KippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

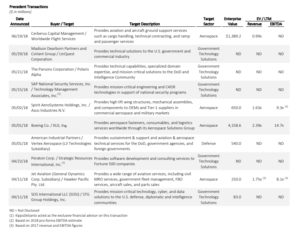

KippsDeSanto & Co., a leading aerospace / defense and government technology solutions investment bank, would like to share its thoughts on the “Top 10 M&A Deals of the Quarter” for the period ended December 31, 2018. The following table is our take on the most notable announced M&A transactions — not only based on size, but also on strategic importance and / or impact.

Of the above transactions, the following were especially noteworthy:

The aerospace and defense deal of the quarter is the all stock merger of equals between Harris Corporation (“Harris”) and L3 Technologies, Inc. (“L3”). Harris and L3 provide a wide array of defense technology-based solutions for global mission-critical challenges. The combined entity will have a market cap of approximately $30 billion and the deal was announced on October 14th. Under the terms of the deal, L3 shareholders will receive a fixed exchange ratio of 1.3 shares of Harris common stock for each share of L3 common stock. The merged company will generate an estimated $16 billion in revenue next year, effectively forming a sixth defense prime contractor. Strategic benefits of the merger include increased scale with a well-balanced portfolio of complementary franchises, shared culture of innovation and operating philosophies, and meaningful value creation through complementary markets and enhanced global presence. The transaction is expected to close in mid-year 2019, pending regulatory approval from the Department of Defense.

The government technology solutions deal of the quarter is Maximus, Inc.’s (NYSE:MMS) acquisition of General Dynamics Information Technology’s (“GDIT”) Citizen Engagement Center (“CEC”). The approximately $400 million all cash transaction was announced on October 9th and closed November 16th. GDIT’s CEC specializes in call center support for citizens in their dealings with federal agencies, such as the CMS and the Census Bureau. This acquisition strengthens Maximus’ position in the administration of federal government programs and bolsters the contractor’s ability to provide improved citizen services. The CEC business will likely add between $600 million and $625 million in FY19 revenue to Maximus’ top line, with anticipated mid-single digit operating margins. GDIT’s divestiture of its call center business follows the August sale of its Navy Systems Engineering and Acquisition Services Business Unit, acquired as part of its $9.7 billion acquisition of CSRA, Inc. This transaction is another example of larger acquirers executing on portfolio shaping activities following consolidation and mega-mergers.

| Click to access KippsDeSanto’s 2019 Aerospace/Defense & Government Services M&A Survey |

About KippsDeSanto & Co KippsDeSanto & Co. is the largest independent investment banking firm exclusively focused on serving leading, growth-oriented Aerospace/Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 100 industry transactions, KippsDeSanto is recognized for our analytical rigor, market insight and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.