KippsDeSanto & Co. advises Physical Optics Corporation on its Sale to Mercury Systems, Inc. (NASDAQ: MRCY)

KippsDeSanto & Co. advises Physical Optics Corporation on its Sale to Mercury Systems, Inc. (NASDAQ: MRCY)

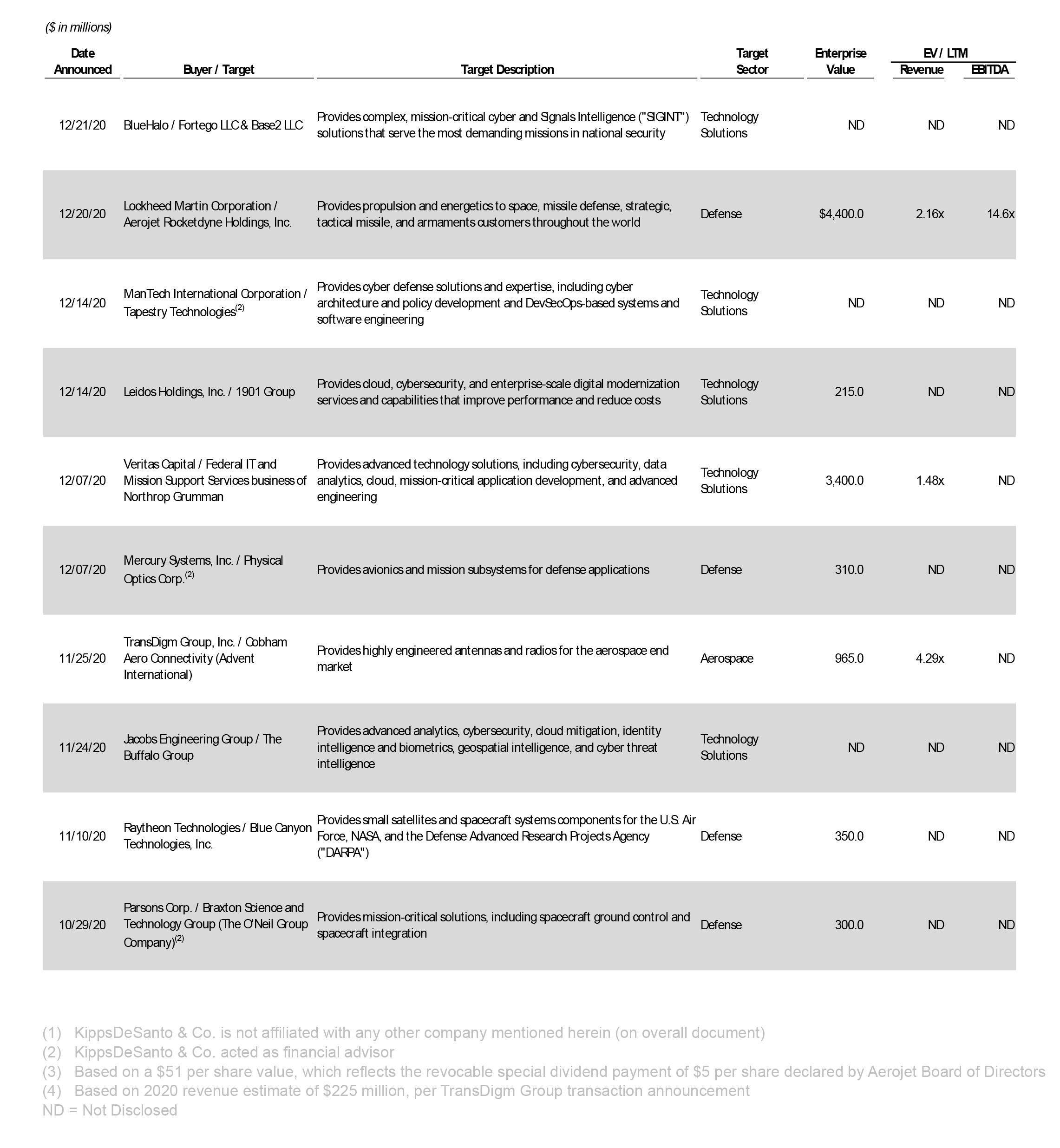

KippsDeSanto & Co. is pleased to announce the sale of its client, Physical Optics Corporation (“POC” or the “Company”) to Mercury Systems, Inc. (“Mercury”).

Headquartered in Torrance, CA, POC serves as a leading designer, developer, and integrator of advanced technologies primarily focused on mission-critical avionics and subsystems for the most demanding defense applications, supporting airborne solutions broadly transferable to ground, maritime, and unmanned platforms. The Company’s principal expertise in optimizing size, weight, and power (“SWaP”) and enhancing encryption capabilities for the most complex and demanding avionics solutions has produced a robust portfolio of innovative products – much of which was developed leveraging the Small Business Innovation Research (“SBIR”) program – including data transfer systems, flight data recorders, mission computers, high-definition data and video recorders, and advanced encryption devices for well-funded and highly-visible programs of record. The common-use nature of POC’s technologies directly translates into broad adoption across the Navy, Army, and Air Force for newly fielded platforms (including burgeoning positions on future vertical lift, the B-2, and various unmanned platforms), as well as established relationships upgrading legacy aircraft (including the F-18, V-22, the H-60 family, T-45, F-16, F-15, and F-22).

Employing approximately 350 employees, including over 160 multi-disciplinary engineers and a deep bench of PhDs, POC has developed a substantial portfolio of intellectual property (“IP”), including over 160 patents as well as numerous SBIR-oriented technologies covering 60 diverse focus areas spanning avionics, electronic warfare, artificial intelligence, and machine learning. POC’s unique combination of avionics solutions, core IP and engineering expertise, embedded status on well-funded airborne programs, and state-of-the-art facilities uniquely position the Company to complement Mercury’s existing capabilities and accelerate the combined company’s growth via the delivery of pre-integrated avionics subsystems to an increasingly broad customer set.

We believe this transaction demonstrates several key trends in the aerospace and defense mergers and acquisitions (“M&A”) market:

- Defense program modernization continues to be an area of significant interest for buyers given the evolving budgetary environment

- Demand for companies with entrenched positioning on well-funded Programs of Record (“PoRs”) and trusted customer relationships remains strong

- Ongoing M&A focus by strategic buyers on acquisition targets with advanced engineering capabilities, proprietary IP, SBIR-oriented technologies, and robust Research & Development capabilities

- Public strategic buyers continue to aggressively deploy capital in order to accelerate organic growth strategies and gain access to PoRs and customers

About KippsDeSanto & Co.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

Mercury Systems to Acquire Physical Optics Corporation

- Continues to scale Mercury’s global avionics & mission systems business

- Complementary capabilities enhance position at forefront of military digital convergence

- Expands platform and mission management content on new and existing airborne platforms

- Broadens mission processing capabilities, adding data transfer and recording solutions

- Leverages investments in embedded security and safety-certifiable avionics processing

ANDOVER, Mass., Dec. 07, 2020 (GLOBE NEWSWIRE) – Mercury Systems, Inc. (NASDAQ: MRCY, www.mrcy.com), a leader in trusted, secure mission-critical technologies for aerospace and defense, today announced that it has signed a definitive agreement to acquire Physical Optics Corporation (“POC”). Based in Torrance, Calif., POC is a leading designer, developer, and integrator of advanced technologies primarily focused on avionics & mission subsystems for defense applications.

Pursuant to the terms of the agreement, Mercury will acquire POC for an all-cash purchase price of $310 million, subject to net working capital and net debt adjustments. The acquisition and associated transaction expenses are expected to be funded through a combination of cash on hand and Mercury’s existing revolving credit facility.

POC is currently expected to generate revenue of over $120 million for its fiscal year ending December 31, 2020. The acquisition represents a multiple of approximately 13x next twelve months EBITDA and is expected to be immediately accretive to adjusted EPS.

“The acquisition of Physical Optics Corporation adds important capabilities on new and existing airborne programs in the platform and mission management market,” said Mark Aslett, Mercury’s president and chief executive officer. “The combination of Mercury’s safety-certifiable and secure avionics processing solutions with POC’s deep portfolio of data storage, transfer, and encryption technologies will enable us to deliver more complete, pre-integrated avionics subsystems to our customers. POC has a similar growth profile to Mercury, supported by several key design wins that are transitioning into production. We are very excited for POC to join the Mercury team.”

“This acquisition broadens our avionics product and technology portfolio to help our defense Prime customers, the U.S. Navy, Army and Air Force deploy next-generation open-architecture mission computing solutions,” added Amela Wilson, senior vice president, Mercury Mission. “Similar to Mercury, POC is well-positioned in faster-growing segments of the defense market and benefits from secular growth drivers, such as supply chain delayering. Together, Mercury and POC can provide customers new capabilities and subsystem solutions.”

Founded in 1985, POC employs approximately 350 people, including more than 160 highly skilled engineers, and holds over 160 patents worldwide, covering 60 technologies. They support mission-critical programs with common-use products spanning data transfer systems, flight data recorders, mission computers, high-definition data and video recorders, and advanced encryption devices. POC is well-positioned on a wide variety of key airborne and naval defense platforms that are experiencing increased funding for electronics modernization to specifically address digital convergence and combat near-peer threats in line with the National Defense Strategy.

The acquisition is subject to customary closing conditions, including approval pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The transaction is currently expected to close during Mercury’s fiscal 2021 second quarter ending January 1, 2021.

Operating at the intersection of high-tech and defense, Mercury Systems is the leader in making trusted, secure mission-critical technologies profoundly more accessible. Our work is inspired by our Purpose of delivering Innovation That Matters by and for People Who Matter, to make the world a safer, more secure place for all. For more information, visit mrcy.com or contact Mercury at (866) 627-6951 or info@mrcy.com.

Mercury Systems – Innovation That Matters®

Mercury Systems is a leading technology company serving the aerospace and defense industry, positioned at the intersection of high-tech and defense. Headquartered in Andover, Mass., the Company delivers solutions that power a broad range of aerospace and defense programs, optimized for mission success in some of the most challenging and demanding environments. The Company envisions, creates and delivers innovative technology solutions purpose-built to meet customers’ most-pressing high-tech needs, including those specific to the defense community. To learn more, visit mrcy.com, or follow us on Twitter.

Forward-Looking Safe Harbor Statement

This press release contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the acquisitions described herein and to fiscal 2021 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of epidemics and pandemics such as COVID, effects of any U.S. federal government shutdown or extended continuing resolution, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company’s products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to industrial security and cyber-security regulations and requirements, changes in tax rates or tax regulations, changes to interest rate swaps or other cash flow hedging arrangements, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended July 3, 2020. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made.

Mercury Systems and Innovation That Matters are registered trademarks of Mercury Systems, Inc. Other product and company names mentioned may be trademarks and/or registered trademarks of their respective holders.