KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

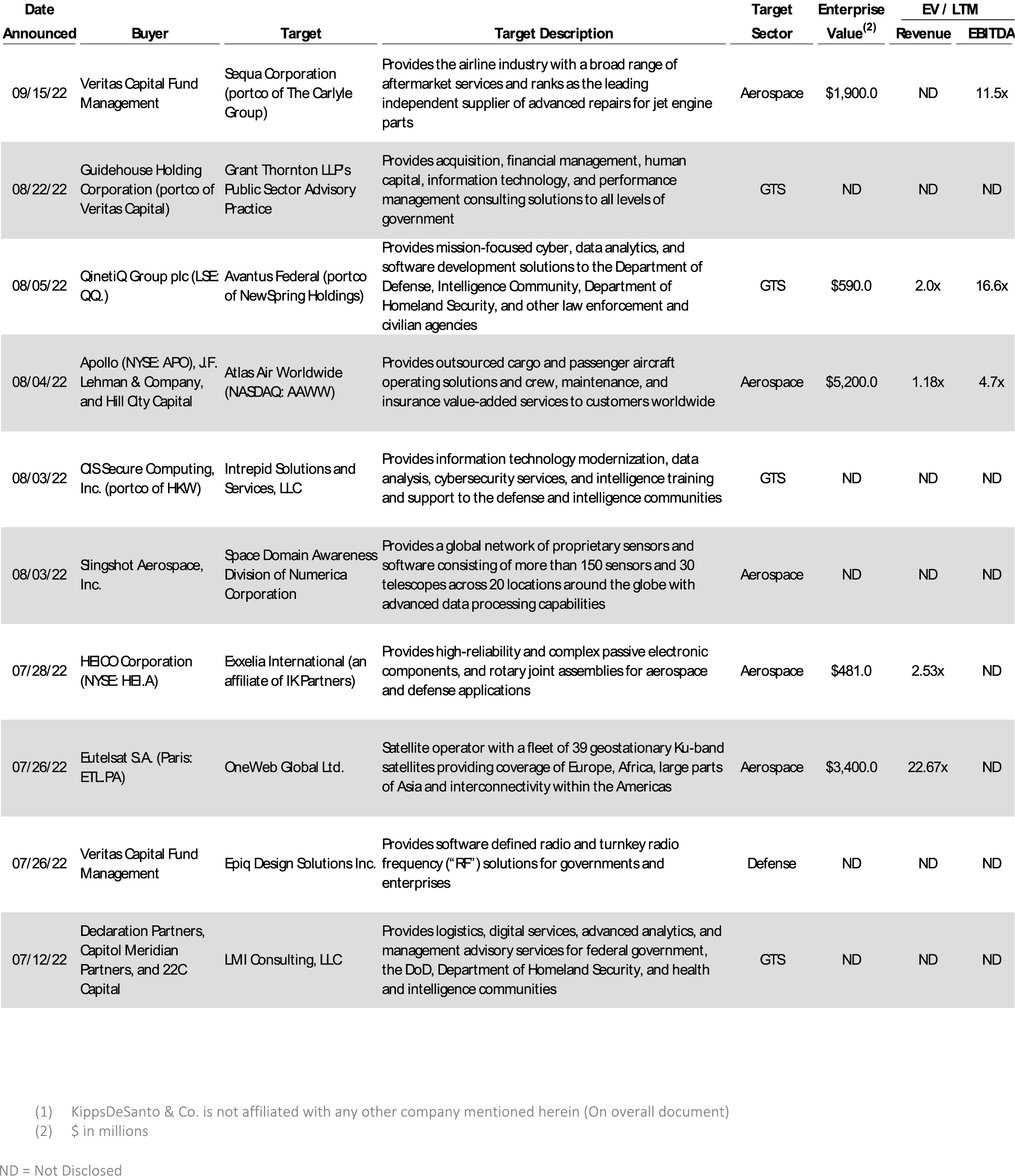

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended September 30, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Eutelsat S.A.’s (“Eutelsat”) (Paris: ETL.PA) pending merger with privately held OneWeb Global Ltd (“OneWeb”). OneWeb is a satellite communications provider that is building a communications network utilizing a constellation of Low Earth Orbit (“LEO”) satellites that deliver low latency high-speed worldwide broadband connectivity. Eutelsat will combine its ~40-strong fleet of Geosynchronous Equatorial Orbit (“GEO”) satellites with OneWeb’s constellation of ~650 LEO satellites to create a fully mutualized network of one-stop shop solutions to its customers. Eutelsat and key OneWeb shareholders have signed a Memorandum of Understanding in which Eutelsat will acquire OneWeb for €12 per share, or $3.4 billion (including the dividend, before synergies). Synergies from the merger are expected to generate annual run-rate savings of over €80 million pre-tax after five years. The potential combination of Eutelsat and OneWeb is occurring on the heels of other notable satellite deals, including the pending business combination announced in November 2021 between Viasat and Inmarsat, which will create a multi-billion dollar global communications provider, and SES’ $450 million acquisition of DRS’ satellite communications business that was completed in August 2022, which will create a multi-orbit satellite communications provider to federal customers. This recent uptick in transformational satellite and communications M&A could drive further appetite for these assets as players in the space look to expand capabilities and further position themselves to be end-to-end providers. The Eutelsat and OneWeb combination requires regulatory approvals, including permission from foreign investment authorities, and is expected to close by the end of first half of 2023.

The GTS deal of the quarter is the acquisition of LMI Consulting LLC (“LMI”), the for-profit subsidiary of Logistics Management Institute, by a consortium of investors formed by Declaration Partners, Capitol Meridian Partners, and 22C Capital. Headquartered in Tysons, VA, LMI is a leading provider of technology-enabled management advisory, logistics, and digital & analytics solutions to the U.S. government. Founded in 1961 to help the Department of Defense (“DoD”) solve complex challenges, LMI has leveraged decades of experience and past performance to establish a franchise position across nearly all federal markets. LMI is focused on bringing future-focused thought leadership and technology to customers within the Defense & Space, Health & Civilian, Homeland Security, and Intelligence markets. With Declaration Partners, Capitol Meridian Partners, and 22C Capital looking to expand on LMI’s rapid growth and build upon its in-demand capabilities and proprietary solutions across its core markets, this transaction highlights the continued demand for GTS acquisitions among private equity buyers with explicit growth strategies and industry knowledge. In the third quarter of 2022, private equity and private equity-backed portfolio companies represented approximately two thirds of all M&A transactions announced in the GTS market. This deal also represents the significant demand for diversified capabilities, market expertise, and intellectual property reinforced by highly skilled, experienced, and cleared employees in a tight labor market. This transaction was announced on July 12, 2022 and closed on July 18, 2022. The remaining nonprofit entity re-branded as NobleReach Foundation™ following the sale of LMI. KippsDeSanto & Co. served as the exclusive M&A advisor to LMI.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.