KippsDeSanto & Co. advises DELTA Resources, Inc. on its sale to VT Group, a portfolio company of The Jordan Company

KippsDeSanto & Co. advises DELTA Resources, Inc. on its sale to VT Group, a portfolio company of The Jordan Company

KippsDeSanto & Co. advises DELTA Resources, Inc. on its sale to VT Group, a portfolio company of The Jordan Company

KippsDeSanto & Co. is pleased to announce the sale of DELTA Resources, Inc. (“DELTA” or the “Company”), to VT Group, a portfolio company of The Jordan Company.

Founded in 2000, DELTA is a next-generation U.S. Navy modernization solutions provider based in Alexandria, VA specializing in full lifecycle naval systems engineering and technical services for critical Naval Sea Systems Command (“NAVSEA”), Navy Program Executive Offices (“PEO”), Army, and DISA programs.

The Company’s deep domain knowledge and past performance in modernization and interoperability, to include Command, Control, Communications, Computers, Cyber and Intelligence (“C5I”), weapon systems engineering, shipbuilding and fleet modernization, IT modernization, cloud implementation, and cybersecurity has established DELTA as trusted partner to address customers’ most challenging mission requirements to advance the capabilities and technological superiority of the Navy’s Fleet and other key DoD programs, platforms, and warfare systems.

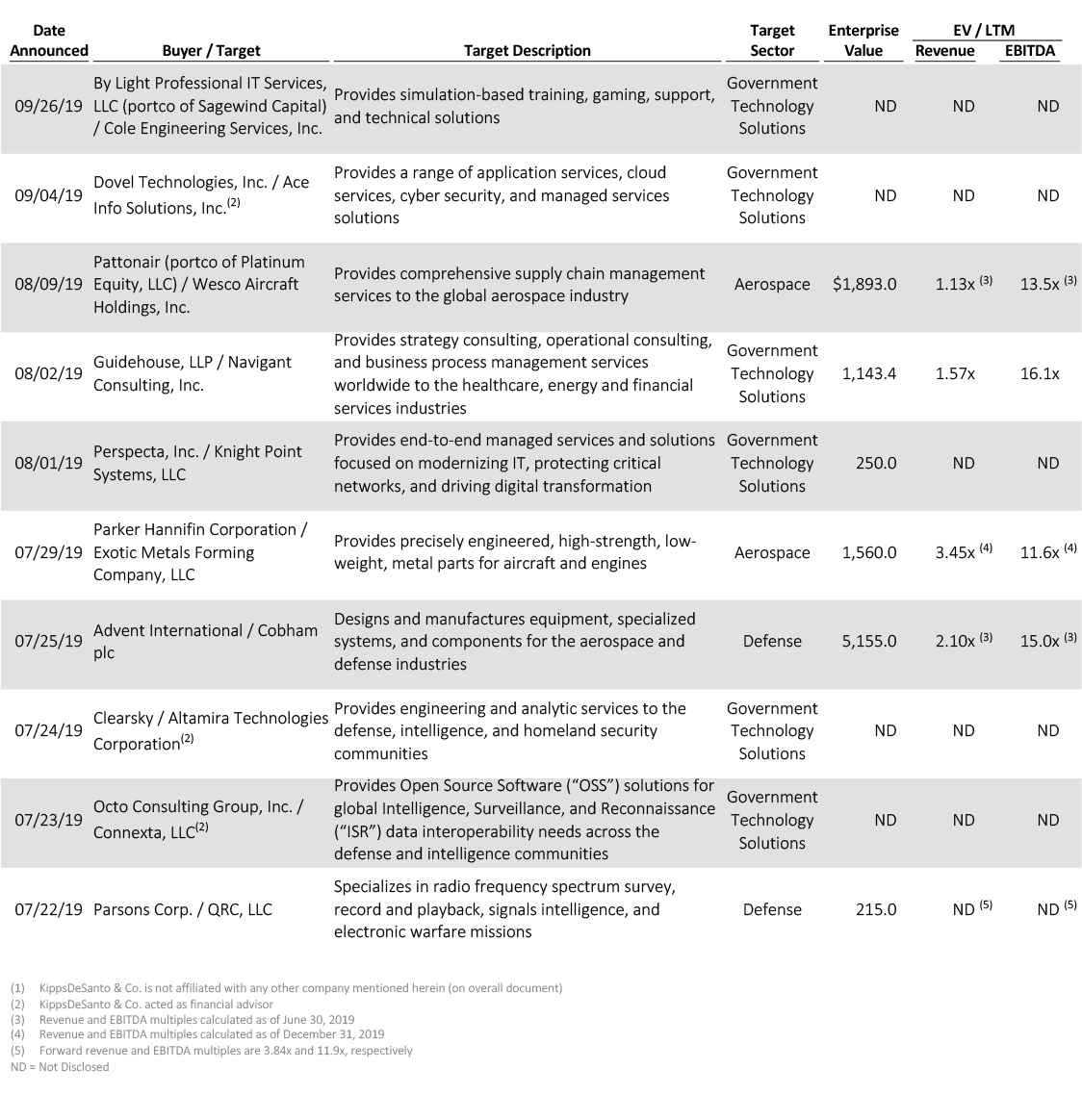

We believe this investment demonstrates several key trends in the defense and government technology M&A environment:

- Acquirers continue to attribute strong value to companies with entrenched customer positioning and longstanding incumbency on mission-critical programs;

- Deep domain and subject matter expertise, particularly in attractive C5I and IT modernization proficiencies, are critical differentiators for sellers in a crowded M&A market; and

- Private equity continues to deploy capital in the government services market – via new platforms and add-ons to existing portfolio companies to further build the middle market; and

About KippsDeSanto & Co.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Press Release

VT Group Enhances Naval Modernization Capabilities with Acquisition of DELTA Resources, Inc.

CHANTILLY, VA – (October 1, 2019) — VT Group, a premier technology integrator and C4ISR solutions provider, is pleased to announce the acquisition of DELTA Resources, Inc., a rapidly growing firm of 350 highly skilled professionals specializing in naval systems engineering and technical services for the US Navy’s most critical shipbuilding and Fleet modernization programs.

Founded in 2000 and headquartered in Alexandria, Virginia, DELTA Resources provides the Naval Sea Systems Command (NAVSEA) and the Navy’s Program Executive Offices (PEOs) with C5I and weapons systems engineering, integrated product support, and a full spectrum of technical services. DELTA Resources also delivers information technology, cloud implementation, and cybersecurity engineering services to a growing customer base that includes the US Army and the Defense Information Systems Agency (DISA).

“I am excited to welcome the DELTA Resources team to VT Group,” said John Hassoun, VT Group President and Chief Executive Officer. “This acquisition adds differentiated technical expertise to our portfolio of Fleet modernization capabilities and positions VT Group as a leading provider of full lifecycle naval engineering services for the next generation of naval platforms and weapons systems.”

DELTA Resources founder and Chief Executive Officer Maria Proestou shared, “I am immensely proud of the DELTA Resources team, their commitment to our customers, and the business we’ve built together. This combination is the next chapter in our story. VT Group and DELTA Resources share a common vision, compatible cultures, complementary capabilities, and a customer-focused team of talented professionals.” Ms. Proestou will continue to lead DELTA Resources as a wholly-owned subsidiary of VT Group.

VT Group provides Defense Department customers with industry leading C4ISR modernization and sustainment solutions and full lifecycle engineering in the air, ashore, and at sea. Its US Navy prime contract customers include the Naval Air Systems Command (NAVAIR), Naval Information Warfare Systems Command (NAVWAR), and Naval Sea Systems Command (NAVSEA) and its capabilities span the engineering lifecycle spectrum, from concept development and design through installation, integration, and sustainment. Chief Growth Officer Sunil Ramchand added, “In the Program Executive Offices, at the Systems Commands, and on the deckplates of every class of warship and submarine in the Fleet, VT Group is honored to support the US Navy and proud to provide our Sailors with the warfighting capabilities of tomorrow.”

About VT Group

Headquartered in Chantilly, VA, VT Group is a leading technology integrator with nearly 50 years of experience delivering C4ISR solutions to complex challenges faced by our government and commercial customers in the Defense and National Security markets. An end-to-end provider of integrated information systems and technology engineering solutions, VT Group operations span more than 80 locations worldwide. For more information on VT Group, visit www.vt-group.com.