KippsDeSanto & Co. Advises ADG Creative on its Sale to Chenega Corporation

/in News & Publications/by kippsdesantoKippsDeSanto & Co. Advises Themis Computer on its Sale to Mercury Systems

/in News & Publications/by kippsdesantoField of (Private Equity) Dreams

/in News & Publications/by kippsdesantoBy Kevin P. DeSanto, Managing Director, and Mel E. Levey, Associate, KippsDeSanto & Co.

For those of us that enjoy movies and baseball, “if you build it, he will come” is a phrase that has deep meaning as a core theme from the 1989 movie Field of Dreams. That same theme applies to private equity involvement in the Government Contracting (“GovCon”) community M&A landscape.

For decades, the GovCon market (the “it” from our famous movie quote) has attracted strong interest from private equity investors (the “he”) because of the tremendous visibility provided by government budgets and strong, cash-flow generating business models. Add in an increasingly risky geopolitical environment, fast-changing technology needs, growing overall economy, strong financing environment, and healthy public equity markets, and you have a formula for a very attractive investment environment in the GovCon industry for private equity firms.

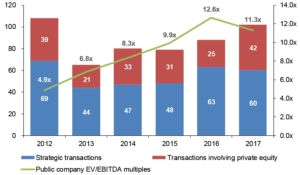

The GovCon industry has seen a consistent uptick in public company valuations and M&A transaction activity in the past few years. The public company median EV/EBITDA multiple has increased from 4.9x EBITDA on December 31, 2012 to 11.3x EBITDA on December 31, 2017. While 2012 was a peak year for GovCon M&A volume with 108 announced transactions, M&A transaction volume in 2013 totaled just 65 transactions and rose to 102 transactions in 2017.

“Private equity firms will continue to play a significant role in the GovCon M&A ecosystem even while vintage portfolio companies are put up for sale as a result of the overall healthy industry and economic dynamics at play.”

Private equity ownership of GovCon companies has been an important part of the M&A ecosystem throughout these tumultuous last 6 years. Out of 522 GovCon M&A transactions in the past 6 years, 191 of these transactions (36.6%) have involved a private equity group on at least one side of the M&A transaction[1]. Private equity involvement in 2017 GovCon M&A reached a peak of 42 transactions, slightly above the activity of 2012 (39 transactions) and a 40% increase over the 2012-2016 average of 30 transactions per year. Of particular note, 12 of the 19 GovCon M&A transactions greater than $100 million[2] that occurred in 2017 involved a private equity group.

One hundred and fourteen distinct private equity groups were involved in the 191 transactions referenced above. In 2017 alone, 40 distinct private equity groups were involved in at least one GovCon M&A transaction. Some of the names are familiar to those who follow the GovCon industry closely, such as long-time industry investors Arlington Capital, CM Equity, DC Capital, and Veritas Capital (each of whom was involved in 2-4 GovCon transactions in 2017). Still others are newer to the scene or have recently increased their exposure to the GovCon marketplace, such as AE Industrial, Apollo Global (involved in 5 GovCon transactions in 2017), Enlightenment Capital and H.I.G. Capital. While a number of the GovCon private equity investors are located in the DC area, the majority are headquartered in locations such as Boston, New York, Philadelphia, South Florida, Chicago, San Francisco, and Los Angeles.

Private equity firms have acquired, as either a new platform investment or as part of a portfolio company, an average of 27 companies annually from 2012-2017. The number of new private equity platform investments increased to 17 announced transactions in 2017, an 89% increase over the annual average of 9 such transactions from 2012-2016. Private equity portfolio company acquisitions have been relatively steady over the years, averaging 17 announced transactions annually from 2012-2017. The GovCon transaction announcements of the past 6 years suggest that private equity portfolio companies typically acquire approximately 3 additional companies to add to the platform company prior to the platform company sale transaction. These investors also show a penchant for finding deals across all sub-sectors of the market (with 2017 alone including investments in government-focused healthcare, cybersecurity, cloud, and defense / intelligence) and different transaction types (acquiring private companies, other private equity-owned companies, public companies, and divestitures).

There have been 38 M&A transactions in the past 3 years (2015-2017) where private equity firms have sold a GovCon portfolio company. This is a dramatic 138% increase in selling activity by private equity groups from the previous 3-year period (2012-2014) in which 16 such transactions were completed. Twenty-one such transactions occurred in 2017 alone, including Lake Capital selling WBB to H.I.G. Capital in October 2017 and DFW selling Triple-I to Salient CRGT in February 2017.

KippsDeSanto believes the strong level of private equity involvement in the GovCon M&A ecosystem will continue, particularly given the recent trend of increasing activity. Private equity’s role will likely be significant on both the buy-side and the sell-side as vintage portfolio companies are put up for sale as a result of the overall healthy industry and economic dynamics at play.

Partnering with private equity firms should be a primary consideration for GovCon business owners and management teams that are looking for liquidity or growth financing options. There are many ways to structure these partnerships – from minority ownership through 100% buy-outs – depending on the objectives of the parties involved. Preparation is often a critical success factor, as these investors require a level of business scale, sophistication, and maturity that is not easy to attain.

That long line of cars (or trains, or planes) approaching Washington is proof that private equity firms are here to continue to invest in the GovCon market and fulfill a vital role in the M&A ecosystem.

[1] Private equity transactions are defined as those involving a private equity group on the buyside as the platform investor, on the buyside as the owner of a platform company and/or on the sellside as the owner of a platform company.

[2] “Greater than $100 million” defined as transaction enterprise value.

[3] KippsDeSanto & Co. served as exclusive financial advisor to WBB and Triple-I.

KippsDeSanto Sees Government Services M&A Momentum Continuing in 2018

/in News & Publications/by kippsdesantoWashingtonExec Video Interview Series: Marc Marlin, KippsDeSanto & Co.

/in News & Publications/by kippsdesantoKippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

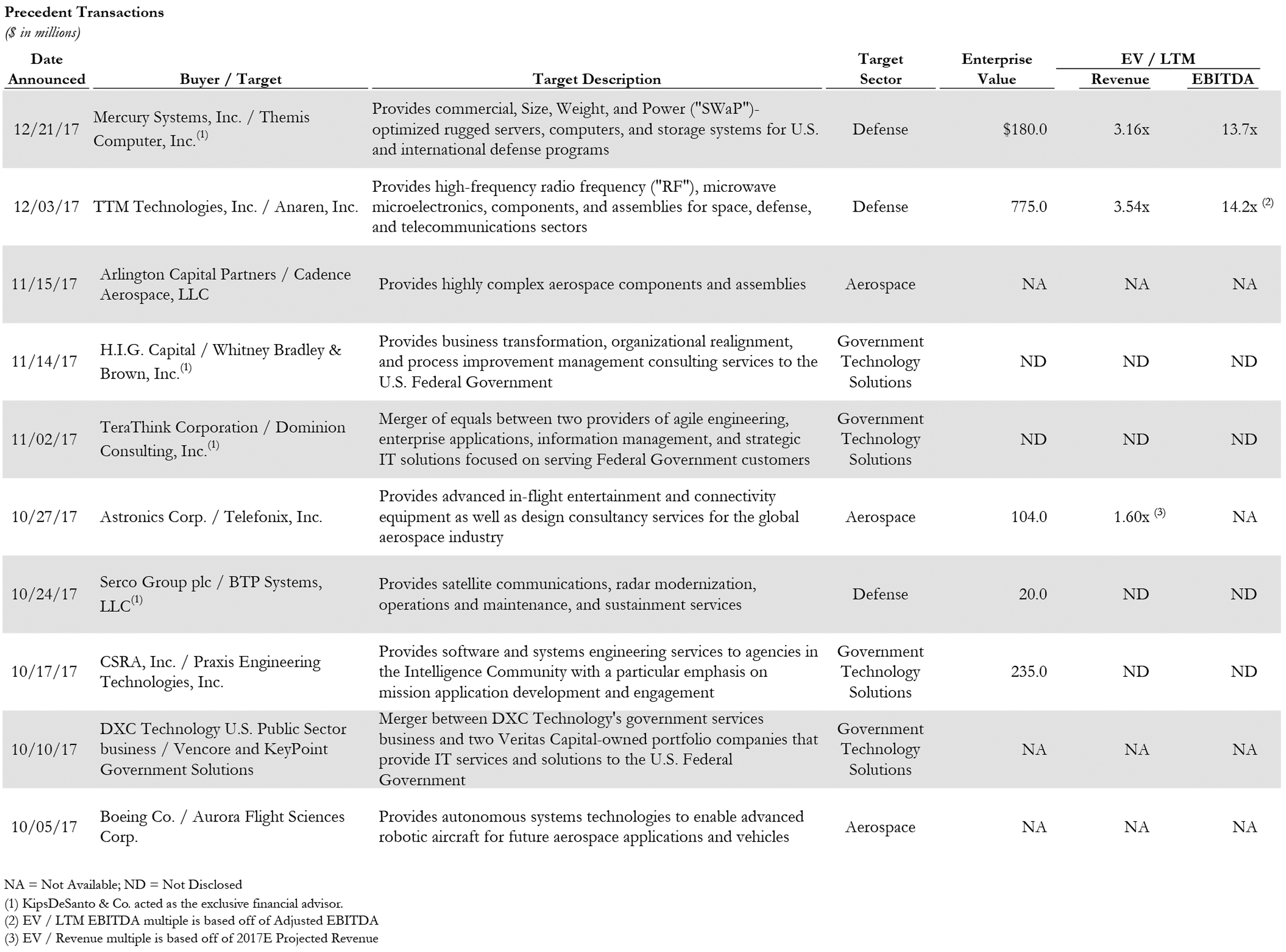

/in News & Publications, Deal View/by kippsdesantoKippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended December 31, 2017. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Click here to download the table above

Of the above transactions, the following were especially noteworthy:

The aerospace and defense (“A&D”) deal of the quarter is Mercury’s announced acquisition of Themis Computer, Inc. The proposed acquisition is an all cash deal worth $180 million, in excess of 3x 2017E revenue and approximately 14x 2017E EBITDA. The deal is expected to be immediately accretive to Mercury’s earnings and will be financed through Mercury’s existing revolving credit facility. Themis Computer is a leading designer, manufacturer, and integrator of commercial, SWaP-optimized rugged servers, computers, and storage systems that serve some of the largest Navy and Army server programs in the U.S. Department of Defense (“DoD”) as well as international defense programs. The acquisition will provide Mercury with a strategic platform acquisition that will enable Mercury to continue penetrating the Command, Control, Communications, Computers, and Intelligence (“C4I”) market and provide important new capabilities for its customers.

The government technology solutions deal of the quarter is the announced merger between DXC Technology’s U.S. Public Sector (“USPS”) business, Vencore Holding Corporation, and KeyPoint Government Solutions. DXC Technology was formed in April 2017, through the merger of Hewlett Packard’s Enterprise Services division and what remained of Computer Sciences Corporation, following the spinoff of its government services business to SRA International, which became CSRA Inc. Vencore is a provider of information solutions, engineering, and analysis to the U.S. Intelligence Community, the Department of Defense, and federal and civilian agencies worldwide, and KeyPoint is a provider of specialized investigative and risk mitigation services to the U.S. Federal Government. DXC is spinning off its USPS business to combine it with Vencore and KeyPoint to create a competitive, large-scale, government-focused IT services provider. The proposed transaction will be tax-free to DXC and its shareholders through a Reverse Morris Trust transaction structure, which is the same structure used for the formation of DXC as well as Leidos’ acquisition of Lockheed Martin’s IT business in 2016. The DXC USPS deal is expected to close by March 31, 2018, and the still-unnamed, public, combined entity will have 14,000 employees and ~$4.3 billion in annual revenue. DXC shareholders will own 86% of the combined business and receive $1.05 billion of cash upon closing. Veritas Capital, the prominent private equity firm that owns both Vencore and KeyPoint, will retain approximately 14% of the combined entity’s equity and receive $400 million of cash at closing. This transaction follows the recent trend of mega-mergers (~$1 billion in revenue) across the government technology solutions landscape and is the third of its kind behind CACI’s acquisition of L-3’s NSS business unit and Leidos’ acquisition of Lockheed Martin’s IT business.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck