KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

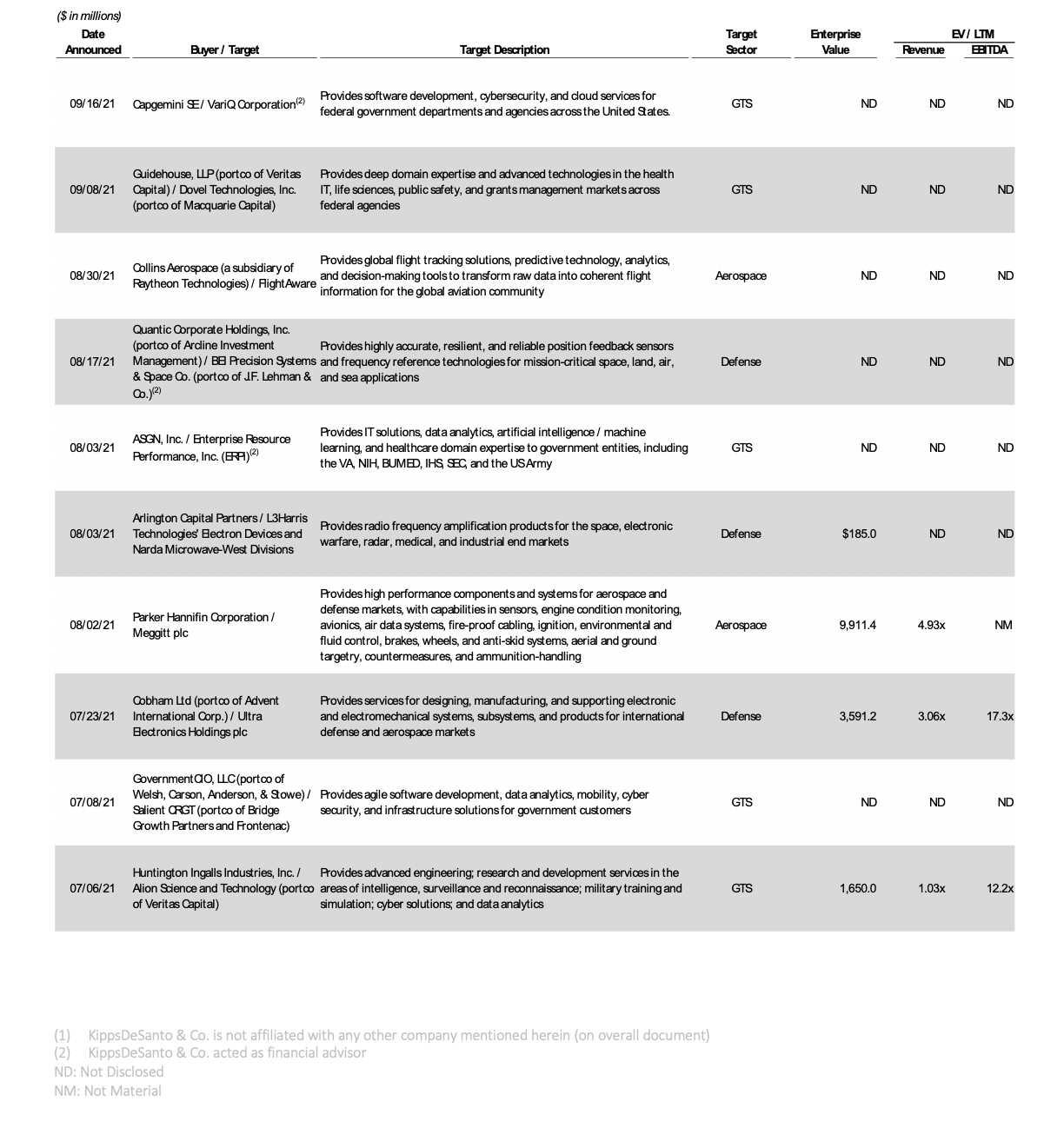

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended September 30, 2021.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Parker Hannifin Corporation’s (NYSE: PH) pending $9.9 billion acquisition of Meggitt plc (“Meggitt” or the “Company”) (LSE: MGGT). Meggitt, a leading engineering company headquartered in Coventry, United Kingdom (“U.K.”), provides high performance components and sub-systems for aerospace, defense, and selected energy markets. The acquisition of Meggitt nearly doubles the size of Parker Hannifin’s Aerospace Systems segment and provides economies of scale that will enable the combined entity to better serve their customers through technological innovation, a broader combined product portfolio, and expanded geographic footprint. To alleviate national security concerns and help win the U.K. government’s support, Parker Hannifin agreed to several legally binding commitments including, maintaining Meggitt’s U.K. headquarters, boosting R&D expenditures in the country, and ensuring that Meggitt continues to meet its contractual obligations. One week after the announcement of Parker Hannifin’s acquisition proposal, TransDigm Group Inc. (NYSE: TDG) made an unsolicited offer of $9.7 billion to acquire Meggitt. However, on September 7, 2021, TransDigm withdrew its proposal citing “limited due diligence information” being made available. On September 21, 2021, an overwhelming majority of Meggitt shareholders approved the acquisition offer from Parker Hannifin. The transaction is expected to close in the third quarter of 2022.

The GTS deal of the quarter is the $1.65 billion acquisition of Alion Science and Technology Corporation (“Alion”), a portfolio company of Veritas Capital, by Huntington Ingalls Industries, Inc. (“HII”) (NYSE: HII). Based in McLean, VA, Alion provides advanced engineering and Research and Development services in the areas of Intelligence, Surveillance, and Reconnaissance (“ISR”), military training and simulation, cyber, data analytics, and other technology based solutions to the Department of Defense and Intelligence Community. HII will integrate Alion into its Technical Solutions division. The transaction represents another HII acquisition of a high-growth defense and national security company, following its acquisition of the Autonomy division of Spatial Integrated Systems, Inc. in January of 2021. The acquisition of Alion is one of several high-profile deals recently consummated in 2021 that highlight a continued desire by both public and private equity-backed strategic buyers to make transformational acquisitions of scale. Other noteworthy recent deals of size include the acquisition of Dovel Technologies, Inc. by Guidehouse, LLP and acquisition of Salient CRGT by GovernmentCIO, LLC. Total GTS deal volume in 2021 is approaching 150 year-to-date, or 200 from an annualized perspective, which is 80% and 50% higher than the 111 and 133 deals closed in 2019 and 2020, respectively.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.