in uncrewed systems, short and long range loitering munitions, counter-uncrewed aircraft systems, space technologies, electronic warfare and cyber, powered by artificial intelligence and autonomy. The combination aims to drive innovation, expand manufacturing capacity and enable better support to customers and their critical missions. The all-stock transaction with an enterprise value of approximately $4.1 billion was announced on November 19, 2024 and is expected to close in the first half of 2025 subject to regulatory approvals.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace & Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients by leveraging our scale, creativity, and industry experience. We help market leaders realize their full strategic value. Having advised more than 200 industry transactions since 2008, KippsDeSanto is recognized for its analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.