KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

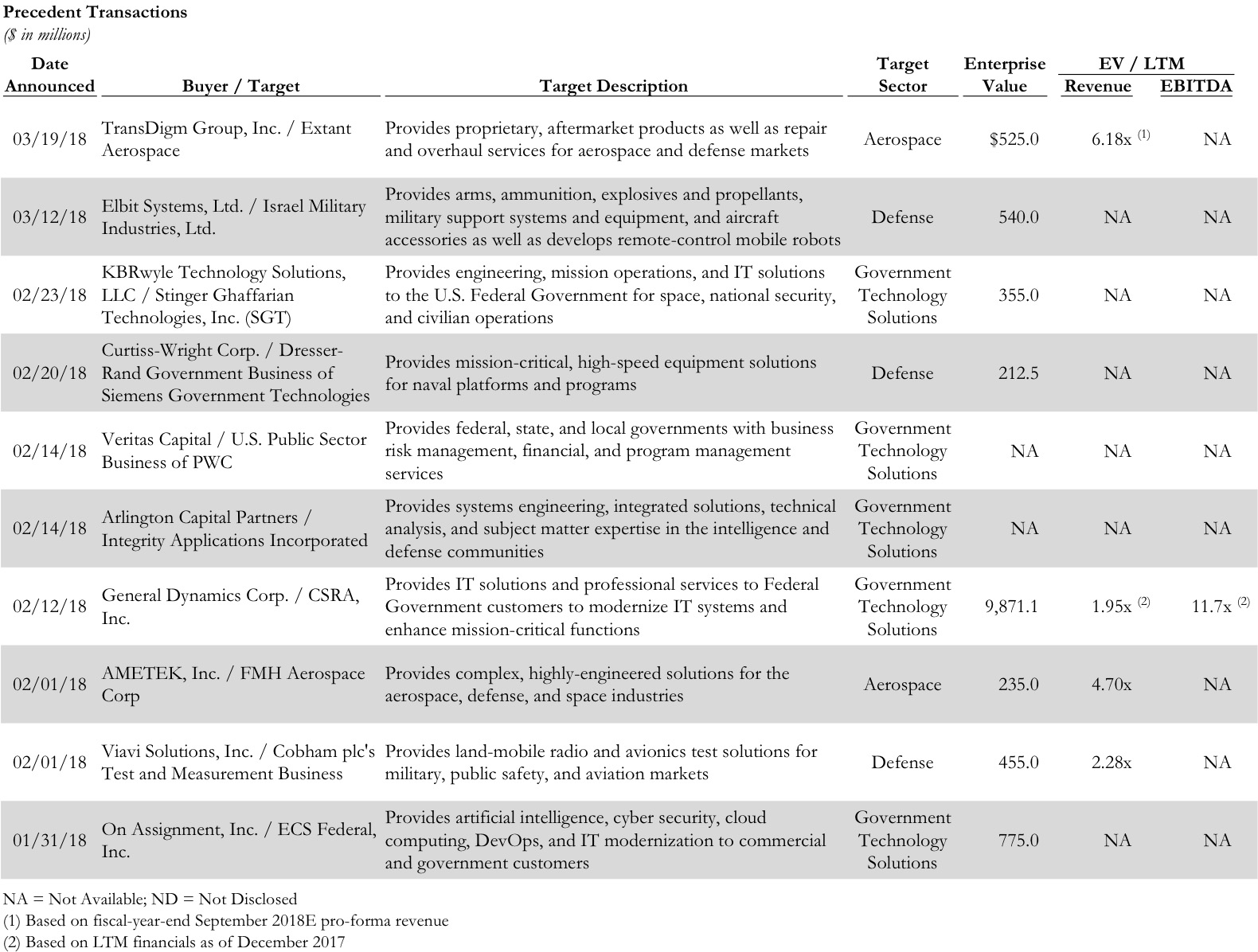

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended March 31, 2018. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Click here to download the table above

Of the above transactions, the following were especially noteworthy:

The aerospace / defense deal of the quarter is TransDigm Group’s acquisition of Extant Aerospace. The proposed acquisition is worth $525 million, or more than 6x fiscal year 2018E pro-forma revenue. Aircraft aftermarket sales are expected to drive 80% of Extant’s 2018E revenue, with a majority of revenue derived from the military end-market. The company licenses or acquires aftermarket products form aerospace and defense original equipment manufacturers, and then provides maintenance and support for these products throughout the rest of its useful life. Extant support various military aircraft platforms such as the F-16, AH064, F-18, F-15, and C-130. Its commercial platforms include the King Air series, MD 900 / 902, B747, B757, and B777 as well as various business jets. TransDigm expects the acquisition to provide significant opportunities for growth and believes that Extant’s unique business model will be a natural fit within its aftermarket-focused value generation strategy. TransDigm plans to finance the acquisition through a combination of cash on hand and its existing revolving credit facility.

The government technology solutions deal of the quarter is General Dynamics’ (“GD”) announced acquisition of CSRA. The proposed transaction is worth approximately $9.9 billion, or 11.7x LTM EBITDA. Recently, GD increased its original February 12th offer of $40.75 per share to $41.25 after CACI made a counter bid on March 18th for $44 per share in cash and stock. GD ultimately prevailed in the bidding war because its offer was all cash, unlike that of CACI’s, which consisted of cash and stock. CACI’s stock traded down approximately 7% the week after their counter-offer was made public, making its offer less compelling given the stock component. The deal highlights sector buyers’ continued focus on increasing scale and next-generation IT (“NGIT”) capabilities via M&A. Following the acquisition, GD’s federal IT business will generate nearly $10 billion per year in revenue. This will make GD the second largest government contractor, slightly behind $10.6 billion Leidos, which became the largest government IT and services contractor through its merger with the former Lockheed Martin IT business in 2016. General Dynamics and CSRA have received clearance from anti-trust officials, and the deal is expected to close in the first half of this year.