KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by Darren SokvaryKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

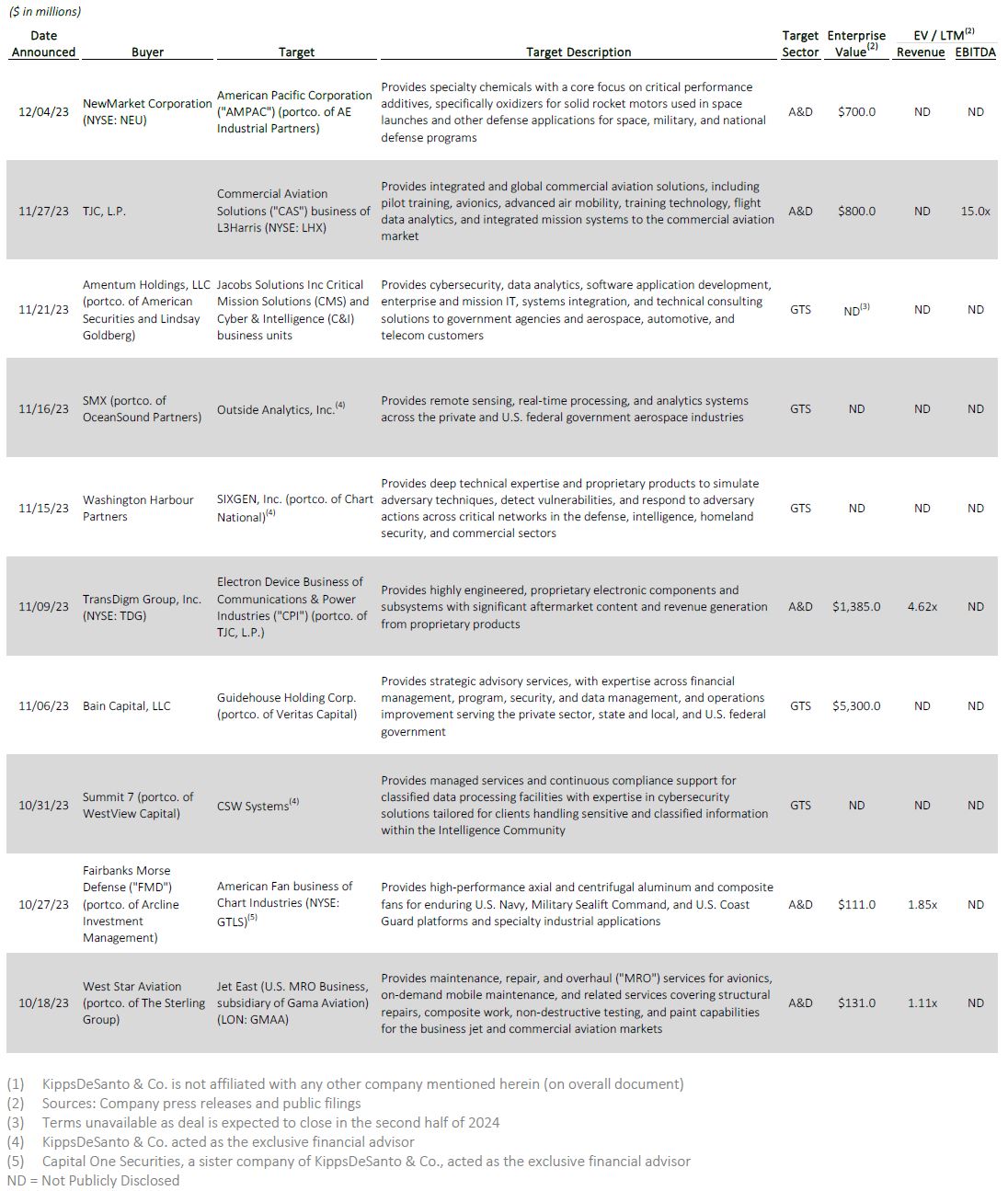

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2023.

Of the above transactions, the following were especially noteworthy:

TransDigm Group Inc.’s (NYSE: TDG) pending acquisition of the Electron Device Business (“the Company” or “EDB”) of Communications & Power Industries (“CPI”), a portfolio company of TJC, L.P. (formerly known as “The Jordan Company”). Headquartered in Palo Alto, California, EDB provides highly engineered, proprietary high-powered microwave components that enable various radar, electronic warfare, quantum sensing, and missile defense platforms. The Company currently employs ~900 employees across facilities in California, Massachusetts, and England, serving military, industrial, scientific, electronic warfare, and communications markets worldwide. The Company’s aftermarket content accounts for ~70% of its $300 million FY2023 revenue, with a diverse range of proprietary products and platforms. The acquisition enables TransDigm to expand its customer and electronic component capabilities through the Company’s 75+ sole- source positions for blue-chip customers on platforms with a large installed base. The EDB acquisition demonstrates continued investor appetite for suppliers of proprietary products on highly-engineered defense platforms with enduring aftermarket demand and forward revenue visibility, directly aligned with TransDigm’s acquisition strategy to deliver long-term shareholder value. The $1.4 billion transaction will be funded with existing cash on hand and new long-term debt, and was announced on November 9, 2023. Subject to United States and United Kingdom regulatory approval, the transaction is expected to close by the end of TransDigm’s third fiscal quarter in 2024.

Bain Capital Private Equity’s (“Bain Capital”) acquisition of Guidehouse Inc. (“Guidehouse”), a portfolio company of Veritas Capital. Headquartered in McLean, VA, Guidehouse is a provider of strategic advisory services, with areas of expertise in financial management, program, security, and data management, and operations improvement. The Company serves the federal government, state and local governments, and the private sector with capabilities and solutions spanning a wide range of industries, including defense and security, energy, infrastructure, sustainability, financial services, and health. The acquisition of Guidehouse increases Bain Capital’s exposure to the consulting industry, which has been growing steadily as businesses strive to navigate increasingly complex challenges. This move provides Bain Capital with a solid platform to enhance its offerings to federal, state, and local governments, leveraging Guidehouse’s extensive government services practice. This transaction was announced on November 6, 2023. The transaction is valued at $5.3 billion.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by Darren SokvaryKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

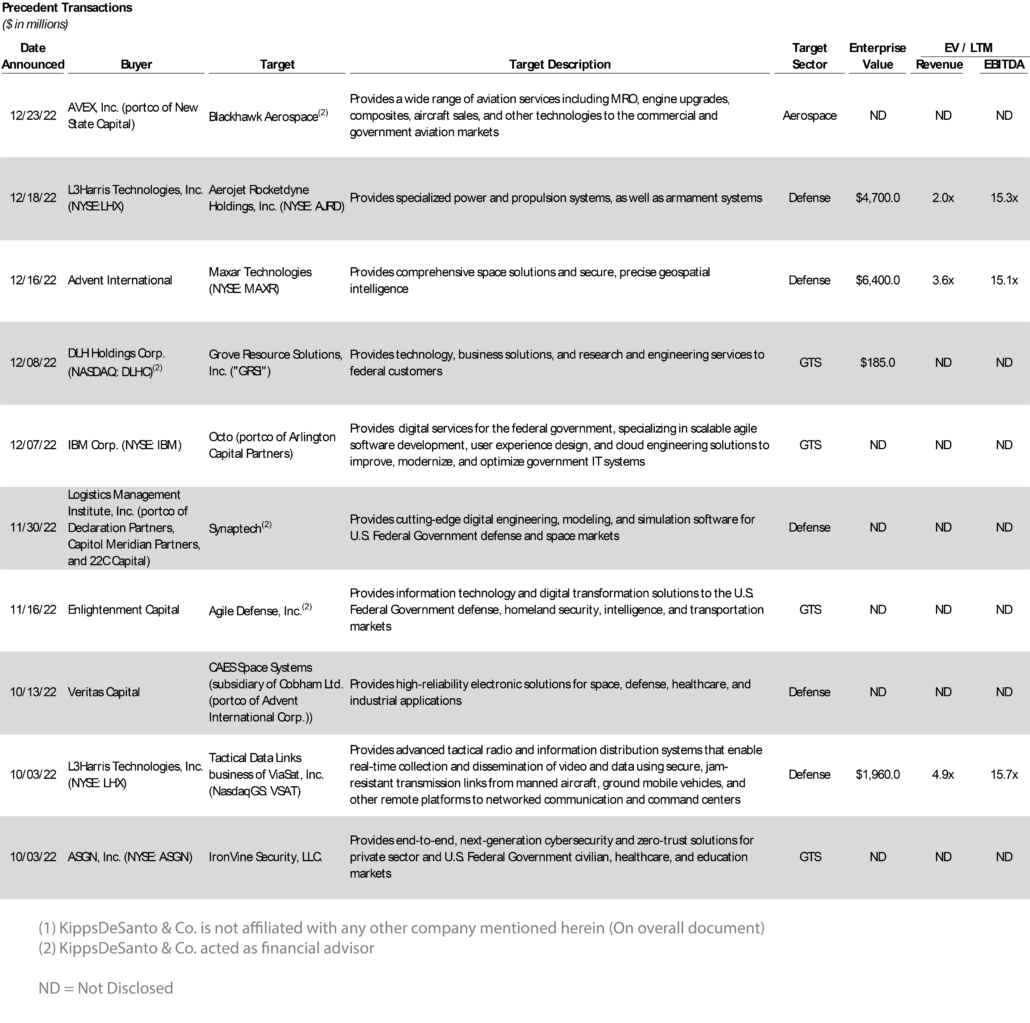

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended September 30, 2023.

Of the above transactions, we would like to highlight the following deals:

BAE Systems plc’s (LON: BA) pending acquisition of Ball Aerospace (“the Company”) (a subsidiary of

Ball Corporation (NYSE: BALL)). Headquartered in Westminster, CO, the Company provides mission critical

space systems and defense technologies including specialized instruments, sensors, and spacecraft that enable

laser SATCOM systems to monitor space-based threats for defense and civilian applications across all domains.

Ball Aerospace currently employs over 5,200 employees across eight U.S.-based facilities and serves the

Intelligence Community (“IC”), the U.S. Department of Defense (“DoD”), and the greater civilian space market.

The Company is well-positioned across military, civil space, C5ISR, and missile & munitions markets and is

known as a pioneer among innovators of technology-based space and defense capabilities. This transaction

supports BAE Systems’ strategy focused on specialization and growth in space-based defense and intelligence

as the U.S. government continues to rely on public-private partnerships for support, protection, and innovation

in the growing space economy. Ball Corporation is expected to use the proceeds from the divestiture of Ball

Aerospace to deleverage and increase share repurchases. The Company is expected to deliver approximately

$2 billion in revenue for FY2023, of which 70% is derived from space-related programs. Additionally, the

acquisition provides BAE Systems with earnings per share (“EPS”) and margin accretive run-rate synergies in

the first year, as well as significant projected returns on invested capital (“ROIC”) within five years post close.

The estimated $5.6 billion, 100% cash acquisition is expected to close in the first half of 2024 after regulatory

approvals and conditions. This transaction was announced on August 17, 2023.

Arlington Capital Partners’ (“ACP”) acquisition of Integrated Data Services, Inc. (“IDS”). Headquartered

in El Segundo, CA, IDS is a provider of software development, technical services, and technology-enabled

support for the U.S. Air Force, Space Force, and other defense and civilian departments. IDS’s flagship software

offering, Comprehensive Cost and Requirement (“CCaR”), enables users to manage requirements, formulate

budgets, and track execution by aggregating big sets of data to embed its highly specialized software into a

technology package that streamlines federal government employee’s daily responsibilities. Through fast,

efficient, and reliable information systems and support services, IDS has become a preferred provider of

financial and programmatic systems, services, and solutions to the federal government. Upon completion of

the transaction, IDS expects to expand its capabilities and product offerings while continuing to deliver high

quality solutions to its customers. The acquisition reflects financial sponsors’ continued investment in midmarket

platforms with integrated technology solutions. This transaction was announced on August 2, 2023.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

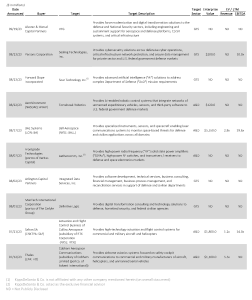

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended March 31, 2023.

Of the above transactions, the following were noteworthy:

The A&D deal of the quarter is the pending acquisition of Calspan Corp. (“Calspan” or “the Company”) by TransDigm Group, Inc. (NYSE: TDG). Headquartered in Buffalo, New York, Calspan provides independent testing and technology development services, solutions, and systems with applications including mobility & safety, flight & wind tunnel, jet engine test solutions, and hypersonics in the aerospace, defense, and automotive industries. The Company operates from seven primary facilities across New York, Virginia, Minnesota, and California. Calspan’s transonic wind tunnel in Buffalo, New York enables a range of critical, aftermarket-focused development activities for commercial and defense aerospace end markets. TransDigm’s proven operating model presents a meaningful opportunity to enhance Calspan’s established positions across a diverse range of aftermarket-focused aerospace and defense development and testing services. This transaction highlights increasing demand for aftermarket services as in-service commercial aviation and defense aircraft continue operating well into projected asset lifecycles and require maintenance, repair, and overhaul (“MRO”). This coincides with increased aircraft utilization concurrent with a notable recovery in commercial passenger demand, business jet OE backlog, and strong air freight traffic in recent months. Calspan employs approximately 625 people and is expected to generate ~$200 million in revenue for FY2023. This 100% cash, $725 million transaction is subject to regulatory approvals and customary closing conditions and is expected to close during TransDigm’s fiscal 2023.

The GTS deal of the quarter is the acquisition of Axim Geospatial, a portfolio company of Bluestone Investment Partners, (“Axim” or “the Company”) by NV5 Global, Inc. (“NV5”) (NASDAQ: NVEE). Headquartered in Sun Prairie, Wisconsin, Axim provides full-spectrum geospatial solutions to clients across the defense, intelligence, state & local (“S&L”) government, and commercial sectors. Axim utilizes over 200 high-tech, proprietary geospatial survey and mapping tools to support repeatable, scalable, and efficient geospatial data production. These tools support the Company’s expansion into new customer sectors—ultimately enabling synergistic opportunities associated with NV5’s high-altitude data acquisition capabilities. Axim offers four core delivery models: Survey and Mapping, Enterprise Geographic Information Systems (“GIS”) and Cloud Services, Critical Infrastructure and Security, and Business Solutions and Analytics to deliver customized solutions to meet clients’ critical business challenges. This transaction highlights the significant market demand for leading-edge, next-generation technologies at the confluence of cloud computing, geospatial data analytics, and machine learning that help improve business decision-making, performance, and operational efficiency. This demand also reflects the continued high level of private equity activity in the market as “buy-and-build” strategies continue to establish portfolio companies with strong industry fundamentals, reputation, and scale. KippsDeSanto & Co. served as the exclusive financial advisor to Axim.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

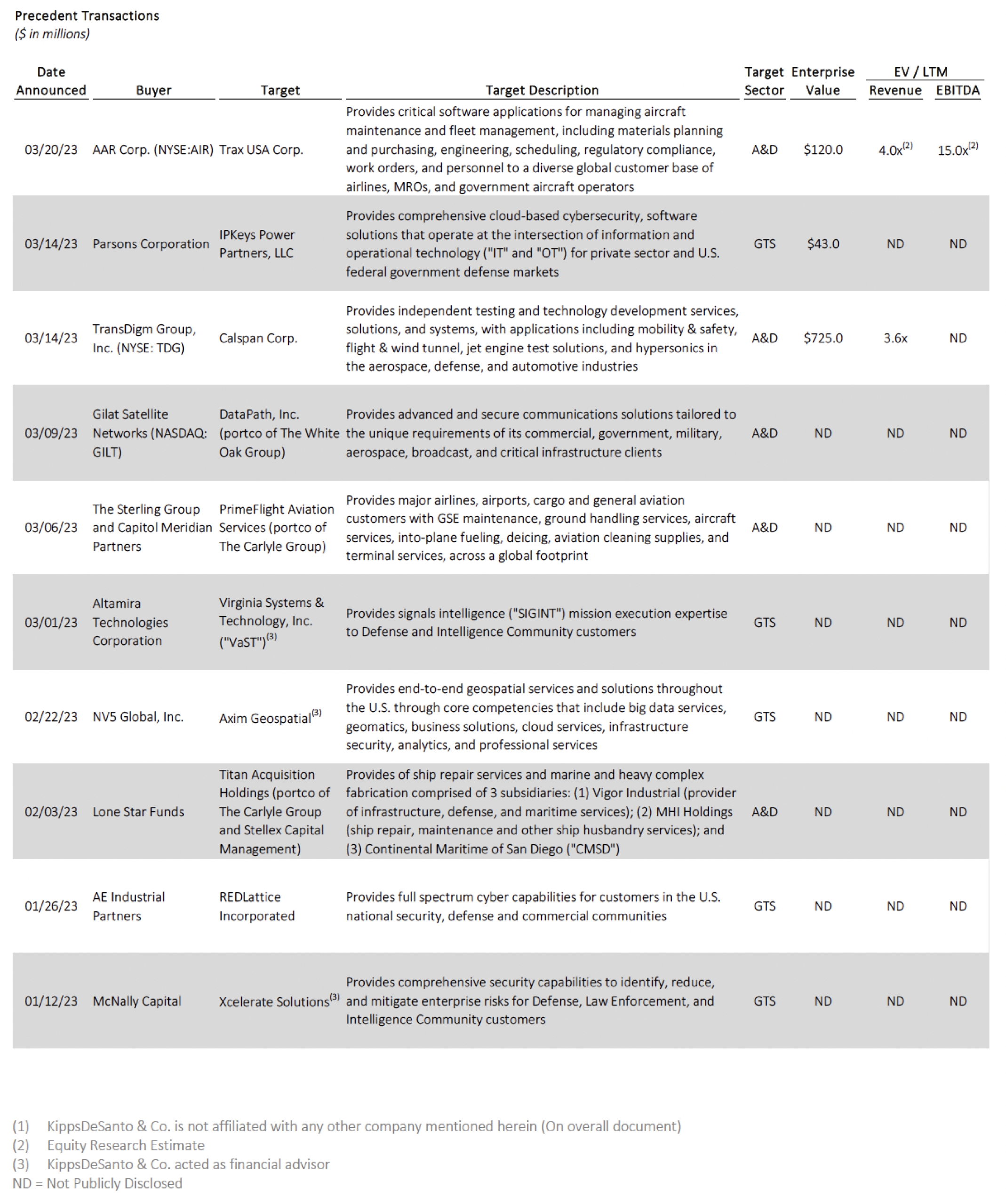

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Advent International’s (“Advent”) pending acquisition of Maxar Technologies (“Maxar”) (NYSE: MAXR). Maxar is a provider of advanced space technology solutions supporting both commercial and government markets, delivering secure and precise Earth imagery, geospatial intelligence, and data analytics. Advent has committed to provide $3.1 billion of equity financing for the deal, while the British Columbia Investment Management Corporation is also making a $1 billion minority equity contribution. Including debt, the deal is valued at $6.4 billion, marking one of the largest leveraged buyouts in 2022. As the U.S. government’s primary supplier of satellite imagery, recently securing a $3.2 billion agreement with the National Reconnaissance Office to provide imagery over the next 10 years, Maxar will remain a U.S.-controlled and operated company. Under the terms of the definitive merger agreement, Advent has agreed to acquire all outstanding shares of Maxar common stock for $53.00 per share in cash, representing a premium of approximately 129% over Maxar’s closing stock price of $23.10 on December 15, 2022, the last full trading day prior to this announcement. As a private company, Maxar hopes to accelerate vital investments in next-generation satellite technologies and data insights, including advanced machine learning and 3D mapping; successfully deploy the next-generation WorldView Legion imaging constellation, a program which has been plagued by delays; further grow its Earth Intelligence and Space Infrastructure businesses; and pursue select, strategic M&A to further enhance its portfolio of solutions. This transaction highlights continued consolidation in the satellite ecosystem this year, following Eutelsat S.A.’s pending merger with OneWeb Global, which will create a fully mutualized network of Low Earth Orbit (“LEO”) and Geosychronous Equatorial Orbit (“GEO”) satellites, and SES’s $450 million acquisition of DRS’s satellite communications (“SATCOM”) business, which will create a multi-orbit SATCOM provider to federal customers. The Advent and Maxar acquisition requires regulatory and stockholder approvals, and it is expected to close in mid-2023.

The GTS deal of the quarter is the acquisition of Grove Resource Solutions, Inc. (“GRSi”) by DLH Holdings Corp (“DLH”) (NASDAQ: DLHC). Headquartered in Bethesda, MD, GSRi is an industry-leading provider of a broad array of cloud-based enterprise modernization and cyber security solutions to Federal Civilian, Health IT, Defense, and commercial sectors. With approximately 700 employees, GRSi brings nearly two decades of experience serving the National Institutes of Health (“NIH”), U.S. Navy, and U.S. Marine Corps to DLH. GRSi was purchased for $185.0 million, or $157.9 million net of transaction-related tax benefits worth approximately $27.1 million on a net present value basis. The purchase price includes $178.0 million of cash and $7.0 million of equity. DLH estimates that GRSi will contribute annualized revenue of approximately $140 million to the Company going forward, and the firm’s backlog was approximately $550 million at closing. DLH plans to leverage GRSi’s high-end IT and technical capabilities, highly credentialed workforce, and reputation for excellence to accelerate growth for the unified company. This deal highlights the increasingly selective M&A strategies of public GTS companies as they prioritize scale as a key target discriminator. In the fourth quarter of 2022, public buyers accounted for just 15% of GTS M&A activity compared to over 30% in the fourth quarter of 2021. This transaction was announced December 8, 2022. KippsDeSanto & Co. served as the exclusive financial advisor to DLH.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

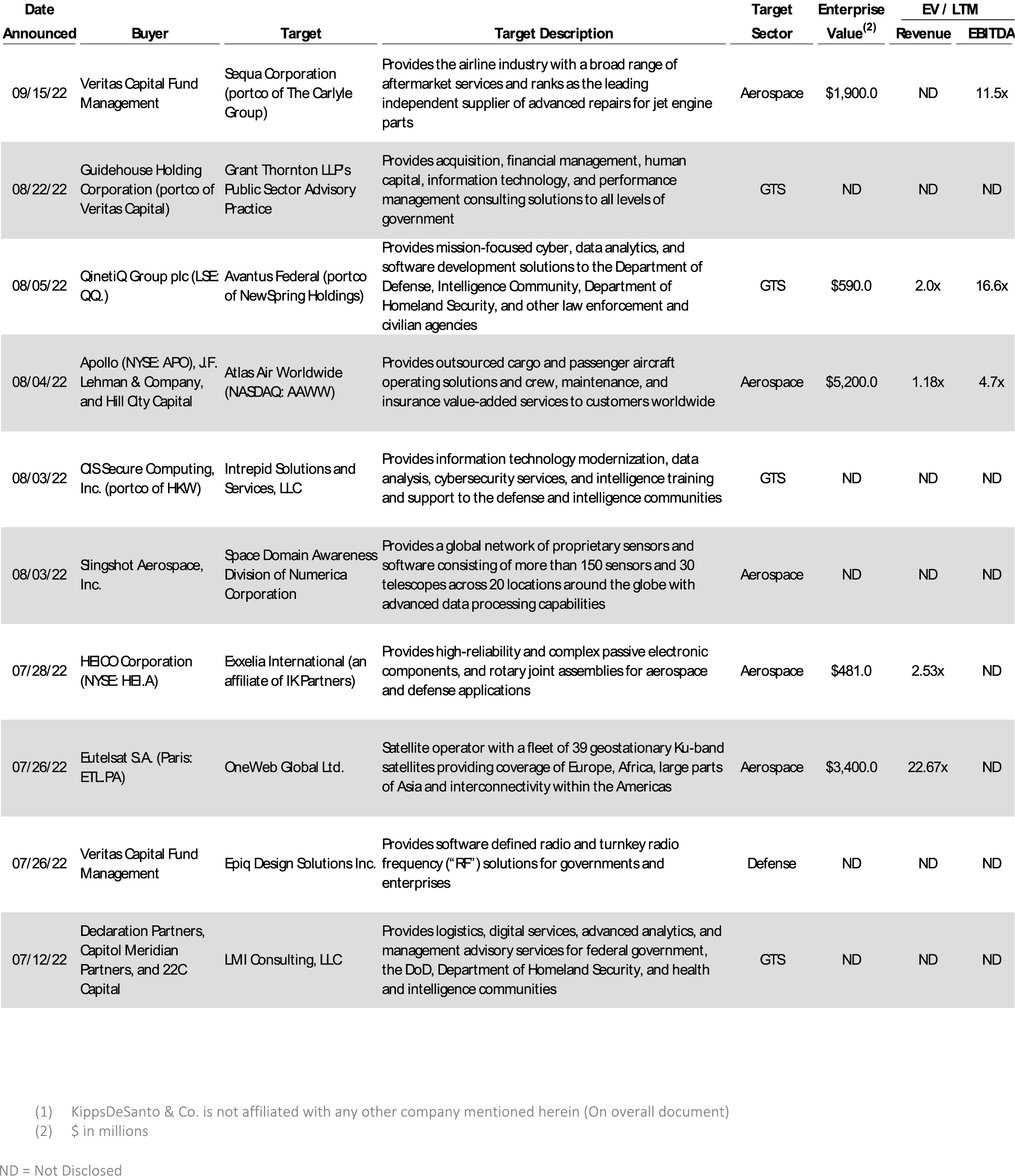

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended September 30, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Eutelsat S.A.’s (“Eutelsat”) (Paris: ETL.PA) pending merger with privately held OneWeb Global Ltd (“OneWeb”). OneWeb is a satellite communications provider that is building a communications network utilizing a constellation of Low Earth Orbit (“LEO”) satellites that deliver low latency high-speed worldwide broadband connectivity. Eutelsat will combine its ~40-strong fleet of Geosynchronous Equatorial Orbit (“GEO”) satellites with OneWeb’s constellation of ~650 LEO satellites to create a fully mutualized network of one-stop shop solutions to its customers. Eutelsat and key OneWeb shareholders have signed a Memorandum of Understanding in which Eutelsat will acquire OneWeb for €12 per share, or $3.4 billion (including the dividend, before synergies). Synergies from the merger are expected to generate annual run-rate savings of over €80 million pre-tax after five years. The potential combination of Eutelsat and OneWeb is occurring on the heels of other notable satellite deals, including the pending business combination announced in November 2021 between Viasat and Inmarsat, which will create a multi-billion dollar global communications provider, and SES’ $450 million acquisition of DRS’ satellite communications business that was completed in August 2022, which will create a multi-orbit satellite communications provider to federal customers. This recent uptick in transformational satellite and communications M&A could drive further appetite for these assets as players in the space look to expand capabilities and further position themselves to be end-to-end providers. The Eutelsat and OneWeb combination requires regulatory approvals, including permission from foreign investment authorities, and is expected to close by the end of first half of 2023.

The GTS deal of the quarter is the acquisition of LMI Consulting LLC (“LMI”), the for-profit subsidiary of Logistics Management Institute, by a consortium of investors formed by Declaration Partners, Capitol Meridian Partners, and 22C Capital. Headquartered in Tysons, VA, LMI is a leading provider of technology-enabled management advisory, logistics, and digital & analytics solutions to the U.S. government. Founded in 1961 to help the Department of Defense (“DoD”) solve complex challenges, LMI has leveraged decades of experience and past performance to establish a franchise position across nearly all federal markets. LMI is focused on bringing future-focused thought leadership and technology to customers within the Defense & Space, Health & Civilian, Homeland Security, and Intelligence markets. With Declaration Partners, Capitol Meridian Partners, and 22C Capital looking to expand on LMI’s rapid growth and build upon its in-demand capabilities and proprietary solutions across its core markets, this transaction highlights the continued demand for GTS acquisitions among private equity buyers with explicit growth strategies and industry knowledge. In the third quarter of 2022, private equity and private equity-backed portfolio companies represented approximately two thirds of all M&A transactions announced in the GTS market. This deal also represents the significant demand for diversified capabilities, market expertise, and intellectual property reinforced by highly skilled, experienced, and cleared employees in a tight labor market. This transaction was announced on July 12, 2022 and closed on July 18, 2022. The remaining nonprofit entity re-branded as NobleReach Foundation™ following the sale of LMI. KippsDeSanto & Co. served as the exclusive M&A advisor to LMI.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Deal View/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

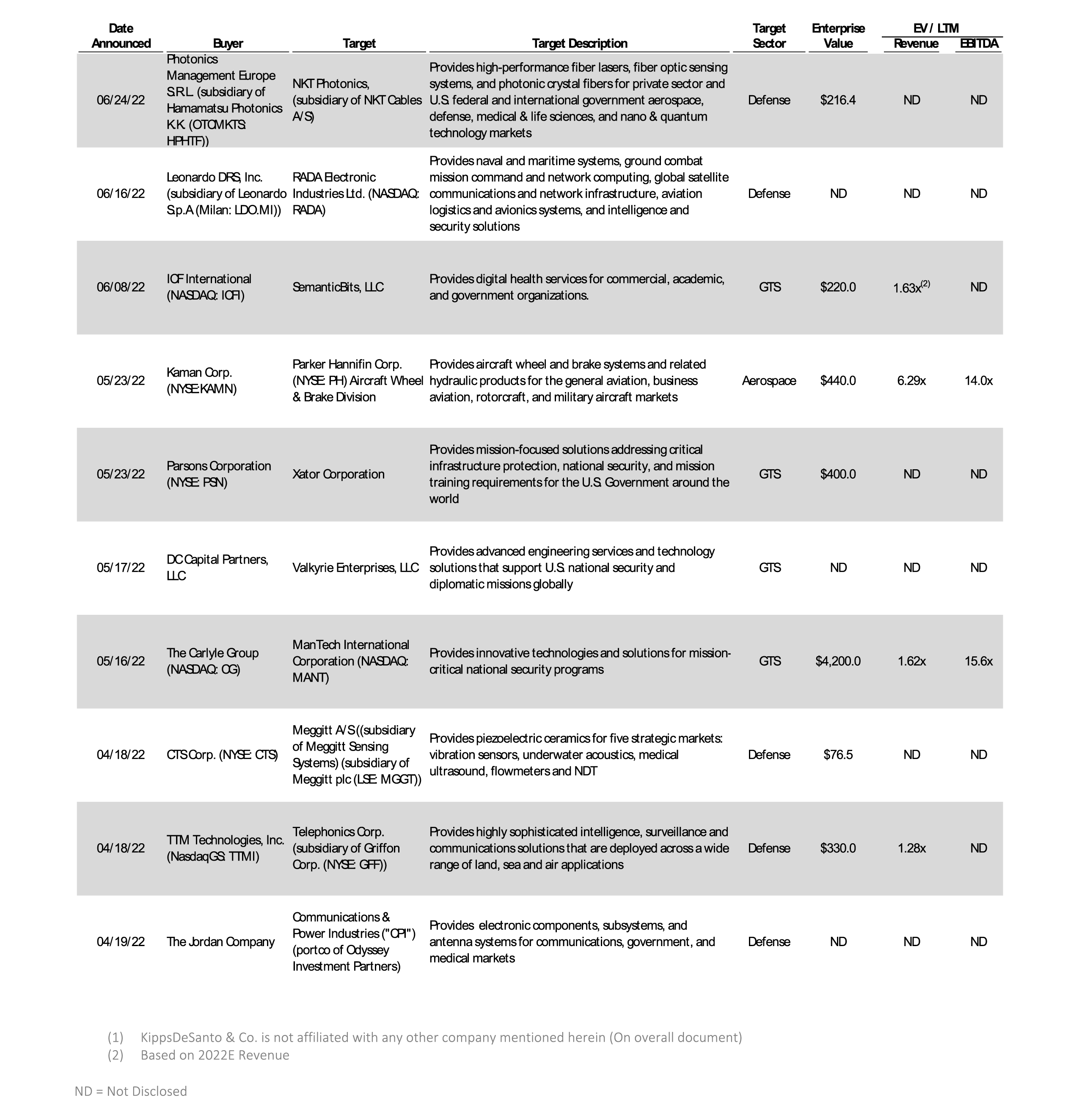

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2022.

Of the above transactions, the following were especially noteworthy:

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Leonardo DRS, Inc.’s (“Leonardo DRS”) (a subsidiary of Leonardo S.p.A (Milan: LDO.MI)) pending reverse merger with RADA Electronic Industries Ltd. (NASDAQ: RADA; “RADA”). RADA provides tactical radar systems across a variety of use cases, including infrastructure protection, border surveillance, active military protection, and counter-unmanned aerial vehicle (“UAV”) applications. The deal brings much-needed scale to RADA, while immediately accelerating growth in two of DRS’ priority markets: advanced sensing and force protection. The two organizations, which have some familiarity through their work on Leonardo DRS’ M-SHORAD program, would immediately form a middle-market leader in priority defense investment areas. The combined entity would continue to trade on the NASDAQ and Tel Aviv stock exchanges as “DRS”, and would bring Leonardo DRS back to the public markets for the first time since 2008, when it was acquired by its current Italian parent. M&A is expected to be a key part of the combined entity’s go-forward growth strategy, and with pro forma leverage of less than 0.5x, it should continue to enjoy substantial capital allocation flexibility (RADA’s current leverage is ~0.6x). The deal is expected to close in the fourth quarter of 2022, subject to regulatory approvals.

The GTS deal of the quarter is the pending all-cash acquisition of ManTech International Corporation (Nasdaq: MANT) (“ManTech”) by global investment firm, Carlyle (NASDAQ: CG). ManTech is a leading provider of cybersecurity, data and analytics, enterprise IT, software development, systems engineering, intelligence missions support, and mission operations services for mission-critical national security programs. Under the terms of the transaction, Carlyle will acquire ManTech for $96 per share, or $4.2 billion, representing a 32% premium on the February 2, 2022 share price, and a 17% premium on the May 13, 2022 share price. As of March 31, 2022, ManTech had TTM revenue of nearly $2.6 billion and TTM EBITDA of $268.5 million. This transaction highlights the continued demand for GTS acquisitions among private equity buyers as Carlyle is hoping to leverage its sector expertise and industry resources to fuel ManTech’s innovation and drive accelerated growth. In the second quarter of 2022, private equity and private equity-backed portfolio companies represented nearly half of all M&A transactions announced in the GTS market. This transaction is expected to close in the second half of 2022, subject to approval by ManTech shareholders, receipt of regulatory approvals, and other customary closing conditions.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

/in Uncategorized, News & Publications, Deal View/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter

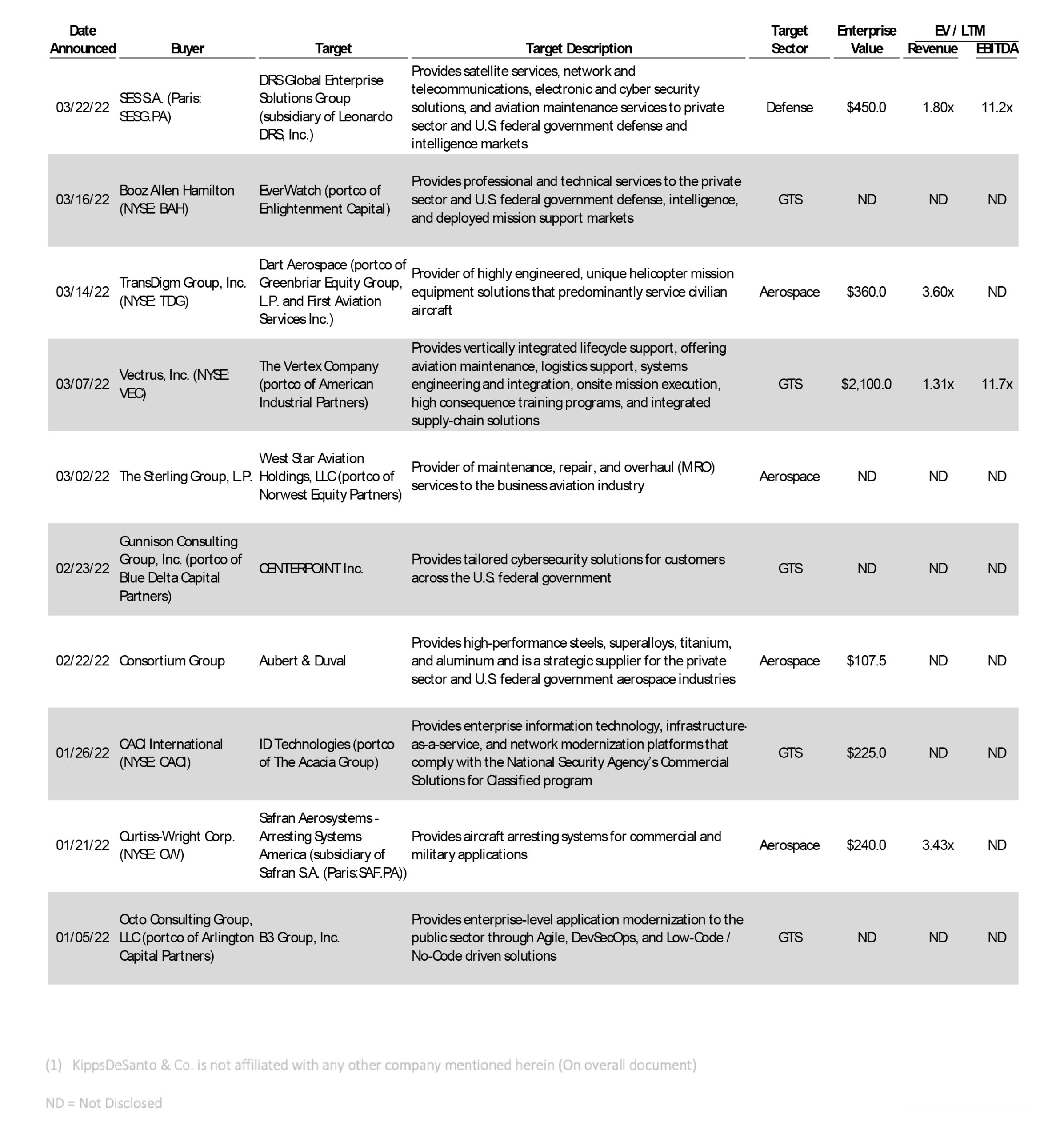

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended March 31, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is SES S.A.’s (Paris: SESG.PA) pending acquisition of Leonardo DRS Global Enterprise Solutions Group (“DRS GES”). DRS GES provides satellite services, network and telecommunications, electronic and cyber security solutions, and aviation maintenance services to private sector and U.S. federal government defense and intelligence markets. SES operates a fleet of more than 70 geosynchronous and medium Earth orbit satellites. SES plans to combine DRS GES with SES Government Solutions (“SES GS”), taking advantage of their shared cultures and deep commitment to providing secure, global solutions to unite the state-of-the-art multi-orbit satellite networking capabilities of SES GS with DRS GES’s experience in satellite communications integration. US Government customers will also benefit from technical and commercial simplification, while ensuring continuity of high-performance satellite-enabled solutions. The transaction values the Global Enterprise Solutions Group at $450 million. The consolidation of DRS GES with SES GS is expected to add about $40 million of EBITDA and will benefit from the combination of future business expansion and $25 million of annualized run-rate synergies, including opportunities to support and enhance existing networks and services with the SES multi-orbit network. Finalization of the deal is targeted for the second half of 2022 subject to regulatory approvals.

The GTS deal of the quarter is the pending all-stock merger of Vectrus, Inc. (NYSE: VEC) (“Vectrus”) and The Vertex Company (“Vertex”), a portfolio company of private equity group, American Industrial Partners. Headquartered in Colorado Springs, CO, Vectrus provides systems integration, operations, sustainment, engineering, logistics, and space launch and range support solutions and services to military customers and government agencies around the world. Madison, MS based Vertex provides vertically integrated lifecycle support, offering aviation maintenance, logistics support, systems engineering and integration, onsite mission execution, high consequence training programs, and integrated supply-chain solutions. The combined company will offer an expanded suite of integrated technology solutions and critical services to help support national security and military convergence. Following the merger, the company will take on a new name and remain listed on the New York Stock Exchange with headquarters in Northern Virginia. Under the terms of the merger, Vertex shareholders will own about 62% of the combined company and Vectrus shareholders will own approximately 38% on a fully diluted basis, valuing Vertex at $2.1 billion. The combined company would have 2021 pro forma revenue of approximately $3.4 billion and adjusted EBITDA of approximately $283 million, which includes $20 million of estimated cost synergies. This transaction highlights the growing trend of public GTS companies providing value to shareholders through M&A, in addition to organic growth efforts. Vertex is one of four public GTS companies to announce or close an M&A transaction in the first quarter of 2022, along with Booz Allen Hamilton (NYSE: BAH), CACI Inc (NYSE: CACI), and ManTech International (NASDAQ: MANT). Following the closing of this transaction, Chuck Prow, Vectrus CEO, and Susan Lynch, Vertex CFO, will serve as CEO and CFO of the combined company, respectively. The merger is expected to close in the third quarter of 2022.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck