KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter

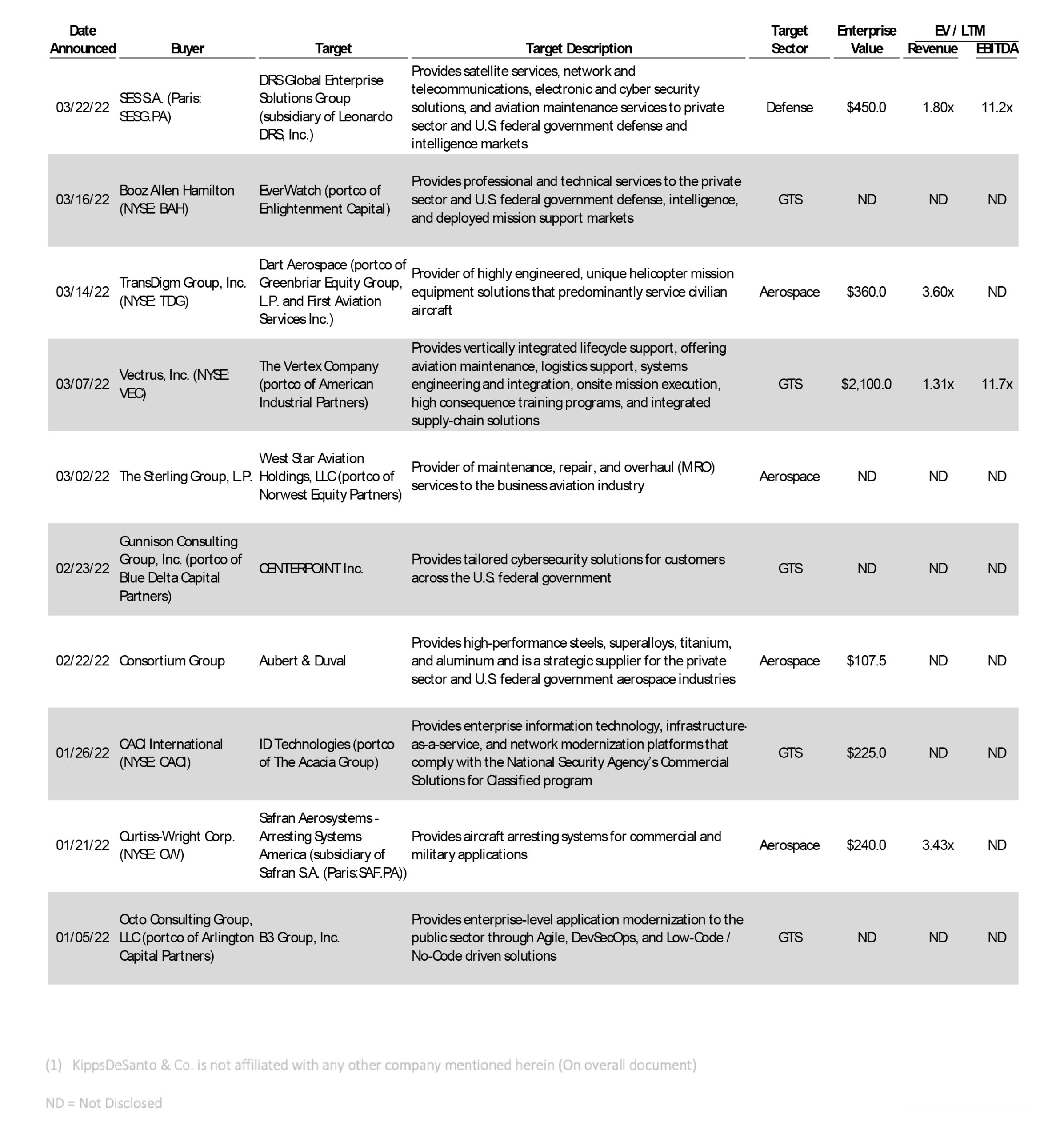

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended March 31, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is SES S.A.’s (Paris: SESG.PA) pending acquisition of Leonardo DRS Global Enterprise Solutions Group (“DRS GES”). DRS GES provides satellite services, network and telecommunications, electronic and cyber security solutions, and aviation maintenance services to private sector and U.S. federal government defense and intelligence markets. SES operates a fleet of more than 70 geosynchronous and medium Earth orbit satellites. SES plans to combine DRS GES with SES Government Solutions (“SES GS”), taking advantage of their shared cultures and deep commitment to providing secure, global solutions to unite the state-of-the-art multi-orbit satellite networking capabilities of SES GS with DRS GES’s experience in satellite communications integration. US Government customers will also benefit from technical and commercial simplification, while ensuring continuity of high-performance satellite-enabled solutions. The transaction values the Global Enterprise Solutions Group at $450 million. The consolidation of DRS GES with SES GS is expected to add about $40 million of EBITDA and will benefit from the combination of future business expansion and $25 million of annualized run-rate synergies, including opportunities to support and enhance existing networks and services with the SES multi-orbit network. Finalization of the deal is targeted for the second half of 2022 subject to regulatory approvals.

The GTS deal of the quarter is the pending all-stock merger of Vectrus, Inc. (NYSE: VEC) (“Vectrus”) and The Vertex Company (“Vertex”), a portfolio company of private equity group, American Industrial Partners. Headquartered in Colorado Springs, CO, Vectrus provides systems integration, operations, sustainment, engineering, logistics, and space launch and range support solutions and services to military customers and government agencies around the world. Madison, MS based Vertex provides vertically integrated lifecycle support, offering aviation maintenance, logistics support, systems engineering and integration, onsite mission execution, high consequence training programs, and integrated supply-chain solutions. The combined company will offer an expanded suite of integrated technology solutions and critical services to help support national security and military convergence. Following the merger, the company will take on a new name and remain listed on the New York Stock Exchange with headquarters in Northern Virginia. Under the terms of the merger, Vertex shareholders will own about 62% of the combined company and Vectrus shareholders will own approximately 38% on a fully diluted basis, valuing Vertex at $2.1 billion. The combined company would have 2021 pro forma revenue of approximately $3.4 billion and adjusted EBITDA of approximately $283 million, which includes $20 million of estimated cost synergies. This transaction highlights the growing trend of public GTS companies providing value to shareholders through M&A, in addition to organic growth efforts. Vertex is one of four public GTS companies to announce or close an M&A transaction in the first quarter of 2022, along with Booz Allen Hamilton (NYSE: BAH), CACI Inc (NYSE: CACI), and ManTech International (NASDAQ: MANT). Following the closing of this transaction, Chuck Prow, Vectrus CEO, and Susan Lynch, Vertex CFO, will serve as CEO and CFO of the combined company, respectively. The merger is expected to close in the third quarter of 2022.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.