KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended March 31, 2020.(1)

Current market conditions and the ongoing COVID-19 global pandemic have already begun to impact M&A activity in our target sectors. While M&A activity was particularly strong during the beginning of 2020, transaction volume in March was noticeably lower. March deal announcements across all three sectors included 20 transactions, compared to an average of 38 transaction announcements per month in the first two months of 2020.

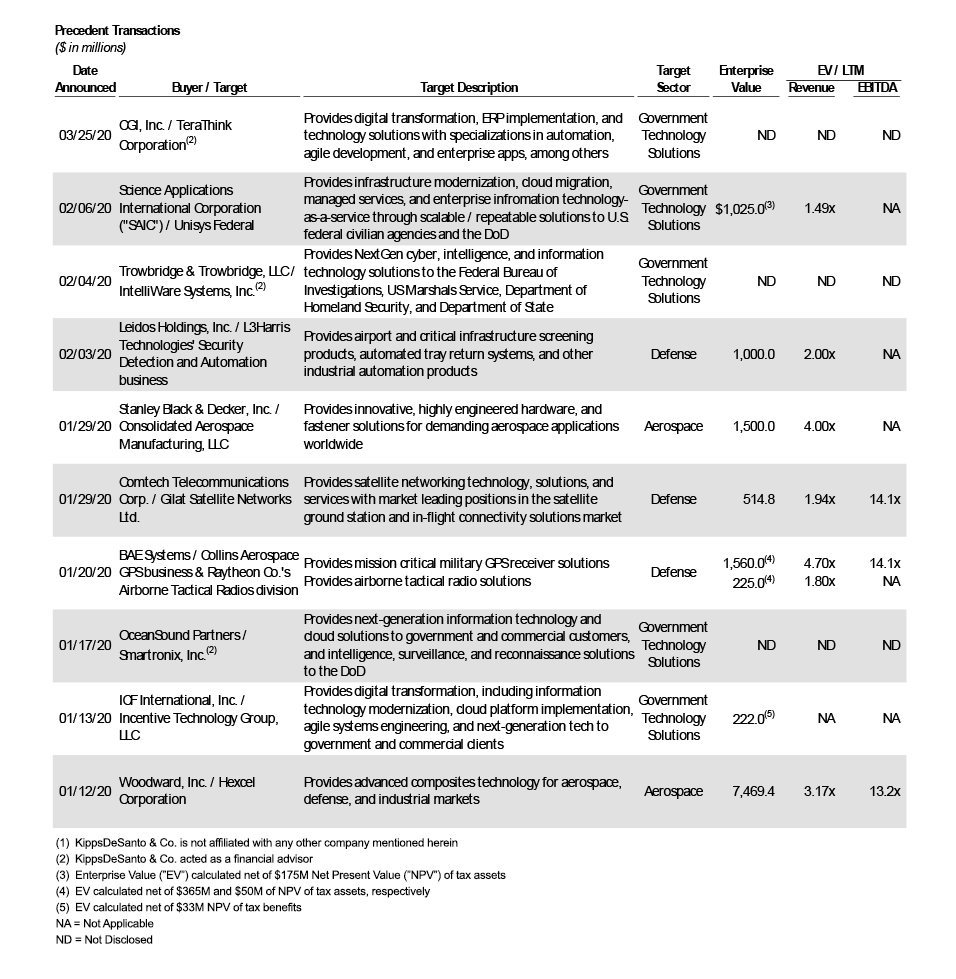

The following is our take on the most notable announced M&A transactions in the first quarter of 2020 — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is Woodward, Inc.’s (NasdaqGS: WWD) and Hexcel Corporation’s (NYSE: HXL) pending merger of equals, with Woodward to remain as the surviving entity. The newly formed Woodward Hexcel is a premier global provider of innovative and integrated aerodynamic, propulsion, and composite technology systems to the aerospace, defense, and industrial markets, and is expected to generate $5.3 billion in sales and $1.1 billion in EBITDA on a 2019 pro-forma basis. Woodward Hexcel is expected to benefit from enhanced scale, combined R&D capabilities, a strategically diversified portfolio of products and customers, as well as a stronger financial profile. The estimated $7.5 billion transaction was announced on January 12th following approval by both Board of Directors, and is expected to close in the third quarter of 2020. The all-stock consideration will be paid at a fixed exchange ratio of 0.625 shares of WWD for each HXL share with Woodward shareholders owning 55% of the combined entity. The acquisition highlights industry consolidatation with the resulting effect yielding Hexcel Woodward improved operating leverage, diversified end market exposure, as well as embedded content and complementary technologies on premier aerospace platforms, to accelerate growth and generate significant value for both sets of shareholders.

The government technology solutions deal of the quarter is SAIC’s (NYSE: SAIC) acquisition of Unisys Federal, an operating unit of Unisys (NYSE: UIS). The all-cash transaction is valued at $1.2 billion ($1.025 billion net of $175 million of tax assets) and is expected to close by May 1, 2020, following customary closing requirements. Unisys Federal is a leading provider of cloud migration, infrastructure modernization, managed services, and enterprise IT-as-a-service (“EITaaS”) to U.S. federal civilian agencies and the Department of Defense. Given its core strengths, the transaction is expected to further differentiate SAIC within the government services market by adding technology-enabled, intellectual property-based solutions and digital transformation services, that are typically sold via commercial-like service delivery models. Unisys Federal holds several sizable and highly-sought after contracts focused on these areas, which are complementary to SAIC’s growing portfolio of NextGen IT awards. In addition, the acquisition provides SAIC with enhanced customer access and offers new avenues for growth as well as cross-selling opportunities. The transaction will help free up resources Unisys can use to cancel debt and pension shortfalls and improve growth prospects for 2020. This acquisition also demonstrates a continued interest by large public companies in the Government Technology Solutions marketplace to add scale, vehicles, and NextGen IT capabilities via acquisitions.

About KippsDeSanto & Co KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.