KippsDeSanto & Co. advises BlueWater Federal Solutions, Inc., on its sale to Tetra Tech, Inc.

KippsDeSanto & Co. advises BlueWater Federal Solutions, Inc., on its sale to Tetra Tech, Inc.

KippsDeSanto & Co. advises BlueWater Federal Solutions, Inc., on its sale to Tetra Tech, Inc.

KippsDeSanto & Co. is pleased to announce the sale of its client, BlueWater Federal Solutions, Inc. (“BlueWater” or the “Company”) to Tetra Tech, Inc. (“Tetra Tech”).

Headquartered in Chantilly, Virginia, BlueWater provides cybersecurity, information technology, systems / network engineering, and program management services to numerous agencies throughout the Federal Government, including the Federal Emergency Management Agency, Department of Energy, and Department of Defense.

BlueWater provides these clients with a variety of high-end IT and mission-oriented services, systems, and solutions that are essential to these agencies’ operations. Over the past decade, the Company’s leadership team and workforce of highly skilled / certified employees have led BlueWater to achieve considerable growth. This growth has been supported by the Company’s ability to understand and address mission challenges while continuing to leverage its technical expertise as a means of expanding its customer footprint.

BlueWater provides Tetra Tech with significant past performance throughout the Federal Government, and is expected to drive continued success by way of leveraging Tetra Tech’s expansive portfolio of contract vehicles and customer reach. BlueWater represents Tetra Tech’s second acquisition of 2020.

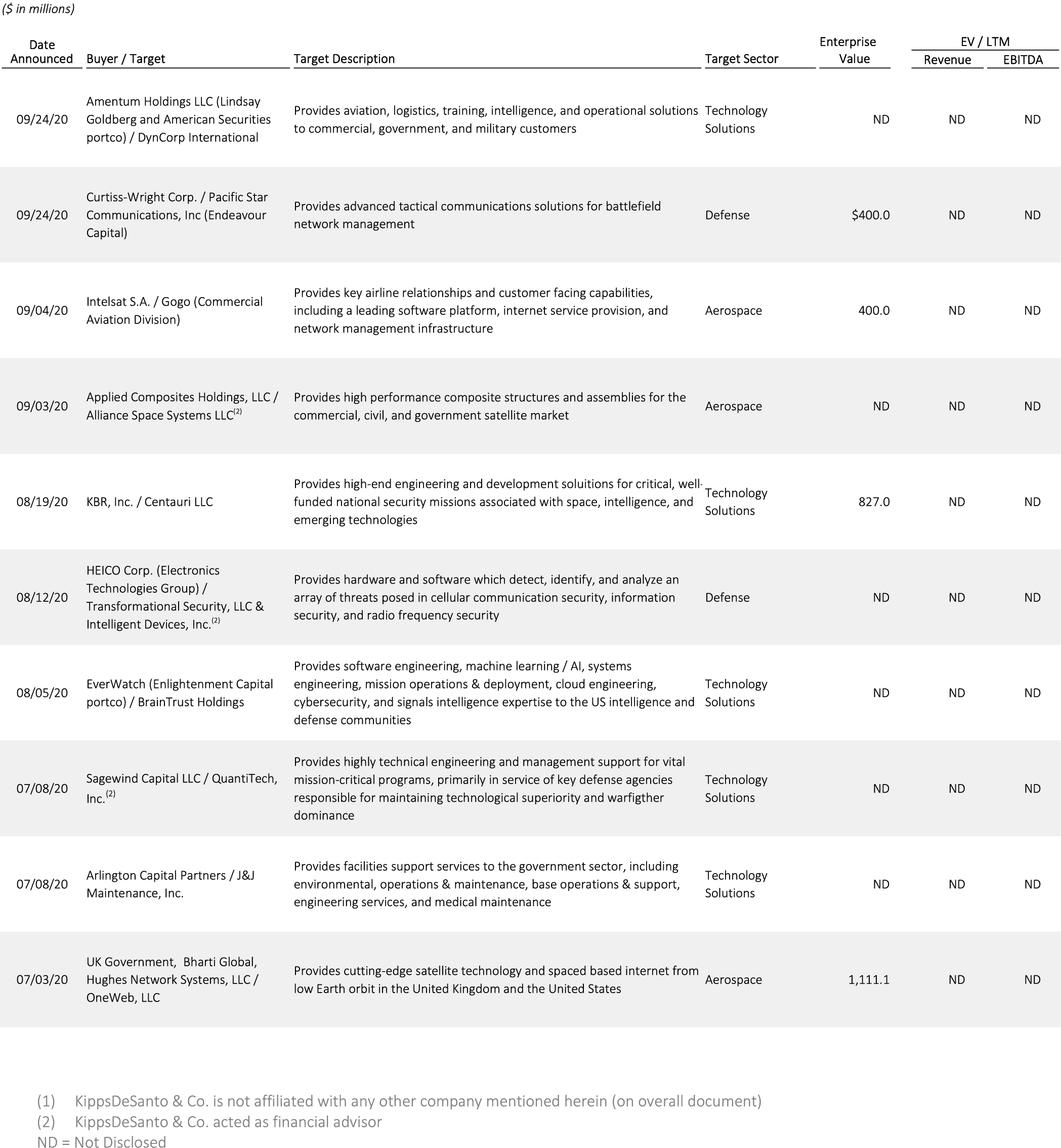

We believe this transaction demonstrates several key trends in the government technology M&A market:

- Acquisition priority for companies with high-end technology and analytics capabilities, in addition to well funded DoD-oriented footprint

- Buyers – public company and private equity firms alike – continue to deploy capital via M&A for well-positioned companies, notwithstanding COVID-19 and broader market turbulence

- Strong company fundamentals in terms of prime contracts, scale, performance, and a track-record of growth drive M&A interest and value

About KippsDeSanto & Co.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

Tetra Tech Acquires BlueWater Federal Solutions to Broaden High-End Technology Service Offerings

“Our ability to integrate high-end technology and analytics in the delivery of customized water, environment, and sustainable infrastructure solutions is a key differentiator for Tetra Tech in the marketplace today,” said Dan Batrack, Tetra Tech Chairman and CEO. “The addition of BlueWater builds on our strategy to grow our advanced analytics business with expanded capabilities in artificial intelligence, cybersecurity solutions, and mission-essential services for our U.S. federal customers.”

Brian Nault, BlueWater President, said, “Our team is thrilled to join Tetra Tech and work together to expand our capabilities and solutions that solve our clients’ most complex problems. By joining with Tetra Tech, BlueWater creates tremendous opportunities for our employees, expands our reach in the federal market through access to key contract vehicles, and increases the technical capacity and access to resources needed for us to deliver on our customers’ new and changing requirements.”

The terms of the acquisition were not disclosed. BlueWater is joining Tetra Tech’s Government Services Group.

About BlueWater Federal Solutions, Inc.

BlueWater is a leading mission support services provider of Enterprise IT solutions, cybersecurity, engineering, global command and control, and applications development. BlueWater, based in Chantilly, Virginia delivers full lifecycle solutions and modernization for U.S. federal agencies, including the Department of Defense and Intelligence.

About Tetra Tech

Tetra Tech is a leading provider of high-end consulting and engineering services for projects worldwide. With 20,000 associates working together, Tetra Tech provides clear solutions to complex problems in water, environment, infrastructure, resource management, energy, and international development. We are Leading with Science® to provide sustainable and resilient solutions for our clients. For more information about Tetra Tech, please visit tetratech.com, follow us on Twitter (@TetraTech), or like us on Facebook.

Any statements made in this release that are not based on historical fact are forward-looking statements. Any forward-looking statements made in this release represent management’s best judgment as to what may occur in the future. However, Tetra Tech’s actual outcome and results are not guaranteed and are subject to certain risks, uncertainties and assumptions (“Future Factors”), and may differ materially from what is expressed. For a description of Future Factors that could cause actual results to differ materially from such forward-looking statements, see the discussion under the section “Risk Factors” included in the Company’s Form 10-K and 10-Q filings with the Securities and Exchange Commission.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200929005255/en/

Jim Wu, Investor Relations

Charlie MacPherson, Media & Public Relations

(626) 470-2844

Source: Tetra Tech, Inc.