KippsDeSanto & Co. advises JANUS Research Group on its recapitalization by CM Equity Partners

/in Uncategorized/by Andrell Barnes

KippsDeSanto & Co. advises JANUS Research Group on its recapitalization by CM Equity Partners

KippsDeSanto & Co. is pleased to announce the recapitalization of its client, JANUS Research Group (“JANUS” or the “Company”), by CM Equity Partners (“CMEP”).

Based in Evans, GA, JANUS is a 350-person U.S. Federal services company providing engineering services as a solution, primarily for the U.S. Army and other Department of Defense (“DoD”) customers. JANUS centers of gravity are in Programmatic Services, Futures Research, Study and Analysis, Modeling & Simulation, Live and Virtual Training, Mission Command / Tactical Communications, Distributed Simulation / Experimentation, Specialty Engineering, Data Management, and Software Development.

The Company has established a foundational presence in its Augusta-Fort Gordon Cyber District marketplace, as well as considerable depth within the Command, Control, Communications, Computers Intelligence, Surveillance, and Reconnaissance (“C4ISR”) Center of Excellence located in Aberdeen Proving Ground (“APG”), and has closely aligned itself with DoD customers looking to grow investments in systems engineering, cyber, training, and technology innovation. JANUS has leveraged its extensive operational expertise, past performance, and technological know-how as a leading provider to mission-critical tactical communications programs to include more than 20 years supporting the U.S. Army Program Executive Office for Command, Control, and Communications-Tactical (“PEO C3T”) under the Project Manager Tactical Radio (“PM TR”) and Project Manager Tactical Network (“PM TN”) organizations. The Company is also positioned at the forefront of next generation tactical and strategic defense and intelligence capability requirements through support of Army Futures Command, Future Concepts Center, and Joint Modernization Command (“JMC”), amongst others.

Jeannette Loop, JANUS Founder and Chairperson, stated that she and her management team are pleased to be partnering with CM Equity “whose vision is aligned with our growth strategy and have sufficient scale, experience and capabilities to grow with us over time.”

We believe this transaction demonstrates several key trends in the government services M&A market:

- Keen market focus on differentiated engineering, analytic, and programmatic services mission support for well-funded government customers

- Deep domain and subject matter expertise, particularly when coupled with long-term relationships, are critical differentiators for sellers in a crowded M&A market

- Private equity firms continue to remain highly active in the government services market, given strong market dynamics and favorable credit markets

About KippsDeSanto & Co. KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity, and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Press Release

CM EQUITY PARTNERS ANNOUNCES THE RECAPITALIZATION OF JANUS RESEARCH GROUP, INC.

New York, June 12, 2019 – CM Equity Partners (“CMEP”) together with the Company’s founders and management, announce the recapitalization of JANUS Research Group, Inc. (“JANUS” or the “Company”). JANUS, headquartered in Evans, Georgia and founded in 1997 by Chairwoman Jeannette Loop, is a 350 person U.S. Federal services company providing engineering services as a solution, primarily for the U.S. Army and other Department of Defense (“DoD”) customers. JANUS centers of gravity are in Programmatic Services, Futures Research, Study and Analysis, Modeling & Simulation, Live and Virtual Training, Mission Command/Tactical Communications, Distributed Simulation/Experimentation, Specialty Engineering, Data Management, and Software Development.

Jeannie and Tony Loop will be members of the Board, with Ms. Loop continuing in her role as Chairwoman of JANUS.

JANUS will operate as a stand-alone company and will continue to be led by John Dewey as Chief Executive Officer and Rob Elich as Chief Operating Officer.

“We are excited to partner with CMEP to continue to build on the brand and legacy that we have built over the past 22 years” said Jeannie and Tony Loop.

John Dewey, CEO, said “We are looking forward to JANUS continuing to support our customers, providing them with lasting solutions to their most complex challenges, as we grow and broaden our business while maintaining the same culture and commitment to JANUS’s highly skilled employees and partners”.

About JANUS Research Group

JANUS (www.janusresearch.com) is an industry leader in Programmatic Services, Futures Research, Study and Analysis, Modeling & Simulation, Live and Virtual Training (with haptic feedback), Mission Command/Tactical Communications, Distributed Simulation/ Experimentation, Specialty Engineering, Data Management, and Software Development, primarily to the U.S. Army and other DoD customers.

About CM Equity Partners

CM Equity Partners (www.cmequity.com), based in New York, NY, provides capital to the Federal services and aerospace and defense industries. For nearly thirty years, CMEP has partnered with management teams to build value by leveraging its long-standing industry knowledge, relationships, operating experience, and its corporate finance, M&A, and private equity expertise. CMEP provides an active and collaborative management approach to its investments, developing long-term strategic plans and supporting re-investment of profits to grow and broaden a company’s revenue base and capabilities. CMEP’s investments are structured with flexibility across a broad spectrum of the capital structure, including equity, structured equity and mezzanine debt. CMEP is associated with Carl Marks & Co. (www.carlmarks.com).

KippsDeSanto’s DealView — Top 10 M&A Deals of the Quarter

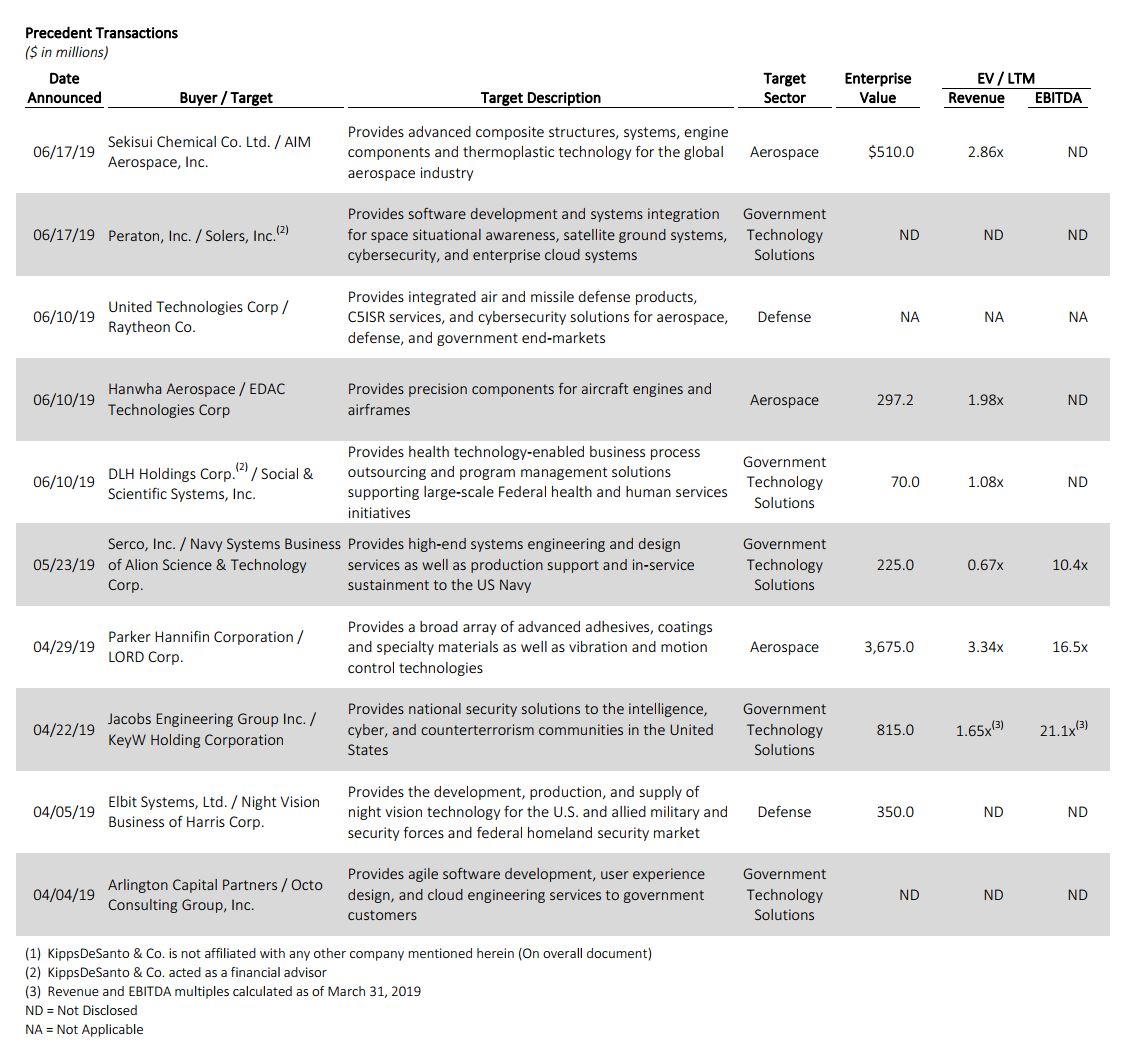

/in News & Publications, Deal View/by Andrell BarnesKippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended June 30, 2019. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is the pending merger of United Technologies Corporation (NYSE:UTX) with Raytheon Company (NYSE:RTN), which was announced in early June. After associated spinoff divestitures, the combined company will be the U.S.’ second-largest aerospace and defense company, behind Boeing, valued at more than $100 billion with annual revenue of approximately $74 billion. The deal is structured as a merger of equals between UTC and Raytheon. The combined entity plans to produce a wide array of products ranging from engines and seats for the F-35, to Patriot missile launchers and space suits. The deal intensifies the consolidation in the aerospace and defense industry as plane makers seek better terms from suppliers and the U.S. government puts greater pressure on contractors to cut costs and invest in new technologies, such as space systems and cybersecurity. The new company will be named Raytheon Technologies Corp. UTC shareholders will own 57% of the shares and plan to appoint eight of the 15 new directors. Raytheon shareholders will own the remaining 43% of the combined company, with current Raytheon Chairman and CEO Tom Kennedy being the designated Executive Chairman of the post-merger company. The deal is subject to regulatory approval and is anticipated to close in the first half of 2020.

The government technology solutions deal of the quarter is Jacobs Engineering Group, Inc.’s (NYSE:JEC) acquisition of KeyW Holding Corporation (Nasdaq: KEYW). KEYW is a leading national security provider of advanced engineering, cyber, and reconnaissance technology solutions for the U.S. Department of Defense “DoD,” Intelligence Community “IC,” and counterterrorism agencies. The approximately $815 million transaction was announced on April 22nd and closed on June 11th. Following the acquisition, JEC plans to merge KEYW with Atom Acquisition Sub, Inc., creating a new, wholly owned subsidiary of JEC to expand JEC’s Aerospace, Technology, and Nuclear capabilities and footprint. KEYW adds proprietary command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance (“C5ISR”) solutions to JEC’s portfolio of capabilities. In addition, the transaction will allow JEC to offer its existing customers “a wide array of capabilities and services via a broad range of contracting vehicles,” according to Bill Webber, President and CEO of KEYW. Since its inception in 2008, KEYW has been focused on NexGen IT capabilities for IC and DoD customers, and has supplemented organic growth with 18 acquisitions, including Sotera in 2017. This transaction serves as another example of how large global engineering companies, such as Huntington Ingalls (NYSE: HII), Parsons Corporation (NYSE:PSN), KBR, Inc. (NYSE:KBR), and others, are expanding their reach in the government sector, seeing the Intelligence Community in particular as promising, stable, and relatively insulated areas for investment.

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace/Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck