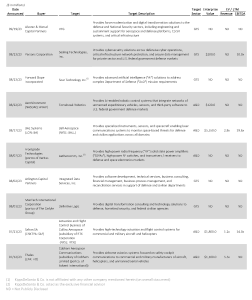

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended September 30, 2023.

Of the above transactions, we would like to highlight the following deals:

BAE Systems plc’s (LON: BA) pending acquisition of Ball Aerospace (“the Company”) (a subsidiary of

Ball Corporation (NYSE: BALL)). Headquartered in Westminster, CO, the Company provides mission critical

space systems and defense technologies including specialized instruments, sensors, and spacecraft that enable

laser SATCOM systems to monitor space-based threats for defense and civilian applications across all domains.

Ball Aerospace currently employs over 5,200 employees across eight U.S.-based facilities and serves the

Intelligence Community (“IC”), the U.S. Department of Defense (“DoD”), and the greater civilian space market.

The Company is well-positioned across military, civil space, C5ISR, and missile & munitions markets and is

known as a pioneer among innovators of technology-based space and defense capabilities. This transaction

supports BAE Systems’ strategy focused on specialization and growth in space-based defense and intelligence

as the U.S. government continues to rely on public-private partnerships for support, protection, and innovation

in the growing space economy. Ball Corporation is expected to use the proceeds from the divestiture of Ball

Aerospace to deleverage and increase share repurchases. The Company is expected to deliver approximately

$2 billion in revenue for FY2023, of which 70% is derived from space-related programs. Additionally, the

acquisition provides BAE Systems with earnings per share (“EPS”) and margin accretive run-rate synergies in

the first year, as well as significant projected returns on invested capital (“ROIC”) within five years post close.

The estimated $5.6 billion, 100% cash acquisition is expected to close in the first half of 2024 after regulatory

approvals and conditions. This transaction was announced on August 17, 2023.

Arlington Capital Partners’ (“ACP”) acquisition of Integrated Data Services, Inc. (“IDS”). Headquartered

in El Segundo, CA, IDS is a provider of software development, technical services, and technology-enabled

support for the U.S. Air Force, Space Force, and other defense and civilian departments. IDS’s flagship software

offering, Comprehensive Cost and Requirement (“CCaR”), enables users to manage requirements, formulate

budgets, and track execution by aggregating big sets of data to embed its highly specialized software into a

technology package that streamlines federal government employee’s daily responsibilities. Through fast,

efficient, and reliable information systems and support services, IDS has become a preferred provider of

financial and programmatic systems, services, and solutions to the federal government. Upon completion of

the transaction, IDS expects to expand its capabilities and product offerings while continuing to deliver high

quality solutions to its customers. The acquisition reflects financial sponsors’ continued investment in midmarket

platforms with integrated technology solutions. This transaction was announced on August 2, 2023.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.