KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

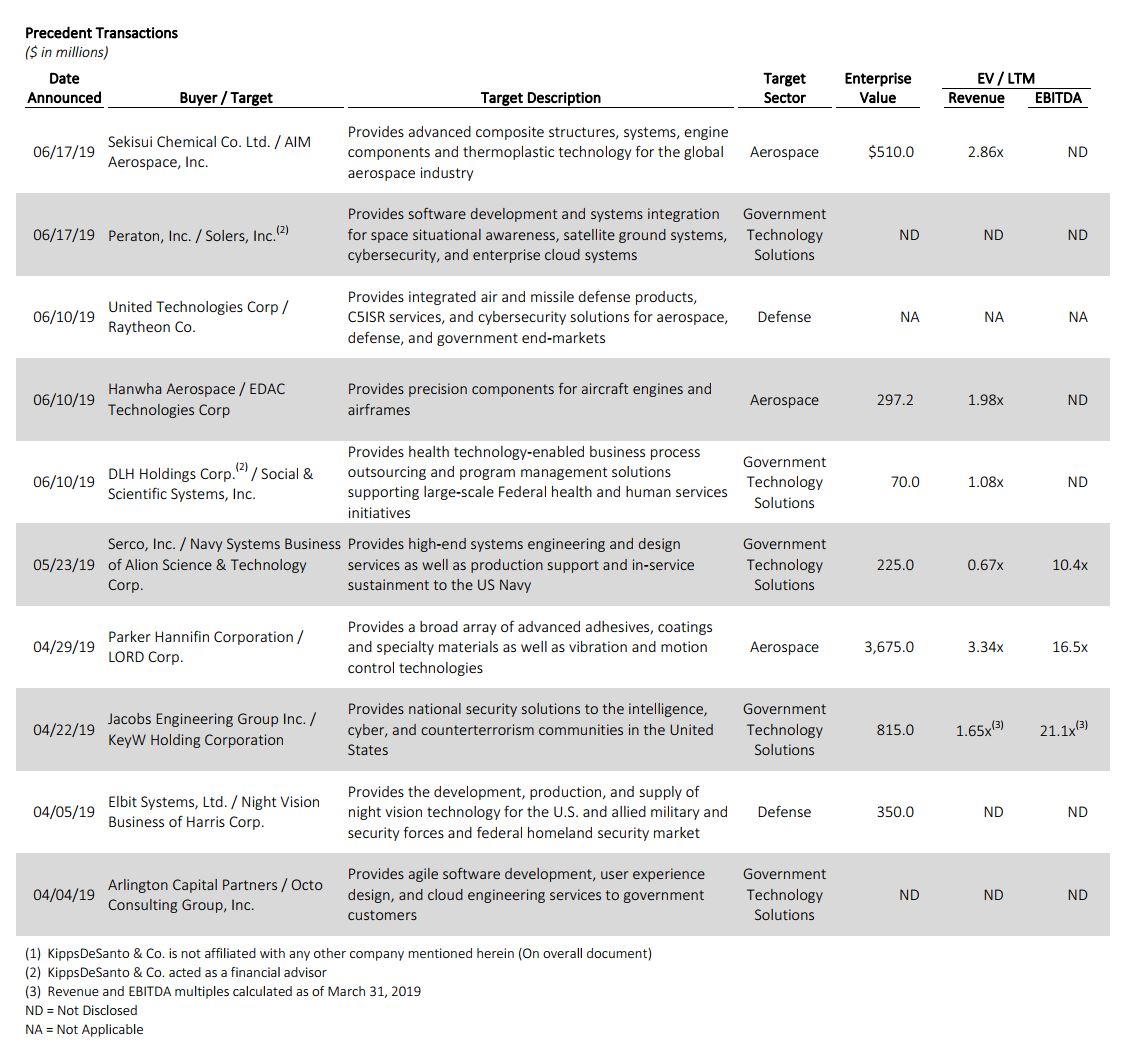

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended June 30, 2019. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is the pending merger of United Technologies Corporation (NYSE:UTX) with Raytheon Company (NYSE:RTN), which was announced in early June. After associated spinoff divestitures, the combined company will be the U.S.’ second-largest aerospace and defense company, behind Boeing, valued at more than $100 billion with annual revenue of approximately $74 billion. The deal is structured as a merger of equals between UTC and Raytheon. The combined entity plans to produce a wide array of products ranging from engines and seats for the F-35, to Patriot missile launchers and space suits. The deal intensifies the consolidation in the aerospace and defense industry as plane makers seek better terms from suppliers and the U.S. government puts greater pressure on contractors to cut costs and invest in new technologies, such as space systems and cybersecurity. The new company will be named Raytheon Technologies Corp. UTC shareholders will own 57% of the shares and plan to appoint eight of the 15 new directors. Raytheon shareholders will own the remaining 43% of the combined company, with current Raytheon Chairman and CEO Tom Kennedy being the designated Executive Chairman of the post-merger company. The deal is subject to regulatory approval and is anticipated to close in the first half of 2020.

The government technology solutions deal of the quarter is Jacobs Engineering Group, Inc.’s (NYSE:JEC) acquisition of KeyW Holding Corporation (Nasdaq: KEYW). KEYW is a leading national security provider of advanced engineering, cyber, and reconnaissance technology solutions for the U.S. Department of Defense “DoD,” Intelligence Community “IC,” and counterterrorism agencies. The approximately $815 million transaction was announced on April 22nd and closed on June 11th. Following the acquisition, JEC plans to merge KEYW with Atom Acquisition Sub, Inc., creating a new, wholly owned subsidiary of JEC to expand JEC’s Aerospace, Technology, and Nuclear capabilities and footprint. KEYW adds proprietary command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance (“C5ISR”) solutions to JEC’s portfolio of capabilities. In addition, the transaction will allow JEC to offer its existing customers “a wide array of capabilities and services via a broad range of contracting vehicles,” according to Bill Webber, President and CEO of KEYW. Since its inception in 2008, KEYW has been focused on NexGen IT capabilities for IC and DoD customers, and has supplemented organic growth with 18 acquisitions, including Sotera in 2017. This transaction serves as another example of how large global engineering companies, such as Huntington Ingalls (NYSE: HII), Parsons Corporation (NYSE:PSN), KBR, Inc. (NYSE:KBR), and others, are expanding their reach in the government sector, seeing the Intelligence Community in particular as promising, stable, and relatively insulated areas for investment.

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace/Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.