KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended September 30th, 2020.

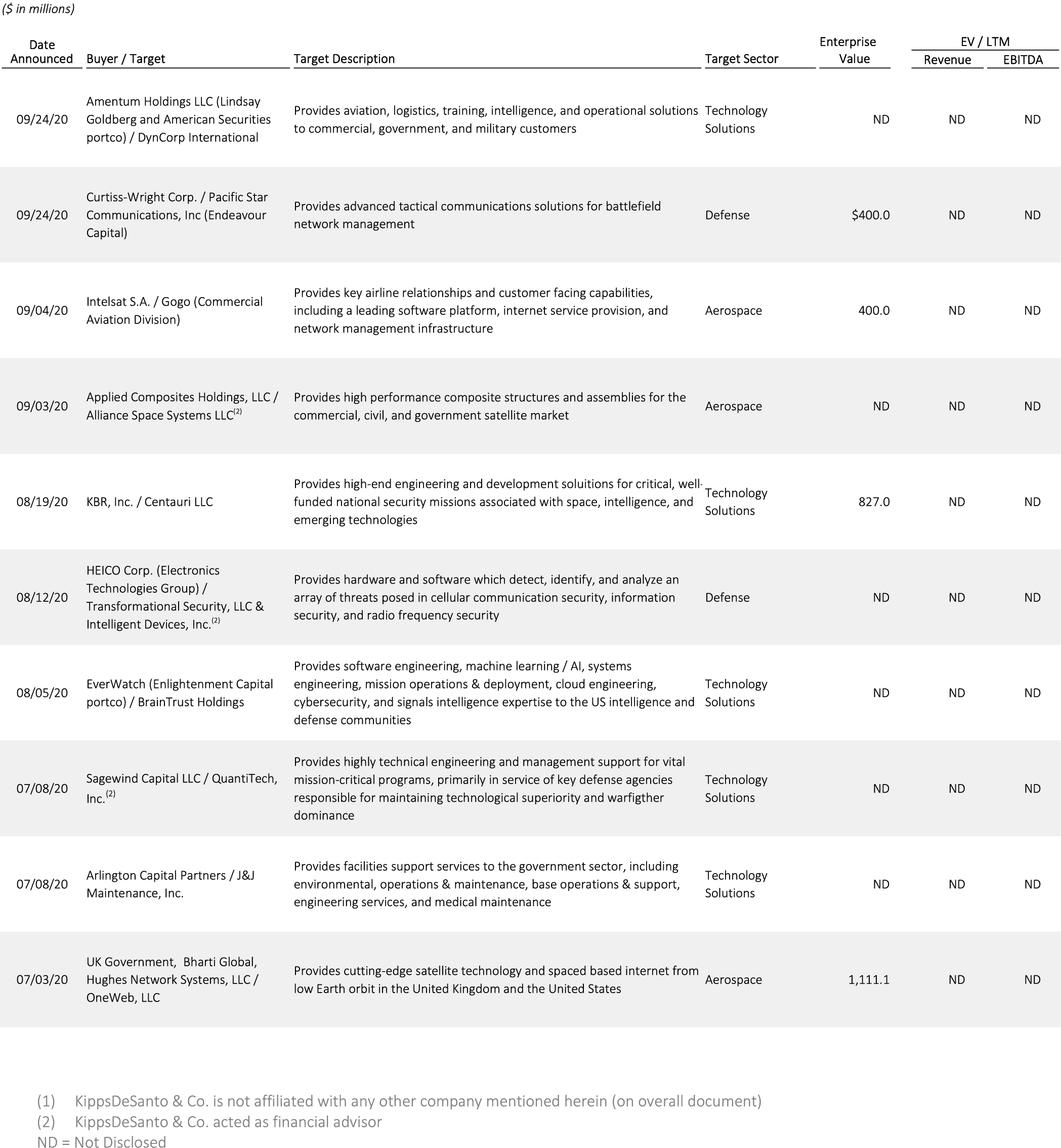

The following is our take on the most notable announced M&A transactions in the third quarter of 2020 — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is the United Kingdom (“UK”) Government’s and Bharti Global’s pending acquisition of OneWeb, LLC. OneWeb, a satellite technology company with dual headquarters in London and the Washington D.C. metro area, provides space-based internet from low Earth orbit (“LEO”). After reducing its headcount nearly 90%, the company filed for bankruptcy in March due to a liquidity crisis exacerbated by the COVID-19 pandemic and the resulting market selloff. The anticipated cash infusion of more than $1 billion is expected to allow OneWeb to successfully emerge from Chapter 11 proceedings and continue its mission of becoming a global leader in low latency connectivity. Previously, OneWeb didn’t have the ability to compete with Starlink’s budget, but with funding from the UK and Bharti, OneWeb becomes a legitimate challenger to Starlink’s dominant presence in the LEO internet market. For Bharti Global, which already has its own mobile broadband networks, the OneWeb investment is expected to return value as Bharti can use its networks as a testing ground for OneWeb products and services. Bharti will also be able to deliver OneWeb’s offerings to established markets in South Asia and Sub-Saharan Africa, where the geography necessitates the use of satellite-based connectivity. The UK benefitted from this acquisition in a different manner. The acquisition allowed the UK to establish its first sovereign space capability. In turn, the UK can potentially leverage this capability for positioning, navigation, and timing (“PNT”) as Brexit has created barriers to the EU’s satellite resources.

The technology solutions deal of the quarter is Amentum’s pending acquisition of DynCorp International, which is expected to close in the fourth quarter of 2020, subject to customary closing conditions and regulatory approvals. DynCorp is a leading global provider of aviation, logistics, training, intelligence, and operational solutions to military, government, and commercial customers. Once finalized, the combined business will become one of the largest providers of mission-critical aviation, logistics, and IT support services, with more than $6 billion of revenue and 34,000 employees operating across approximately 30 countries. The acquisition is expected to accelerate growth across the combined platform by creating cross-selling opportunities, as DynCorp enhances Amentum’s services offerings and provides expanded customer access. The combination of Amentum’s core offerings within mission support, IT, cybersecurity, nuclear and environmental remediation, program management, and testing is complementary to DynCorp’s expertise across aviation, contractor logistics, intelligence, and training. The expanded set of capabilities allows the combined platform to offer a more complete set of solutions to its customers and hopefully augment growth. At an industry level, the deal, in tandem with such other acquisitions as KBR’s purchase of Centauri, SAIC’s purchase of Unisys Federal, and Leidos’ purchase of Dynetics, underscores an ongoing appetite to add scale via mergers and acquisitions among the industry’s largest players.

About KippsDeSanto & Co KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace/Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a nonbanking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.