KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

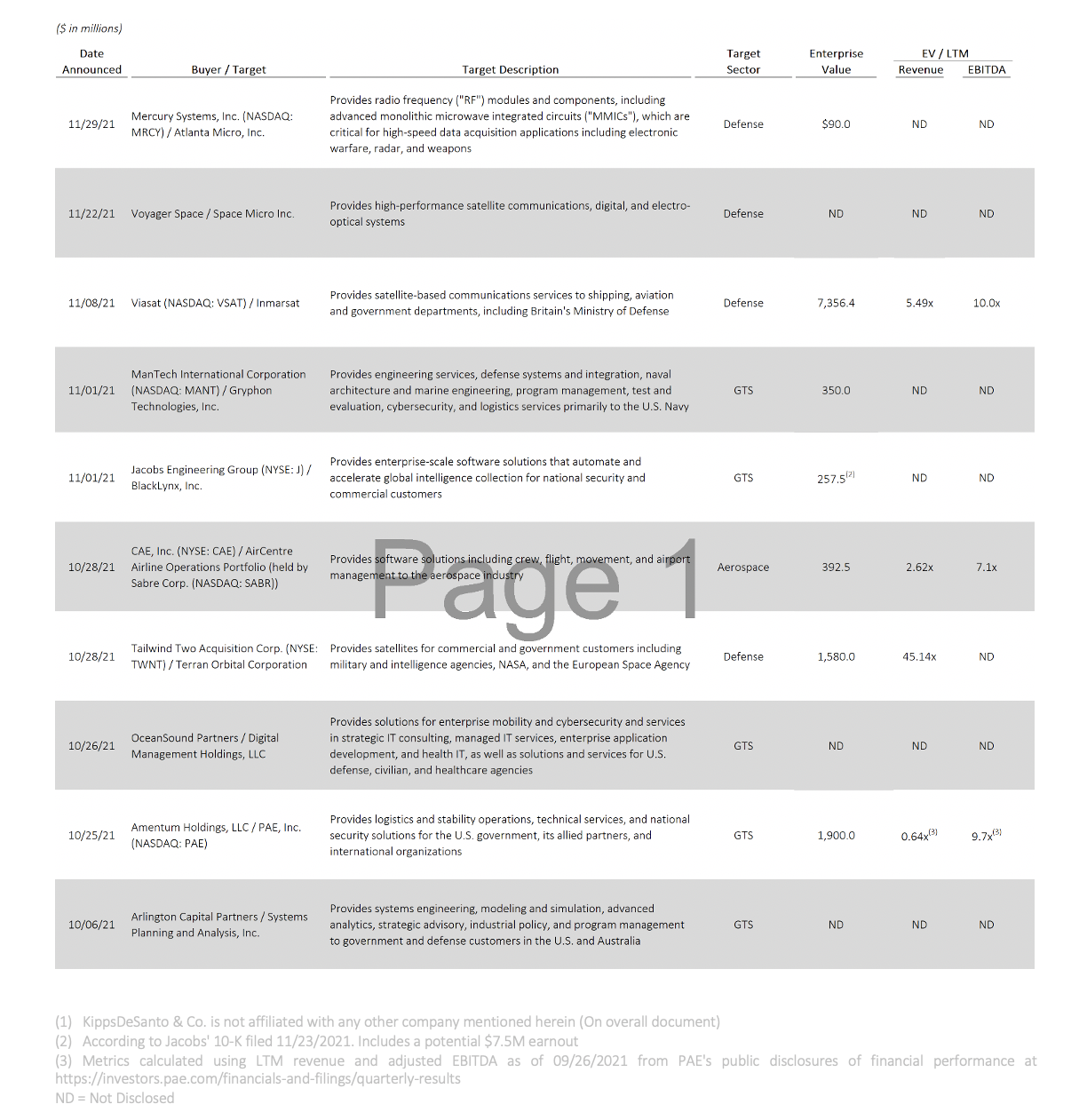

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”), Government Technology Services (“GTS”), and Enterprise Technology (“ET”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2021.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Tailwind Two Acquisition Corporation’s (NYSE: TWNT) (“Tailwind Two”), a special purpose acquisition company, pending $1.58 billion business combination agreement with Terran Orbital Corporation (“Terran Orbital” or the “Company”). The combined company will operate as Terran Orbital Corporation, with plans to list on the NYSE under the symbol LLAP. The deal will give Terran Orbital access to $345 million of cash from Tailwind Two’s cash-in-trust, $50 million from a private investment in public equity (“PIPE”) with participation from AE Industrial Partners, Beach Point Capital, and Lockheed Martin, as well as $75 million of additional financial commitments from Francisco Partners and Beach Point Capital. This agreement continues the trend of space companies going public through SPAC’s following recent announcements of Redwire, Astra Space, BlackSky, and others. Headquartered in Boca Raton, Florida, Terran Orbital provides satellites for commercial and government customers including military and intelligence agencies, NASA, and the European Space Agency. With the growth capital raised from the business combination, Terran Orbital will be able to expand existing manufacturing capabilities to deliver new technologies quicker and more affordably. Small satellites will play a critical role in the future of space infrastructure and exploration, as well as provide customers with real time data to make informed and actionable decisions. LLAP expects to have a positive adjusted EBITDA by 2023 and ~$3 billion in revenue by 2026, a significant increase from $35 million in revenue expected in 2021. Additionally, LLAP is capitalizing on its fully integrated manufacturing capabilities to launch the most advanced Earth observation constellations of small satellites. This will provide highly persistent, real-time Earth imagery as a service, making Earth observation data more abundant and accessible than ever before. The transaction is expected to close in the first quarter of 2022 subject to shareholder approval and other customary closing conditions.

The GTS deal of the quarter is the $1.9 billion pending acquisition of Pacific Architects and Engineers (NASDAQ: PAE) (“PAE”), by Amentum Government Services Holdings, LLC (“Amentum”), a portfolio company of Lindsay Goldberg and American Securities, LLC, in an all-cash transaction. Headquartered in Arlington, VA, PAE provides a broad range of services and operational solutions for the U.S. government, allied governments, and international organizations. The combined company will become one of the largest Federal government contractors, with more than $9.0 billion in annual revenue. The addition of PAE will complement Amentum’s intelligence and technology services capabilities, expand customer relationships across the Department of Defense (“DoD”), Department of State, NASA, and the Intelligence Community (“IC”), and significantly increase Amentum’s scale and suite of capabilities. The transaction reinforces the ongoing prioritization by buyers of acquisition targets with deep relationships with difficult to penetrate customers within the DoD and the IC. Other recent acquisitions of targets with embedded positioning across the DoD/ IC include the acquisition of Asymmetrik by BlueHalo and of Entegra Systems, LLC, by Acclaim Technical Services. Under the merger agreement, PAE shareholders will receive $10.05 per share in cash, a 70% premium to PAE’s closing price on the last day of trading prior to the announcement. This is the third acquisition this year of a public target by a private equity-sponsor or portfolio company. In May, Veritas Capital and Evergreen Coast Capital acquired Cubic Corporation (NYSE: CUB) for $3.0 billion, and Peraton (a portfolio company of Veritas Capital) acquired Perspecta Inc. (NYSE: PRSP) for $7.1 billion. PAE shareholders have yet to approve the transaction, following the end of a “go-shop” period on November 29, 2021. However, PE Shay Holdings, LLC, which currently owns 22.5% of PAE’s outstanding shares, has agreed to vote to approve the transaction in accordance with management. The deal is expected to close in the first quarter of 2022.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 140 industry transactions since 2007, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.