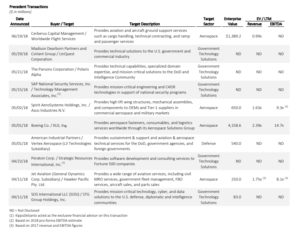

KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended

June 30, 2018. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Click here to download the table above

Of the above transactions, the following were especially noteworthy:

The aerospace / defense deal of the quarter is Boeing Co.’s acquisition of KLX, Inc. (NASDAQ:KLXI). KLX primarily provides aerospace fasteners, consumables, and logistics services worldwide through its

Aerospace Solutions Group, which generated 90% of total sales in its most recent fiscal year. KLX’s Energy Services Group made up the remaining 10% of revenue, and Boeing plans to divest the business unit

before closing the deal. The transaction values the Aerospace Solutions Group at a multiple of 15.7x LTM.

(1) KippsDeSanto & Company is not affiliated with any other company mentioned herein

(2) Source: KLX Press Release on May 1, 2018

EBITDA(2) for FY2017 and values the entire business at $4.2 billion, representing 14.7x LTM EBITDA. KLX will operate as part of Boeing’s expanding aircraft services business, Boeing Global Services, and will be

fully integrated with Boeing’s parts subsidiary, Aviall. The acquisition continues Boeing’s strategic push into the highly profitable aftermarket and MRO sector, as Boeing continues to make acquisitions along its

vertical supply chain. The transaction is expected to generate $70 million in cost-savings by 2021, and Boeing plans to finance the acquisition through a combination of cash on hand and $1.0 billion of net

debt.

The government technology solutions deal of the quarter is SOS International’s (“SOSi”) acquisition of STG Inc. The approximately $83 million all cash transaction closed on April 11th. The deal took place

approximately one year after STG’s failed transaction with Preferred Systems Solutions, and nearly five months after STG’s parent company, STG Group, was taken over by creditors. This marks the third and

largest acquisition in three years for SOSi, the Reston-based government services integrator, which also acquired Defense Group Inc., in September 2017, and New World Solutions, in January 2016. STG expands

SOSi’s capabilities across mission-critical technology, cyber, and data solutions. SOSi, with the addition of STG, now has 1,300 employees worldwide. STG also holds the Alliant 2 and Eagle II contracts, among

others, that provide SOSi with an ability to expand its customer base and pursue previously unavailable opportunities. This transaction highlights continued consolidation and capability expansion strategies

amongst mid-tier firms. Moreover, SOSi showcased deal ingenuity in its ability to navigate the complicated ownership and creditor dynamics of STG. As a result of this deal, the SOSi / STG combination

establishes a highly formidable mid-sized IT player with enhanced IT capabilities and footprint.

Click here to access KippsDeSanto’s 2018 Aerospace/Defense & Government Services M&A Survey

About KippsDeSanto & Co.: KippsDeSanto & Co. is an investment bank focused on delivering exceptional results for leading, growth-oriented aerospace / defense and technology companies. We leverage our

creativity and industry experience to provide M&A, private financing and strategic consulting. Capitalizing on real-time industry trends and in-depth technical and strategic analysis, our solutions-driven approach

is highly structured and uniquely tailored to each client. KippsDeSanto is recognized for its market insight and broad industry relationships. We help market leaders realize their full strategic value. KippsDeSanto,

member FINRA/SIPC, is not affiliated with other companies mentioned herein. For more information, visit www.kippsdesanto.com.