KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

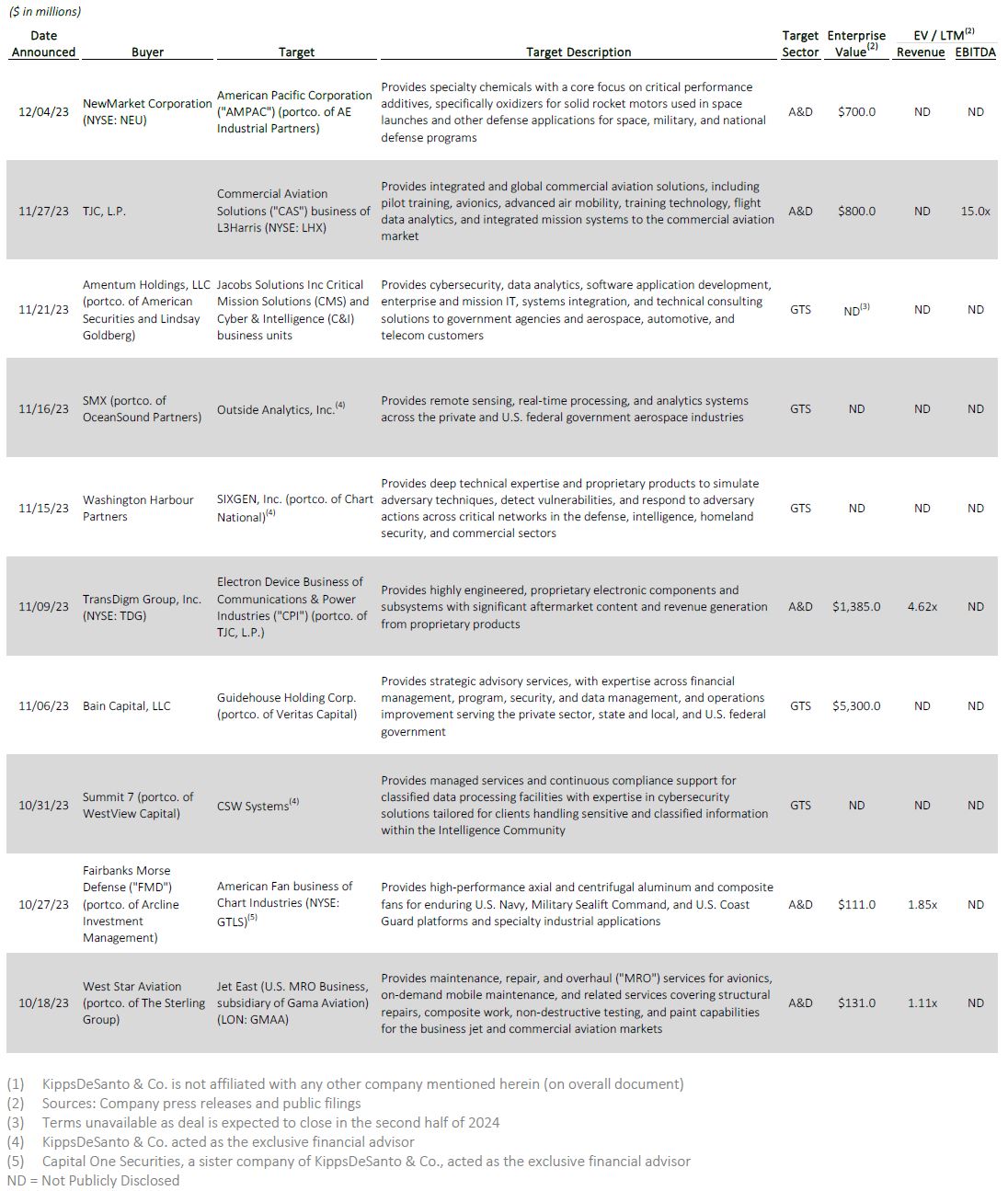

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2023.

Of the above transactions, the following were especially noteworthy:

TransDigm Group Inc.’s (NYSE: TDG) pending acquisition of the Electron Device Business (“the Company” or “EDB”) of Communications & Power Industries (“CPI”), a portfolio company of TJC, L.P. (formerly known as “The Jordan Company”). Headquartered in Palo Alto, California, EDB provides highly engineered, proprietary high-powered microwave components that enable various radar, electronic warfare, quantum sensing, and missile defense platforms. The Company currently employs ~900 employees across facilities in California, Massachusetts, and England, serving military, industrial, scientific, electronic warfare, and communications markets worldwide. The Company’s aftermarket content accounts for ~70% of its $300 million FY2023 revenue, with a diverse range of proprietary products and platforms. The acquisition enables TransDigm to expand its customer and electronic component capabilities through the Company’s 75+ sole- source positions for blue-chip customers on platforms with a large installed base. The EDB acquisition demonstrates continued investor appetite for suppliers of proprietary products on highly-engineered defense platforms with enduring aftermarket demand and forward revenue visibility, directly aligned with TransDigm’s acquisition strategy to deliver long-term shareholder value. The $1.4 billion transaction will be funded with existing cash on hand and new long-term debt, and was announced on November 9, 2023. Subject to United States and United Kingdom regulatory approval, the transaction is expected to close by the end of TransDigm’s third fiscal quarter in 2024.

Bain Capital Private Equity’s (“Bain Capital”) acquisition of Guidehouse Inc. (“Guidehouse”), a portfolio company of Veritas Capital. Headquartered in McLean, VA, Guidehouse is a provider of strategic advisory services, with areas of expertise in financial management, program, security, and data management, and operations improvement. The Company serves the federal government, state and local governments, and the private sector with capabilities and solutions spanning a wide range of industries, including defense and security, energy, infrastructure, sustainability, financial services, and health. The acquisition of Guidehouse increases Bain Capital’s exposure to the consulting industry, which has been growing steadily as businesses strive to navigate increasingly complex challenges. This move provides Bain Capital with a solid platform to enhance its offerings to federal, state, and local governments, leveraging Guidehouse’s extensive government services practice. This transaction was announced on November 6, 2023. The transaction is valued at $5.3 billion.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.