KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

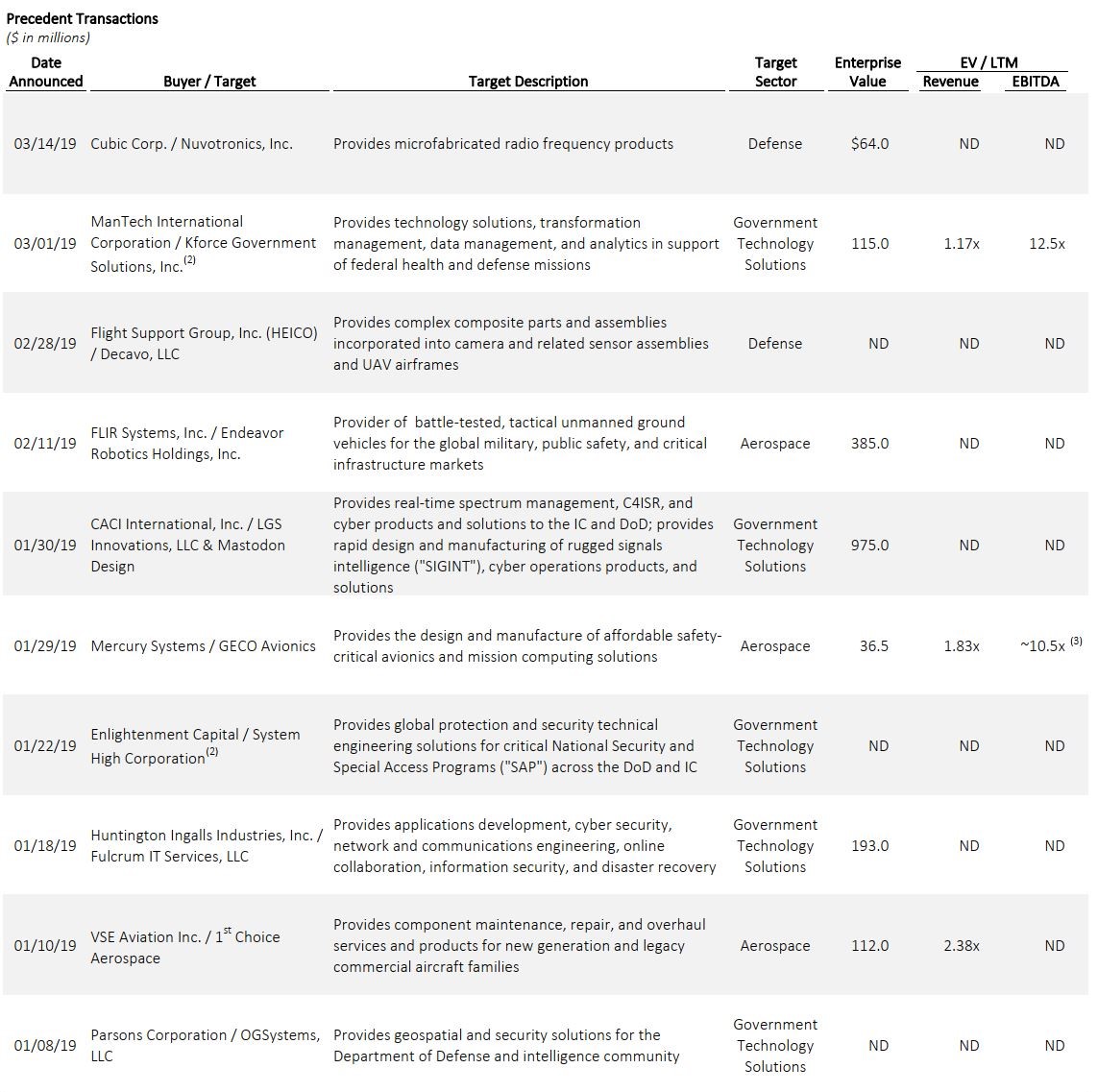

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended March 31, 2019. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

The aerospace and defense deal of the quarter is the acquisition of Endeavor Robotic Holdings, Inc. (“Endeavor”) by FLIR systems, Inc. (“FLIR”) from private equity firm, Arlington Capital Partners, for an estimated $385 million in cash. Based outside Boston and formerly known as iRobot Defense & Security, Endeavor has shipped more than 7,000 unmanned ground vehicles (“UGV”) to customers in over 55 countries. Endeavor provides battle-tested, tactical UGVs for the global military, public safety, and critical infrastructure markets. This transaction, along with FLIR’s recent acquisitions of Aeryon Labs and PROX Dynamics, has significantly expanded FLIR’s unmanned systems capabilities and aligns with its evolution from sensors to intelligent sensing and ultimately integrated solutions. Upon closing of the acquisition, Endeavor will be part of the FLIR Government and Defense Business Unit’s Unmanned Systems and Integrated Solutions division. The transaction is expected to be $0.03 dilutive to FLIR’s 2019 adjusted earnings per share, due to borrowing costs associated with funding the transaction, but accretive thereafter.

The government technology solutions deal of the quarter is ManTech, Inc.’s (NASDAQ:MANT) acquisition of Kforce Government Solutions, Inc. (“KGS”), a subsidiary of Kforce, Inc. (NASDAQ:KFRC). KGS provides high-end technology and business consulting solutions aimed at improving mission effectiveness and operational efficiencies for Federal customers, primarily at the Department of Veteran Affairs (“VA”) and Department of Defense (“DoD”). The $115 million all cash transaction was announced on March 1st. This acquisition significantly expands ManTech’s footprint at the VA and gives ManTech access to KGS’ prime position on the VA’s 10-year, $22.3 billion, Transformation Twenty-One Total Technology Next Generation (“T4NG”) Indefinite Delivery Indefinite Quantity (“IDIQ”) program. KGS adds ~500 skilled employees and ~$100 million of annual revenue to ManTech. This transaction is yet another example of strategic buyers paying premium valuations for well positioned businesses that hold key contract vehicles, like T4NG. KippsDeSanto & Co. acted as the exclusive financial advisor to KGS on this transaction.

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace/Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.