KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

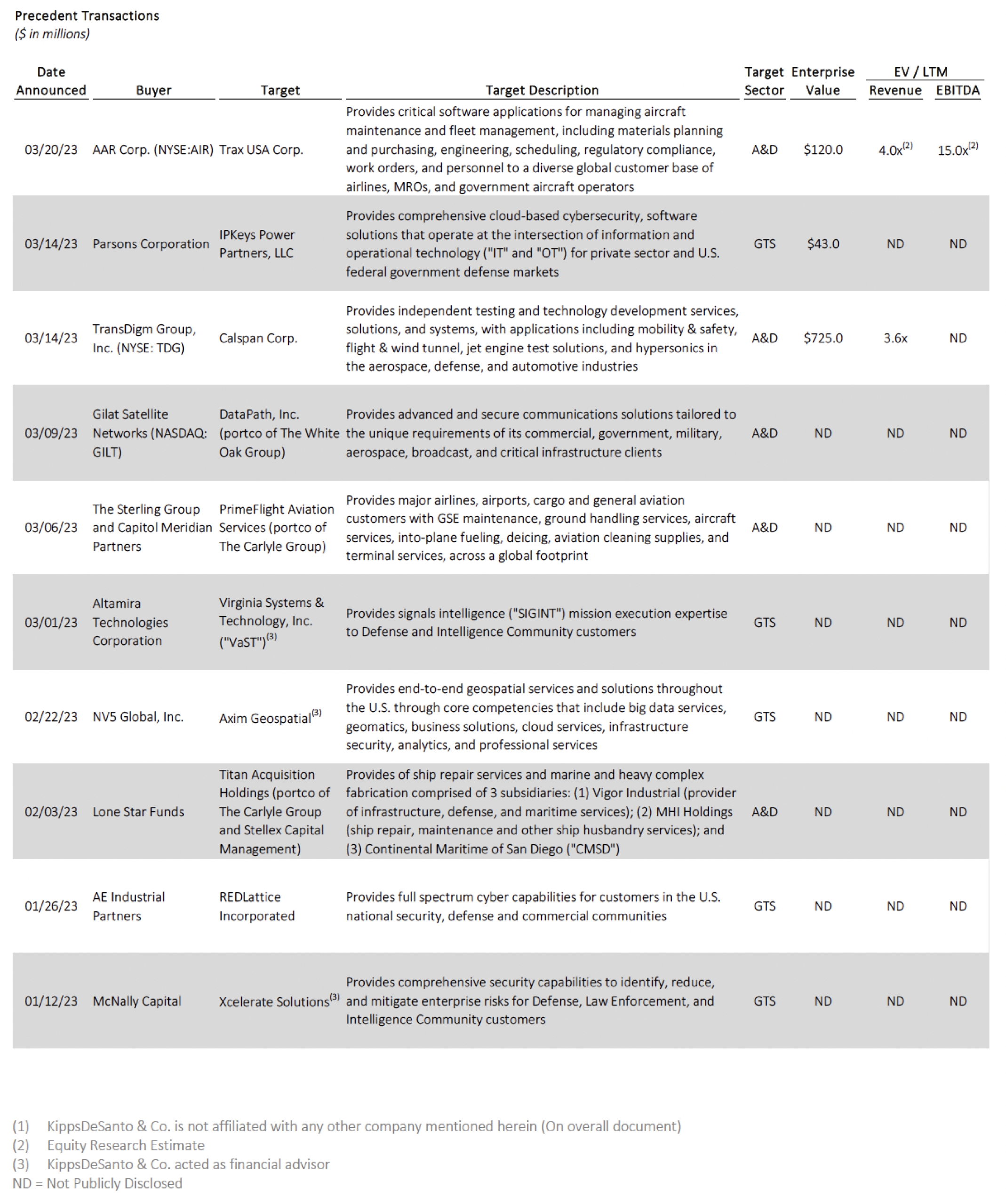

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended March 31, 2023.

Of the above transactions, the following were noteworthy:

The A&D deal of the quarter is the pending acquisition of Calspan Corp. (“Calspan” or “the Company”) by TransDigm Group, Inc. (NYSE: TDG). Headquartered in Buffalo, New York, Calspan provides independent testing and technology development services, solutions, and systems with applications including mobility & safety, flight & wind tunnel, jet engine test solutions, and hypersonics in the aerospace, defense, and automotive industries. The Company operates from seven primary facilities across New York, Virginia, Minnesota, and California. Calspan’s transonic wind tunnel in Buffalo, New York enables a range of critical, aftermarket-focused development activities for commercial and defense aerospace end markets. TransDigm’s proven operating model presents a meaningful opportunity to enhance Calspan’s established positions across a diverse range of aftermarket-focused aerospace and defense development and testing services. This transaction highlights increasing demand for aftermarket services as in-service commercial aviation and defense aircraft continue operating well into projected asset lifecycles and require maintenance, repair, and overhaul (“MRO”). This coincides with increased aircraft utilization concurrent with a notable recovery in commercial passenger demand, business jet OE backlog, and strong air freight traffic in recent months. Calspan employs approximately 625 people and is expected to generate ~$200 million in revenue for FY2023. This 100% cash, $725 million transaction is subject to regulatory approvals and customary closing conditions and is expected to close during TransDigm’s fiscal 2023.

The GTS deal of the quarter is the acquisition of Axim Geospatial, a portfolio company of Bluestone Investment Partners, (“Axim” or “the Company”) by NV5 Global, Inc. (“NV5”) (NASDAQ: NVEE). Headquartered in Sun Prairie, Wisconsin, Axim provides full-spectrum geospatial solutions to clients across the defense, intelligence, state & local (“S&L”) government, and commercial sectors. Axim utilizes over 200 high-tech, proprietary geospatial survey and mapping tools to support repeatable, scalable, and efficient geospatial data production. These tools support the Company’s expansion into new customer sectors—ultimately enabling synergistic opportunities associated with NV5’s high-altitude data acquisition capabilities. Axim offers four core delivery models: Survey and Mapping, Enterprise Geographic Information Systems (“GIS”) and Cloud Services, Critical Infrastructure and Security, and Business Solutions and Analytics to deliver customized solutions to meet clients’ critical business challenges. This transaction highlights the significant market demand for leading-edge, next-generation technologies at the confluence of cloud computing, geospatial data analytics, and machine learning that help improve business decision-making, performance, and operational efficiency. This demand also reflects the continued high level of private equity activity in the market as “buy-and-build” strategies continue to establish portfolio companies with strong industry fundamentals, reputation, and scale. KippsDeSanto & Co. served as the exclusive financial advisor to Axim.

KippsDeSanto & Co is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.