KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

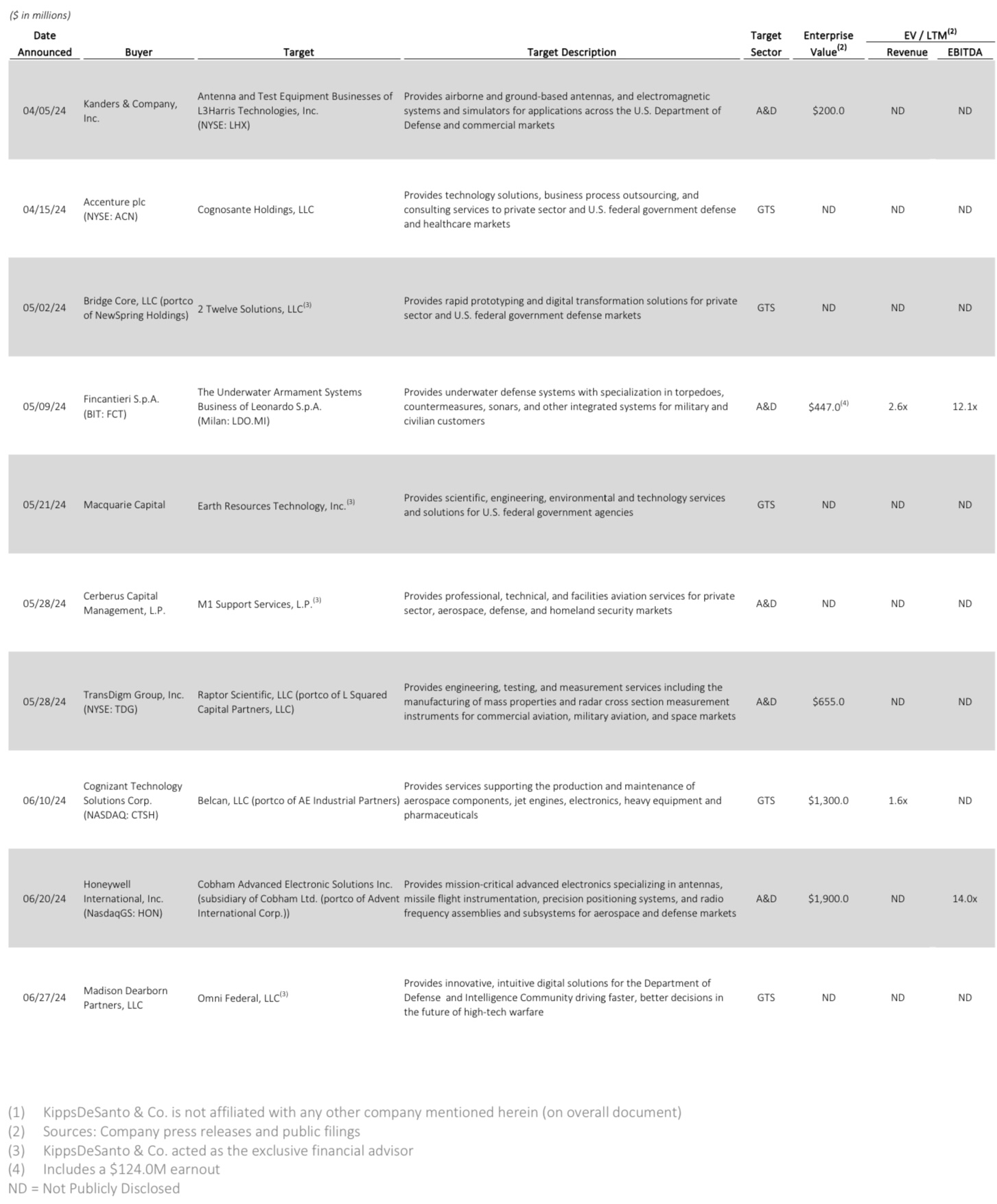

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2024.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Honeywell’s (Nasdaq: HON) pending $1.9 billion acquisition of CAES Systems Holdings LLC (”CAES” or “the Company”), a subsidiary of Cobham Ltd., a portfolio company of Advent International. Headquartered in Arlington, VA, CAES provides Electronic Attack (“EA”), Electronic Protection (“EP”), and Electronic Warfare support capabilities through systems and products including radio frequency (“RF”), microwave, microelectronics, and other antenna subsystems. CAES currently utilizes 13 facilities across the U.S. with approximately 2,200 employees serving aerospace, defense, space, and medical end markets. The Company operates in two business segments: Integrated Defense Systems and Missile Systems providing mission-critical solutions specifically designed for air, land, and maritime operations. CAES will provide Honeywell with favorable positions on well established, critical platforms such as GMLRS, AMRAAM, F-35, and EA-18G. This transaction demonstrates a strategic return to the M&A market for larger public companies, as Honeywell adds hyperscaling capabilities and enhanced electromagnetic systems to their existing Defense and Space business. The acquisition is expected to be earnings per share accretive within the first full year of ownership and is anticipated to close in the second half of 2024 subject to certain regulatory approvals.

The GTS deal of the quarter is the acquisition of Earth Resources Technology, Inc. (“ERT”) by Macquarie Capital (“Macquarie”). Based in Laurel, MD, ERT integrates full-spectrum, data-driven science and technology solutions that address complex and critical federal Earth and space mission priorities, from predicting extreme weather and climate trends to tracking and analyzing airborne and ocean pollutants. ERT’s core data and space competencies help to protect lives and properties and to sustain and improve economies and ecosystems. Macquarie’s acquisition of ERT represents the creation of a new platform company for the private equity group. The partnership will enable ERT to leverage Macquarie’s resources to accelerate growth opportunities across both existing and new federal agencies. The transaction was announced on May 28, 2024, and financial metrics have not been disclosed.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 200 industry transactions, KippsDeSanto & Co. is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.