KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

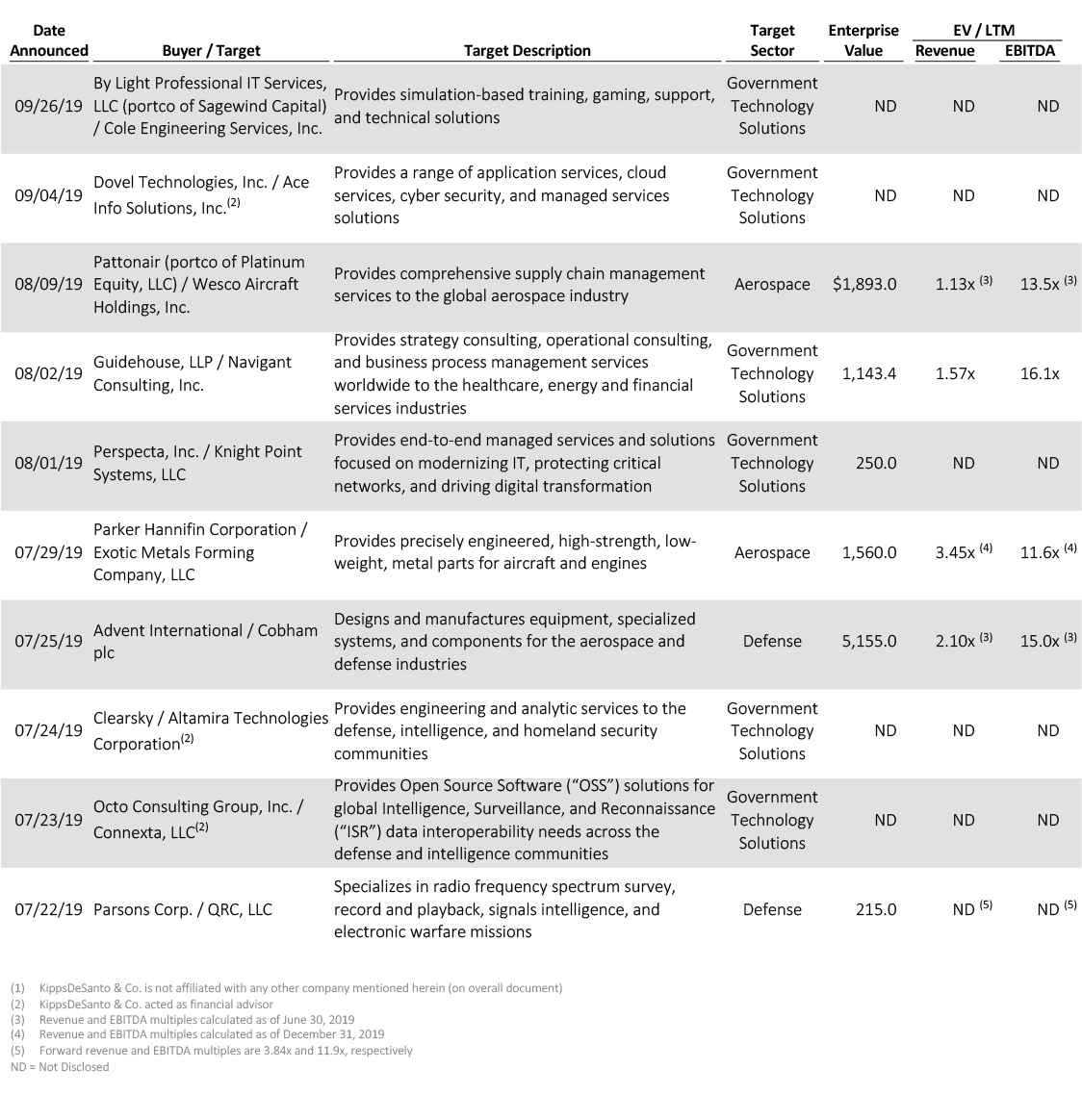

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended September 30, 2019. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is Advent International’s pending acquisition of Cobham plc (LSE:COB). Cobham designs and manufactures equipment, specialized systems, and components for the aerospace and defense industries. The estimated $5.16 billion transaction was announced on July 25th and required shareholder and government approval after the initial announcement. Advent’s offer of $2.06 per share represents a 50 percent premium to the three-month average stock price. The deal required 75 percent shareholder approval; over 90 percent of shareholders voted in favor of the transaction on September 16th, even after pushback from the Company’s largest shareholder. Cobham’s board of directors unanimously supported and recommended the deal. The acquisition fits Advent’s transaction history in the British electronics industry with its previous acquisition of Laird for $1.65 billion in 2018. The deal still faces political and regulatory scrutiny after the British government served an intervention notice on national-security grounds. The British government utilized a similar strategy for Melrose Industries plc’s acquisition of GKN plc in 2018, forcing Melrose into assurances that it would not divest key portions of GKN’s aerospace division. The deal is expected to close by the end of 2019.

The government technology solutions deal of the quarter is Guidehouse’s acquisition of the global management consulting firm Navigant Consulting, Inc. (Nasdaq: NCI). Navigant is a specialized professional services firm serving clients primarily in the healthcare, energy and financial services sectors. Guidehouse, a Veritas portfolio company, is a leading provider of management consulting and strategic advisory services to government clients. The combination of these two market leaders in consulting brings together complementary service offerings and deep industry expertise in both the commercial and public sectors, with a focus on supporting clients in the healthcare, financial services, energy, national security and aerospace and defense industries. Guidehouse CEO Scott McIntyre, who will lead the combined company, highlighted the forward-leaning nature of this combination, stating that “the acquisition of Navigant is the next step in our journey to create the next generation global consultancy.” The acquisition is the first for Guidehouse since its formation in May 2018 through PwC’s divestiture of its U.S. Public Sector Business to Veritas Capital. This deal reflects the broader trend of sponsors expanding their platforms’ offerings and customer base through bolt-on acquisitions of complementary targets, as seen this quarter by the sale of Connexta to Octo (Arlington Capital Partners platform) and AceInfo Solution’s acquisition by Dovel Technologies (Macquarie Capital platform).

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.