KippsDeSanto & Co. advises Synaptech, LLC on its sale to LMI, a portfolio company of Declaration Partners, Capitol Meridian Partners, and 22C Capital

KippsDeSanto & Co. advises Synaptech, LLC on its sale to LMI, a portfolio company of Declaration Partners, Capitol Meridian Partners, and 22C Capital

KippsDeSanto & Co. advises Synaptech, LLC on its sale to LMI, a portfolio company of Declaration Partners, Capitol Meridian Partners, and 22C Capital

KippsDeSanto & Co. is pleased to announce the sale of Synaptech, LLC (“Synaptech” or the “Company”) to LMI, a portfolio company of Declaration Capital Partners, Capitol Meridian Partners, and 22C Capital.

Headquartered in Colorado Springs, CO, Synaptech is a technical solutions provider in the National Security industry, providing modern, proprietary software solutions to organize, educate, train, and equip future space warfighters to understand the battlefield and make key decisions with confidence, speed, and clarity.

The Company specializes in delivering cutting-edge operational planning, modeling, simulation, and decision-making software that serves as the connective tissue throughout the U.S. Space Force. Specific core offerings include modeling & simulation, software development, artificial intelligence, agile project management, operational analysis, and user centered designs and experiences. Additionally, the Company’s flagship proprietary software solution, Rapid Analysis and Prototyping Toolkit for Resiliency (“RAPTR”), provides scalable and efficient analysis in multiple mission areas to help visualize the space warfighting domain.

The partnership with LMI will further accelerate Synaptech’s growth as the needs of the Company’s in-demand capabilities and proprietary solutions across the Space Force expand.

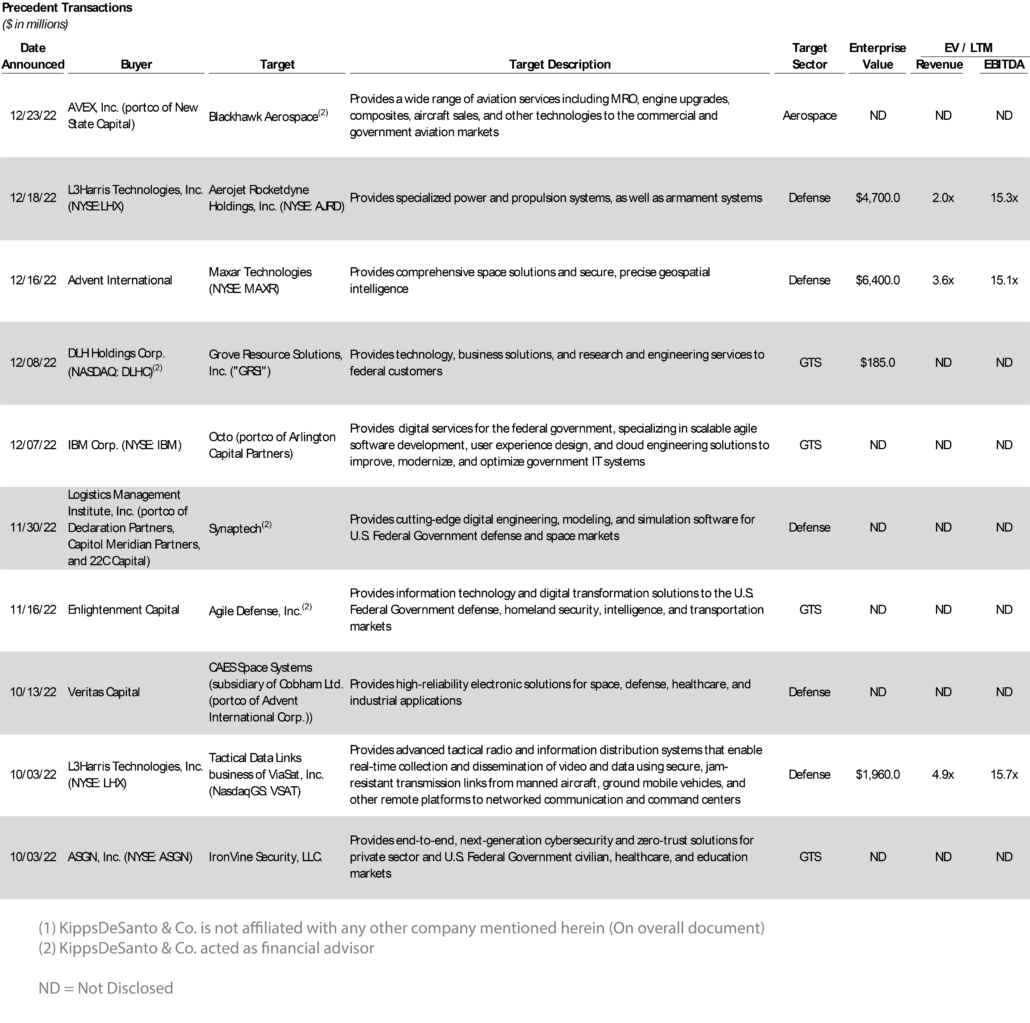

We believe this transaction highlights several key trends in the government technology solutions M&A market:

- High-end, next-generation technologies in support of National Security missions remain attractive targets given increasing budgetary trends and growth opportunities;

- Continued investments in the space economy has had knock-on effects contributing to the value of the technologies that protect that investment; and

- Buyers with explicit growth strategies, industry knowledge, and private equity backing continue to deploy capital, particularly for companies with deep domain and subject matter expertise, established customer relationships, and differentiated proprietary technologies

About KippsDeSanto & Co.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 175 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Investment Banking products and services are offered through KippsDeSanto & Co., a non-bank subsidiary of Capital One, N.A., a wholly-owned subsidiary of Capital One Financial Corporation, and a member of FINRA and SIPC. Products and services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured by Any Federal Government Agency.

Press Release

LMI Expands Presence in Space Industry By Acquiring Synaptech

— Modeling and simulation software company addresses growing space threats

— Synaptech’s space expertise complements LMI’s work with DoD

Tysons, Va. – LMI, a provider of technology-enabled management consulting, logistics, and digital & analytics solutions to the U.S. government, today announced it has acquired Synaptech, which creates digital engineering, modeling, and simulation software for the national security and space industries.

“LMI is thrilled to be entering the fast-paced, growing space market by acquiring Synaptech, which protects our nation’s national security assets and provides senior leaders with physics-backed decisional options,” said Doug Wagoner, LMI’s president and CEO.

Founded in 2015 and headquartered in Colorado Springs, CO, Synaptech is an innovator in space defense through its proprietary software: the Rapid Analysis and Prototyping Toolkit for Resiliency (RAPTR). RAPTR provides an extensive, scalable architecture for modeling, simulation, analysis, and visualization for the space warfighting domain, as well as cross-domain warfare integration.

LMI’s expertise in logistics, deep analytics and technology will complement Synaptech’s modeling and simulation strengths, better positioning both companies to innovate and support the missions of their respective Department of Defense customers.

“LMI and Synaptech share the same vision, culture, and passion for creating innovative, mission-focused solutions that make this partnership a perfect match. The combination of LMI’s incredible talent, resources, and rich history of proven performance throughout the DoD, and Synaptech’s knowledge and extensive experience in the space domain will yield tremendous results for our customers within the national security space industry for years to come,” said Zac Gorrell and Elias Peroulas, CEO, CTO and co-founders of Synaptech who will lead LMI’s space business moving forward. Mr. Wagoner said, “We are excited to welcome Synaptech’s employees, the best and brightest in the space industry, to the LMI team where they will find colleagues just as passionate about applying technology to solve our nation’s greatest challenges. Chartered by President Kennedy in 1961 at the dawn of the space race, it is fitting that LMI is now entering the space marketplace to support a renewed space race where adversaries seek to disrupt and disable our dominance in space.”

Wagoner also stated, “To help our customers innovate at the pace of need, one must understand all discreet and interdependent operational domains from the sea floor and sea surface, to ground, air, cyber, and space. The acquisition of Synaptech enables LMI total multi-domain awareness at scale.”

In addition to LMI’s 60-plus years of partnership with the federal government, Synaptech brings an expansive record of operating with speed and agility to efficiently integrate people, processes, and technologies to solve customers’ most complex challenges with an operationally relevant timeframe.

KippsDeSanto & Co. served as exclusive financial advisor to Synaptech.

About LMI

LMI is dedicated to powering a future-ready, high-performing government, drawing from expertise in digital and analytic solutions, logistics, and management advisory services. We deliver integrated capabilities that incorporate emerging technologies and are tailored to customers’ unique mission needs, backed by objective research and data analysis. Founded in 1961 under the Kennedy Administration to solve the government’s most complex problems, LMI continues to enable growth and transformation, enhance operational readiness and resiliency, and ensure mission success for federal civilian and defense agencies.

Media Contact

Robin Milton

(703) 727-8517