KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

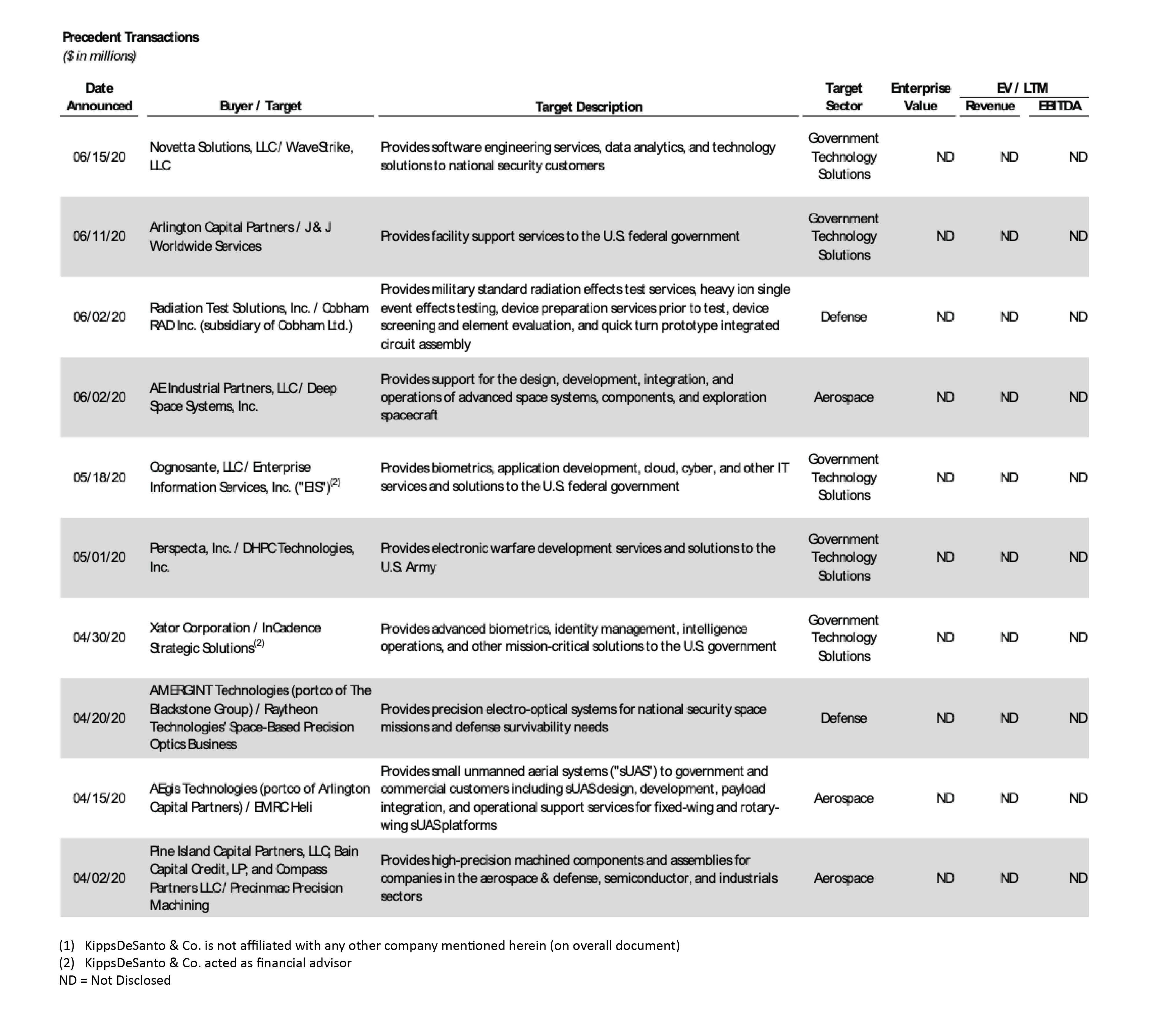

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended June 30, 2020.

While the COVID-19 global pandemic has impacted M&A activity, most notably fueling a decline in April transaction volume (particularly in the Aerospace / Defense side of the market), buyers generally remain interested in strategic acquisitions. In addition, volume appears to be rebounding with 16 and 28 announced transactions in May and June, respectively, across all three sectors.

The following is our take on the most notable announced M&A transactions in the second quarter of 2020 — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following was especially noteworthy:

Of the above transactions, the following was especially noteworthy:

The aerospace and defense deal of the quarter is AMERGINT Technologies’ pending acquisition of Raytheon Technologies’ (NYSE: RTX) space-based precision optics business (“the Business”). Formerly a part of Collins Aerospace, the Business provides precision electro-optical systems for national security space missions and defense survivability needs. This transaction marks the third and final required divestiture as part of the regulatory terms laid out by the Justice Department’s Antitrust Division for the merger between United Technologies and Raytheon. Upon completion of the transaction, the Business will become a wholly owned business unit of AMERGINT Technologies, a portfolio company of The Blackstone Group. AMERGINT is a leading provider of software-defined technology for military, intelligence, and commercial space customers with a focus on developing NextGen solutions for capturing, processing, transporting, and exploiting mission critical data. The acquisition of preeminent electro-optical capabilities will vertically extend AMERGINT’s product offering and allow the combined entity to target more comprehensive space opportunities and contracts. With a renewed federal and commercial interest in the space industry, the transaction highlights an optimistic outlook of sustained growth and investment in the sector. In addition, the acquisition highlights the presence of private equity financing in an industry dominated by venture capitalists and start-up funding.

The government technology solutions deal of the quarter is Cognosante’s acquisition of Enterprise Information Services, LLC (“EIS”). EIS is leading provider of biometrics, cybersecurity, application development, cloud migration, and other IT services to defense and civilian government agencies, including the U.S. Army, Intelligence Community, and Department of Homeland Security. In addition to its in-demand, NextGen IT offerings, EIS has amassed prime positions on numerous high-profile, full & open (“F&O”) contract vehicles, including Alliant II, Army RS3, and ITES-3S. Through this transaction, Cognosante bolstered its capability set, greatly expanded its DoD presence, and enhanced its contract portfolio. This deal underscores the continued demand for NextGen IT companies and buyer interest in prime, F&O positions on best-in-class vehicles. Additionally, despite COVID-19 related market impacts, M&A deals continue to transpire between well-positioned buyers and sellers.

About

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.