KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

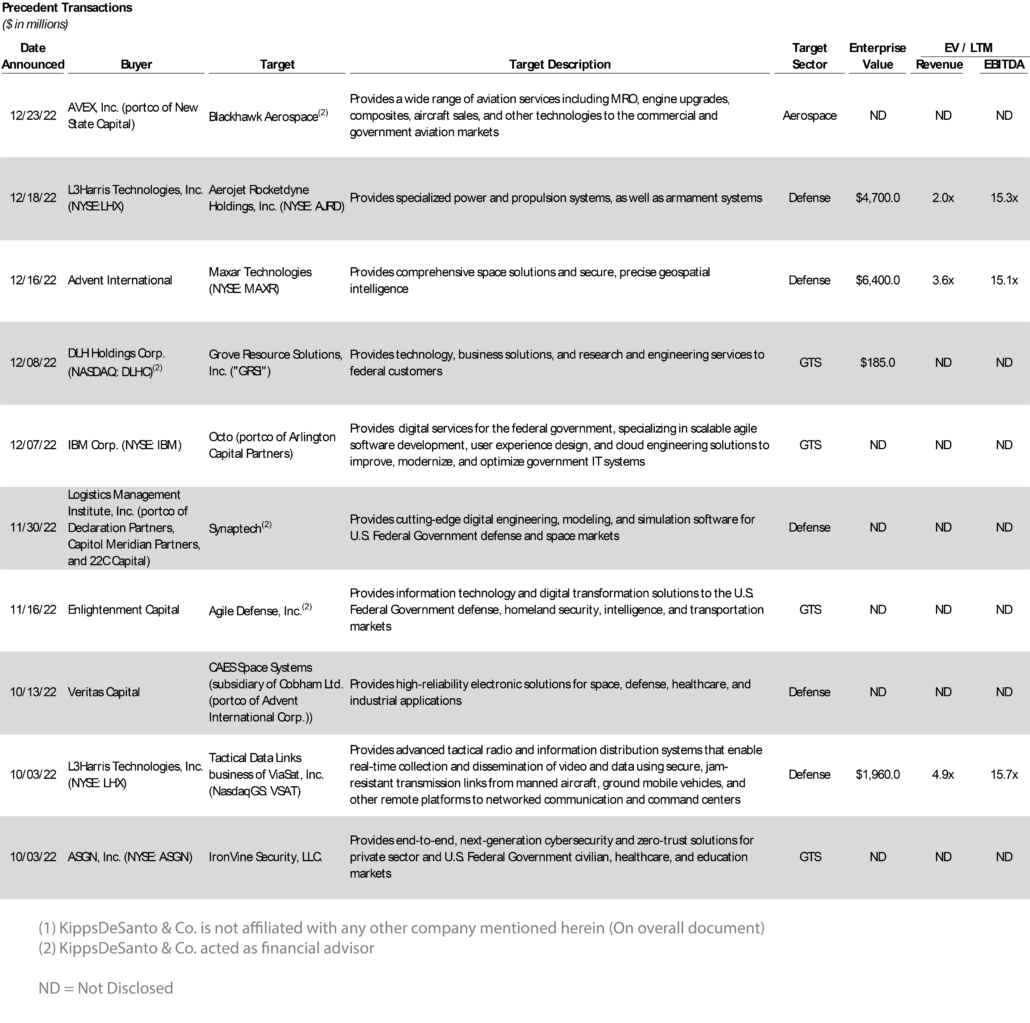

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended December 31, 2022.

Of the above transactions, the following were especially noteworthy:

The A&D deal of the quarter is Advent International’s (“Advent”) pending acquisition of Maxar Technologies (“Maxar”) (NYSE: MAXR). Maxar is a provider of advanced space technology solutions supporting both commercial and government markets, delivering secure and precise Earth imagery, geospatial intelligence, and data analytics. Advent has committed to provide $3.1 billion of equity financing for the deal, while the British Columbia Investment Management Corporation is also making a $1 billion minority equity contribution. Including debt, the deal is valued at $6.4 billion, marking one of the largest leveraged buyouts in 2022. As the U.S. government’s primary supplier of satellite imagery, recently securing a $3.2 billion agreement with the National Reconnaissance Office to provide imagery over the next 10 years, Maxar will remain a U.S.-controlled and operated company. Under the terms of the definitive merger agreement, Advent has agreed to acquire all outstanding shares of Maxar common stock for $53.00 per share in cash, representing a premium of approximately 129% over Maxar’s closing stock price of $23.10 on December 15, 2022, the last full trading day prior to this announcement. As a private company, Maxar hopes to accelerate vital investments in next-generation satellite technologies and data insights, including advanced machine learning and 3D mapping; successfully deploy the next-generation WorldView Legion imaging constellation, a program which has been plagued by delays; further grow its Earth Intelligence and Space Infrastructure businesses; and pursue select, strategic M&A to further enhance its portfolio of solutions. This transaction highlights continued consolidation in the satellite ecosystem this year, following Eutelsat S.A.’s pending merger with OneWeb Global, which will create a fully mutualized network of Low Earth Orbit (“LEO”) and Geosychronous Equatorial Orbit (“GEO”) satellites, and SES’s $450 million acquisition of DRS’s satellite communications (“SATCOM”) business, which will create a multi-orbit SATCOM provider to federal customers. The Advent and Maxar acquisition requires regulatory and stockholder approvals, and it is expected to close in mid-2023.

The GTS deal of the quarter is the acquisition of Grove Resource Solutions, Inc. (“GRSi”) by DLH Holdings Corp (“DLH”) (NASDAQ: DLHC). Headquartered in Bethesda, MD, GSRi is an industry-leading provider of a broad array of cloud-based enterprise modernization and cyber security solutions to Federal Civilian, Health IT, Defense, and commercial sectors. With approximately 700 employees, GRSi brings nearly two decades of experience serving the National Institutes of Health (“NIH”), U.S. Navy, and U.S. Marine Corps to DLH. GRSi was purchased for $185.0 million, or $157.9 million net of transaction-related tax benefits worth approximately $27.1 million on a net present value basis. The purchase price includes $178.0 million of cash and $7.0 million of equity. DLH estimates that GRSi will contribute annualized revenue of approximately $140 million to the Company going forward, and the firm’s backlog was approximately $550 million at closing. DLH plans to leverage GRSi’s high-end IT and technical capabilities, highly credentialed workforce, and reputation for excellence to accelerate growth for the unified company. This deal highlights the increasingly selective M&A strategies of public GTS companies as they prioritize scale as a key target discriminator. In the fourth quarter of 2022, public buyers accounted for just 15% of GTS M&A activity compared to over 30% in the fourth quarter of 2021. This transaction was announced December 8, 2022. KippsDeSanto & Co. served as the exclusive financial advisor to DLH.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.