KippsDeSanto & Co. Advised Fenix Group, Inc. on its investment from Enlightenment Capital

/in News & Publications/by Andrell Barnes KippsDeSanto & Co. Advised Fenix Group, Inc. on its investment from Enlightenment Capital

KippsDeSanto & Co. Advised Fenix Group, Inc. on its investment from Enlightenment Capital

KippsDeSanto & Co. is pleased to announce that our client, Fenix Group, Inc. (“Fenix” or the “Company”) has received a strategic investment from Enlightenment Capital.

Headquartered in Chantilly, Virginia, Fenix provides innovative, band-agile closed loop carrier grade (4G / LTE and 5G) networks supporting battlefield communication and sensor ecosystems with advanced sensor endpoints for the defense, intelligence, and disaster response sectors. Through specialized network communication services, unmanned systems integration, and patented products, Fenix increases warfighter lethality while reducing risk, complexity, and costs over legacy systems. The Company is aligned with several key government programs and customers across the U.S. Department of Defense and Intelligence Community.

Fenix has developed its technology solutions with a focus on edge networks and integrated systems, which it refers to as the “Battlefield of Things®” sensor ecosystem. Through this ecosystem, it connects a variety of battlefield sensors to include UAVs, UGVs, Unattended Ground Sensors (“UGS”), and COTS end-user devices. By leveraging 4G / LTE and 5G combined with Mobile Ad Hoc Network (“MANET”) communication technologies and edge computing, Fenix enhances situational awareness and is able to pass increased amounts of data and information at the tactical edge in both domestic and deployed environments. The Company is also at the forefront of 5G integration for military use providing infrastructure and mobile platforms equipped with 5G functionality for military installations across the U.S. through recently awarded subcontracts with several key partners.

The investment from Enlightenment Capital will support Fenix’s growth strategy by providing financial resources and strategic / M&A support as it looks to build on its success to date and expand its facility footprints in multiple states and refine the Company’s engineering process and manufacturing capacity to scale with demand.

We believe this transaction demonstrates several key trends for defense technology investing:

- Strong demand for innovative, field-proven tactical communication and sensor ecosystem capabilities supporting mission-critical defense and intelligence programs

- Continued emphasis on R&D and strategic partnerships as a means for consistent and steady product development and evolution

- Investors continue to seek opportunities to deploy capital in the defense technology market for coveted assets with strategic footprints and differentiated solutions in key high growth segments, such as 5G and communications at the tactical edge

About KippsDeSanto & Co. KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

Enlightenment Capital Invests in Fenix Group

Chevy Chase, Maryland – June 21, 2021: Enlightenment Capital, an Aerospace, Defense, Government & Technology (ADG&T) focused investment firm based in the Washington, DC area, announced it has made a strategic investment in Fenix Group. Fenix is a provider of integrated systems, battlefield edge networks, and Low Probability of Intercept / Low Probability of Detection (LPI / LPD) communications solutions in support of the U.S. Department of Defense (DoD), special operations, and intelligence communities. The investment will support Fenix’s growth strategy by providing financial resources and strategic / M&A support, as it looks to build on its success to date.

Founded in 2016 and based in Chantilly, VA, Fenix provides equipment and services for private broadband networks (e.g., 5G / LTE) and handheld communication devices, supporting battlefield communication and sensor ecosystems with endpoints for the defense, intelligence, and disaster response sectors. The Company was recently awarded subcontracts with several key partners to provide military grade mobile products and infrastructure with 5G functionality for military bases throughout the U.S. In 2020, Fenix was named a Government Contractor of the Year by the Small and Emerging Contractor Advisory Forum (SECAF).

“Fenix supports some of the most cutting-edge electronics solutions being implemented on the tactical edge of the DoD and intelligence communities,” said Jason Rigoli, Partner at Enlightenment Capital. “The solutions span 5G, LTE, and other mobile communications technologies from domestic to austere environments. We are excited to invest in their vision of pushing the boundaries of interconnected defense and intelligence systems in use around the world.”

“We are very excited to partner with Enlightenment Capital as we begin the next chapter in our growth strategy. Enlightenment’s experience and deep industry expertise is exactly what we were looking for in a strategic investor. This partnership greatly enhances our ability to drive growth through expansion of our facility footprints in multiple states and allows us to refine our engineering process and manufacturing capacity to scale with demand,” said Dave Peterson, Founder & CEO.

About Fenix Group

Founded in 2016, Fenix Group provides technology solutions with a focus on edge networks and integrated systems, which it refers to as the “Battlefield of Things®” sensor ecosystem. Through this ecosystem, it connects a variety of battlefield sensors to include UAVs, UGVs, Unattended Ground Sensors (UGS), and COTS end-user devices. By leveraging 4G / LTE & 5G combined with Mobile Ad Hoc Network (MANET) communications technologies and edge computing, Fenix enhances situational awareness as well as data and information sharing at the tactical edge in both domestic and deployed environments. For more information, visit www.fenixgroup.io.

About Enlightenment Capital

Enlightenment Capital, a Washington, DC area based private investment firm, provides flexible capital and strategic support to middle market companies in the Aerospace, Defense, Government & Technology (ADG&T) sector. The firm partners with businesses that provide vital services, protect critical

infrastructure, innovate cyber and data solutions, enhance decision making capabilities, engineer aerospace systems, safeguard national security, and endeavor to meet the challenges of today and tomorrow. For more information, visit www.enlightenment-cap.com

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

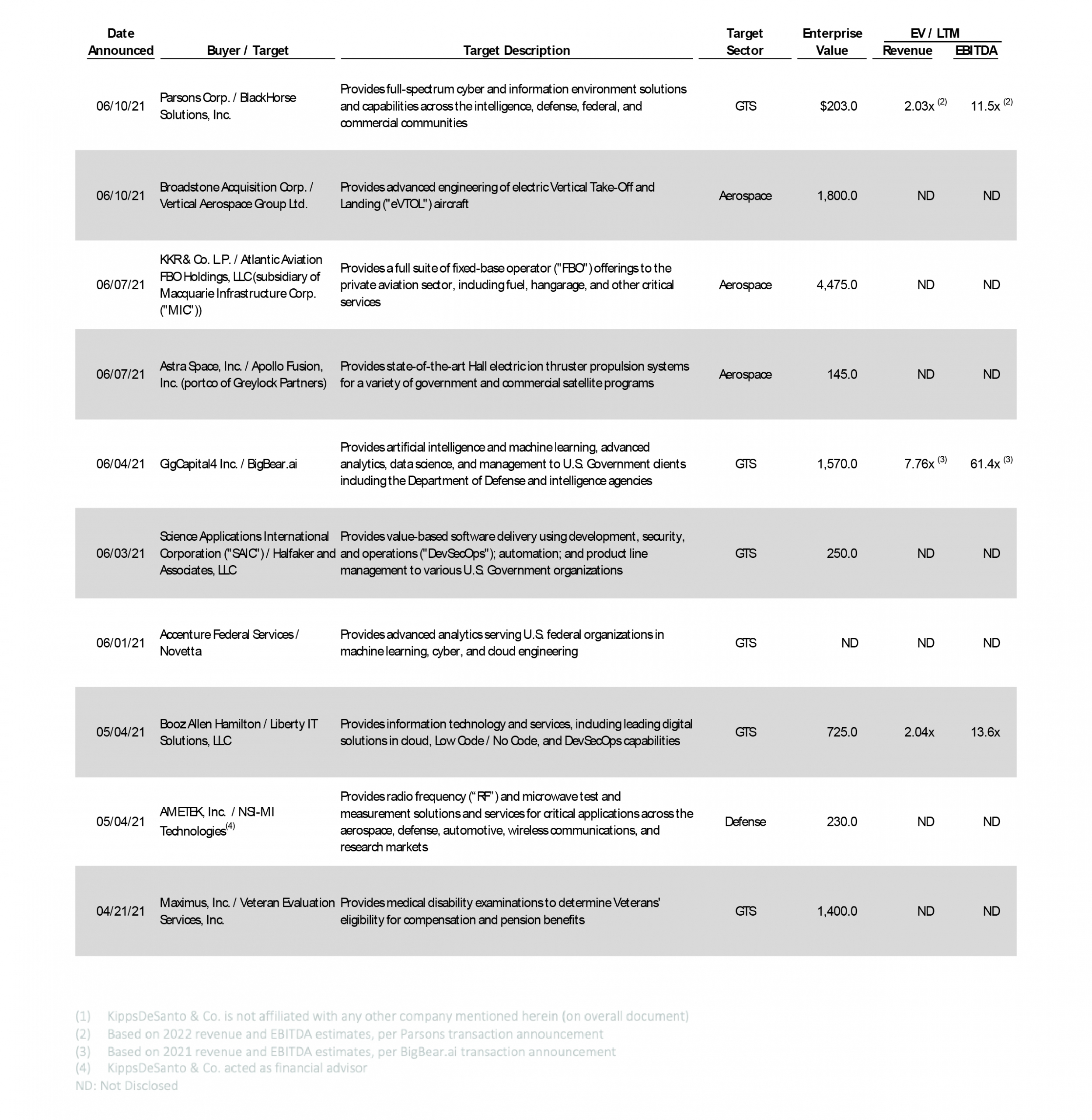

/in News & Publications, Deal View/by acscreativeKippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2021.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is KKR & Co. L.P.’s (“KKR”) pending $4.5 billion acquisition of Atlantic Aviation FBO Holdings, LLC (“Atlantic Aviation” or the “Company”), a subsidiary of Macquarie Infrastructure Corporation (“MIC”). MIC anticipates $3.3 billion of the purchase price to be available for distribution post-closing following payments related to MIC’s reorganization into Macquarie Infrastructure Holdings, LLC (“MIH”), which was approved by MIC shareholders on May 6, 2021. Headquartered in Plano, TX, Atlantic Aviation operates one of the largest networks of fixed base operations (“FBOs”) in the U.S., providing a full suite of critical services, such as fuel and hangarage to owners and operators of private-jet aircraft. The Company operates at 69 airport locations in some of the most popular business and recreational destinations around the U.S. The investment from KKR positions Atlantic Aviation for continued growth as a standalone company led by its existing management team. The transaction comes on the heels of Blackstone Group’s, Cascade Investment’s, and Global Infrastructure Partners’ (“GIP”) $4.7 billion acquisition of Signature Aviation, the world’s largest FBO chain, and further represents the renewed interest in the commercial aerospace market displayed by private equity firms as the global economy continues its recovery from the COVID-19 pandemic. The transaction is expected to close in the fourth quarter of 2021, subject to customary regulatory approvals and approval from MIC shareholders.

The GTS deal of the quarter is the pending acquisition of Novetta Solutions, LLC (“Novetta”), a portfolio company of The Carlyle Group, by Accenture Federal Services (“AFS”), a wholly owned subsidiary of Accenture (NYSE: ACN). Based in McLean, VA, Novetta provides analytic software solutions that detect potential threats, and protect high-value networks for government and commercial enterprises worldwide. The acquisition of Novetta complements AFS’ presence in the national security sector and bolsters its next-generation capability set in software development, data science, artificial intelligence, machine learning, cyber, and cloud. The combined organization will strive to improve the digital landscape of the federal government through a true DevSecOps approach. Terms of the transaction have not been publicly disclosed. Under The Carlyle Group’s 100% ownership, Novetta acquired Berico Technologies, LLC in November 2018 and most recently WaveStrike, LLC in June of 2020, both of which helped the platform scale and expand its capability set. This acquisition demonstrates a continued interest by public companies to acquire targets providing cutting edge technology solutions to high-profile Intelligence Community and Department of Defense customers. This transaction is one of several high-profile deals consummated in the quarter highlighting the robust current M&A environment with total GTS deal volume approaching 100 through year-to-date 2021.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck