KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

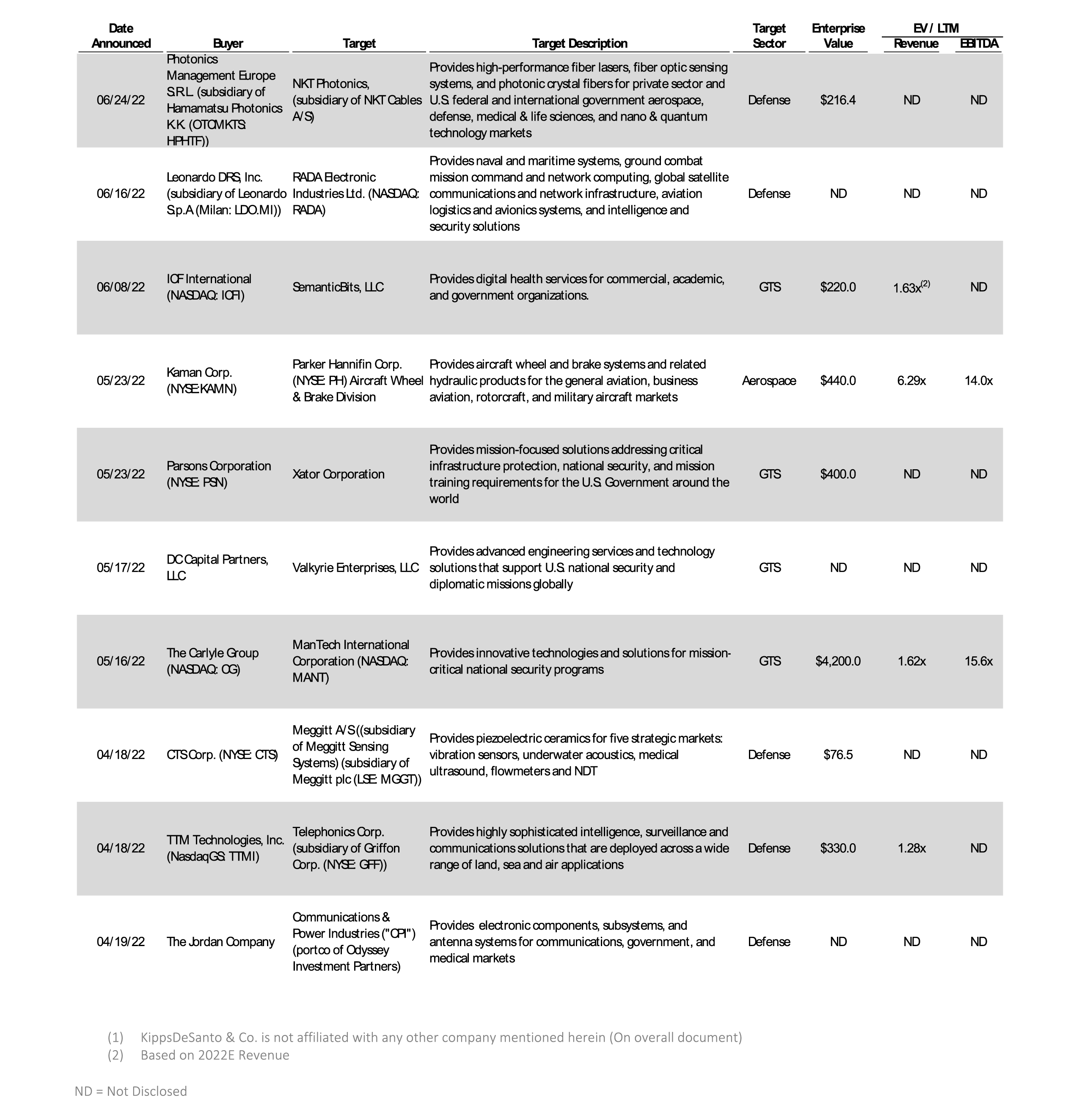

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2022.

Of the above transactions, the following were especially noteworthy:

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Leonardo DRS, Inc.’s (“Leonardo DRS”) (a subsidiary of Leonardo S.p.A (Milan: LDO.MI)) pending reverse merger with RADA Electronic Industries Ltd. (NASDAQ: RADA; “RADA”). RADA provides tactical radar systems across a variety of use cases, including infrastructure protection, border surveillance, active military protection, and counter-unmanned aerial vehicle (“UAV”) applications. The deal brings much-needed scale to RADA, while immediately accelerating growth in two of DRS’ priority markets: advanced sensing and force protection. The two organizations, which have some familiarity through their work on Leonardo DRS’ M-SHORAD program, would immediately form a middle-market leader in priority defense investment areas. The combined entity would continue to trade on the NASDAQ and Tel Aviv stock exchanges as “DRS”, and would bring Leonardo DRS back to the public markets for the first time since 2008, when it was acquired by its current Italian parent. M&A is expected to be a key part of the combined entity’s go-forward growth strategy, and with pro forma leverage of less than 0.5x, it should continue to enjoy substantial capital allocation flexibility (RADA’s current leverage is ~0.6x). The deal is expected to close in the fourth quarter of 2022, subject to regulatory approvals.

The GTS deal of the quarter is the pending all-cash acquisition of ManTech International Corporation (Nasdaq: MANT) (“ManTech”) by global investment firm, Carlyle (NASDAQ: CG). ManTech is a leading provider of cybersecurity, data and analytics, enterprise IT, software development, systems engineering, intelligence missions support, and mission operations services for mission-critical national security programs. Under the terms of the transaction, Carlyle will acquire ManTech for $96 per share, or $4.2 billion, representing a 32% premium on the February 2, 2022 share price, and a 17% premium on the May 13, 2022 share price. As of March 31, 2022, ManTech had TTM revenue of nearly $2.6 billion and TTM EBITDA of $268.5 million. This transaction highlights the continued demand for GTS acquisitions among private equity buyers as Carlyle is hoping to leverage its sector expertise and industry resources to fuel ManTech’s innovation and drive accelerated growth. In the second quarter of 2022, private equity and private equity-backed portfolio companies represented nearly half of all M&A transactions announced in the GTS market. This transaction is expected to close in the second half of 2022, subject to approval by ManTech shareholders, receipt of regulatory approvals, and other customary closing conditions.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.