KippsDeSanto & Co. Advises TeraThink on its Sale to CGI, Inc

KippsDeSanto & Co. Advises TeraThink on its Sale to CGI, Inc

KippsDeSanto & Co. Advises TeraThink on its Sale to CGI, Inc

KippsDeSanto & Co. is pleased to announce the sale of its client, TeraThink Corporation (“TeraThink” or the “Company”), to CGI, Inc. (“CGI”).

Headquartered in Reston, VA, TeraThink is a purpose-built digital transformation, ERP implementation, and technology solutions provider specializing in automation, agile development, enterprise application technologies, data analytics, optimization, and cloud computing. TeraThink delivers digital transformations by modernizing and integrating mainstream IT and deploying digital solutions at scale to produce better business outcomes for federal civilian, national security, and defense customers. The Company merged with Dominion Consulting in November 2017.

This acquisition strengthens CGI Federal’s position as an end-to-end enterprise application services provider with the additional management consulting and digital transformation capabilities that TeraThink brings to the table.

We believe this acquisition demonstrates several key trends in the government services market:

- Strong demand for technology-driven, next-generation IT service companies;

- Importance of a full and open contract profile with visible backlog;

- Focus on high-growth businesses with proven scale, relevant past performance, and sustainable, recurring revenue and profitability; and

- Significant value attributed to deeply-embedded customer relationships and market know-how

About KippsDeSanto & Co.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

CGI to Acquire TeraThink

Expands end-to-end enterprise application services for federal clients.

March 25, 2020

Fairfax, Virginia – CGI (NYSE: GIB) (TSX: GIB.A) announced its intent to acquire TeraThink, a leading information technology and management consulting firm providing digitization, enterprise finance, risk management, and data analytics services to the U.S. federal government. The two companies signed an agreement to proceed with the transaction, which is expected to close by the end of March.

This merger will strengthen CGI Federal’s consulting expertise, and expand its enterprise application development and management services. Combining TeraThink’s agile enablement, application development, and data analytics capabilities with CGI’s Federal’s breadth of IT services will enhance offerings available to federal agencies. This merger will significantly increase the scale of enterprise applications support CGI Federal provides to all three branches of government.

“TeraThink and its approximately 250 professionals have made significant contributions for their federal government clients,” said George D. Schindler, President and Chief Executive Officer. “Through combined portfolios, we strengthen our capabilities and broaden our offerings to meet the growing digitization needs of federal agencies.”

“TeraThink and CGI Federal share a culture of delivering quality services, addressing evolving needs in partnership with our clients, and maintaining a track record of high client satisfaction and longevity,” said Tim Hurlebaus, President CGI Federal. “We look forward to welcoming the TeraThink members to the CGI team.”

About CGI Federal

CGI Federal Inc. is a wholly-owned U.S. operating subsidiary of CGI Inc., dedicated to partnering with federal agencies to provide solutions for defense, civilian, healthcare and intelligence missions. Founded in 1976, CGI is among the largest independent IT and business consulting services firms in the world. With 77,500 consultants and other professionals across the globe, CGI delivers an end-to-end portfolio of capabilities, from strategic IT and business consulting to systems integration, managed IT and business process services and intellectual property solutions. CGI works with clients through a local relationship model complemented by a global delivery network that helps clients digitally transform their organizations and accelerate results. With Fiscal 2019 reported revenue of C$12.1 billion, CGI shares are listed on the TSX (GIB.A) and the NYSE (GIB). Learn more at www.cgi.com.

Forward-looking information and statements

This press release contains “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking information and statements are made and disclosed in reliance upon the safe harbor provisions of applicable Canadian and United States securities laws. Forward-looking information and statements include all information and statements regarding CGI’s intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “believe”, “estimate”, “expect”, “intend”, “anticipate”, “foresee”, “plan”, “predict”, “project”, “aim”, “seek”, “strive”, “potential”, “continue”, “target”, “may”, “might”, “could”, “should”, and similar expressions and variations thereof. These information and statements are based on our perception of historic trends, current conditions and expected future developments, as well as other assumptions, both general and specific, that we believe are appropriate in the circumstances. Such information and statements are, however, by their very nature, subject to inherent risks and uncertainties, of which many are beyond the control of CGI, and which give rise to the possibility that actual results could differ materially from our expectations expressed in, or implied by, such forward-looking information or forward-looking statements. These risks and uncertainties include but are not restricted to: risks related to the market such as the level of business activity of our clients, which is affected by economic conditions, and our ability to negotiate new contracts; risks related to our industry such as competition and our ability to attract and retain qualified employees, to develop and expand our services, to penetrate new markets, and to protect our intellectual property rights; risks related to our business such as risks associated with our growth strategy, including the integration of new operations, financial and operational risks inherent in worldwide operations, foreign exchange risks, income tax laws, our ability to negotiate favorable contractual terms, to deliver our services and to collect receivables, and the reputational and financial risks attendant to cybersecurity breaches and other incidents; as well as other risks identified or incorporated by reference in this press release, in CGI’s annual and quarterly MD&A and in other documents that we make public, including our filings with the Canadian Securities Administrators (on SEDAR at www.sedar.com) and the U.S. Securities and Exchange Commission (on EDGAR at www.sec.gov). Unless otherwise stated, the forward-looking information and statements contained in this press release are made as of the date hereof and CGI disclaims any intention or obligation to publicly update or revise any forward-looking information or forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. While we believe that our assumptions on which these forward-looking information and forward-looking statements are based were reasonable as at the date of this press release, readers are cautioned not to place undue reliance on these forward-looking information or statements. Furthermore, readers are reminded that forward-looking information and statements are presented for the sole purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes. Further information on the risks that could cause our actual results to differ significantly from our current expectations may be found in the section titled “Risk Environment” of CGI’s annual and quarterly MD&A, which is incorporated by reference in this cautionary statement. We also caution readers that the above-mentioned risks and the risks disclosed in CGI’s annual and quarterly MD&A and other documents and filings are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial could also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation.

For more information:

Investors

Lorne Gorber

Executive Vice-President, Investor and Public Relations

lorne.gorber@cgi.com

+1 514-841-3355

Media

Jennifer Horowitz

Vice-President, Marketing & Communications

jennifer.horowitz@cgi.com

+1 202-807-9558

KippsDeSanto & Co. Advises Continental Mapping Consultants, Inc. on its investment by Bluestone Investment Partners

KippsDeSanto & Co. Advises Continental Mapping Consultants, Inc. on its investment by Bluestone Investment Partners

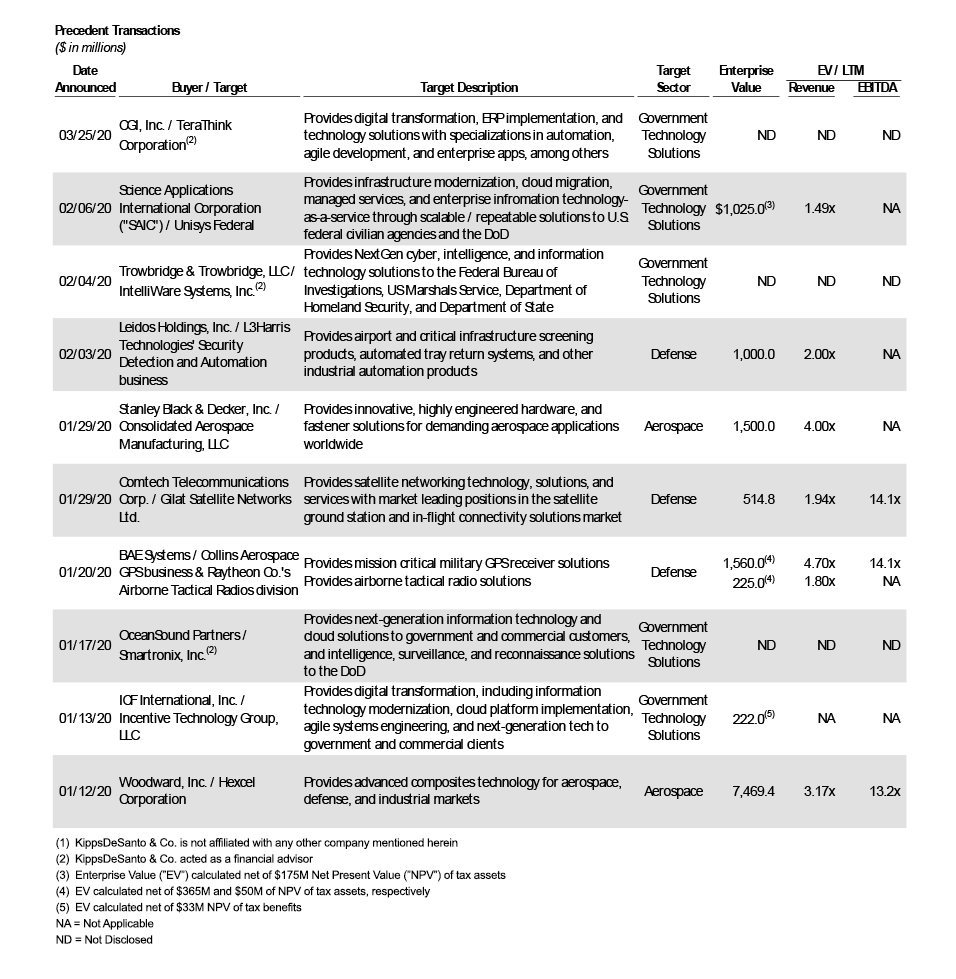

Of the above transactions, the following were especially noteworthy:

Of the above transactions, the following were especially noteworthy: