KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

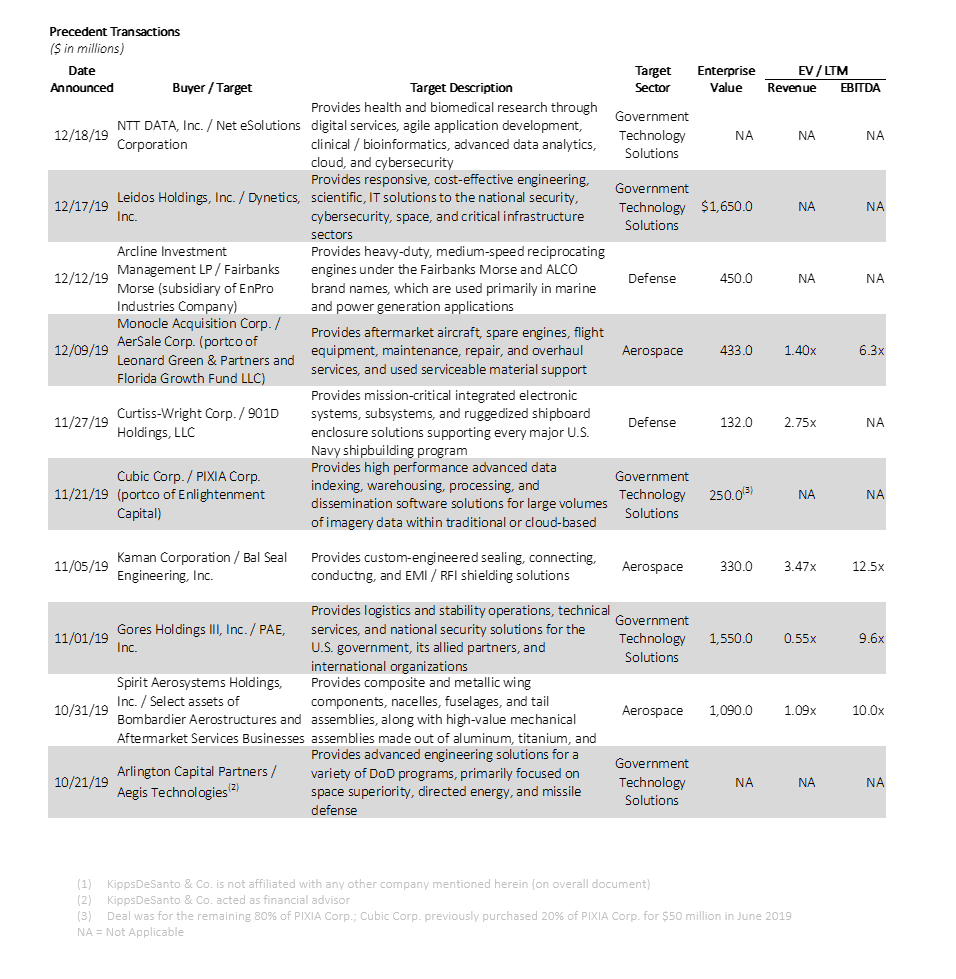

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended December 31, 2019. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is Spirit Aerosystems Holdings Inc.’s pending acquisition of select assets of Bombardier Aerostructures and its Aftermarket Services Businesses in Morocco, Texas and Northern Ireland. The acquired assets, which produce parts for the Airbus SE A320 and A220 jets, employ more than 4,000 people at three sites, and will help cushion Spirit from the disruption caused by the grounding and slowed production of the 737 MAX; the 737 MAX accounts for an estimated 50% of Spirit’s annual sales. The purchase of these assets is part of Spirit’s strategy to secure additional business at Airbus, expand military and helicopter aircraft work, and strengthen its non-U.S. operations. The wing-making facility in Northern Ireland will provide Spirit with access to the Airbus A220 program, as well as the potential for additional next generation work for single-aisle jets. The estimated $1.09 billion transaction was announced on October 31st; the cash consideration will be $500 milllion; Spirit AeroSystems will assume approximately $300 million in net pension liabilities and approximately $290 million of government grant repayment options.

The government technology solutions deal of the quarter is Leidos’ (NYSE: LDOS) $1.65B acquisition of the employee-owned and privately-held national security solutions provider, Dynetics, Inc (“Dynetics”). Dynetics will operate as a wholly-owned subsidiary of Leidos. The acquisition is expected to add $110M of EBITDA to Leidos in 2020. Dynetics is a leading provider of high-tech, mission-critical services and solutions to the U.S. government. Leidos is a market leader in providing information technology, engineering, and science solutions to defense, civilian, and healthcare federal agencies. The acquisition of Dynetics will strengthen Leidos’ position in existing markets, while accelerating research within the Leidos Innovations Center to develop new technologies and solutions that address evolving customer requirements. Leidos CEO Roger Krone highlighted the innovative nature of Dynetics’ work, stating that “the addition of Dynetics will significantly increase our capabilities for rapid prototyping and agile system integration and production.” The acquisition is the third and largest for Leidos in the past 18 months (the company purchased IMX Medical Management in August 2019 and Aranea Solutions in June 2018), evidencing the Company’s commitment to its M&A strategy. This deal reflects the broader trend of public buyers seeking acquisitions that add scale and provide differentiated solutions, such as advanced engineering and prototyping, intellectual property, and embedded customer positioning within the Department of Defense and Intelligence Community.

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.